Canaux

108470 éléments (108470 non lus) dans 10 canaux

Actualités

(48730 non lus)

Actualités

(48730 non lus)

Hoax

(65 non lus)

Hoax

(65 non lus)

Logiciels

(39066 non lus)

Logiciels

(39066 non lus)

Sécurité

(1668 non lus)

Sécurité

(1668 non lus)

Referencement

(18941 non lus)

Referencement

(18941 non lus)

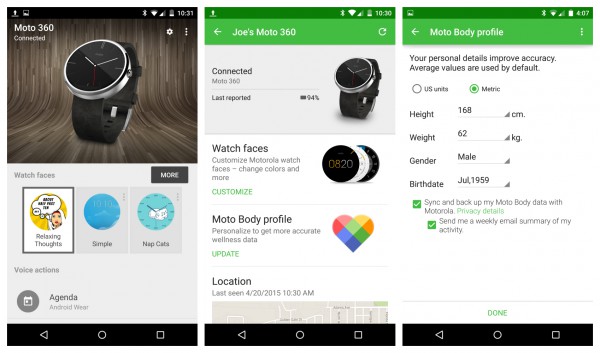

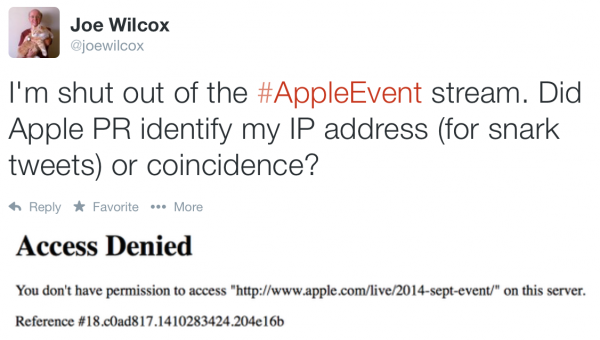

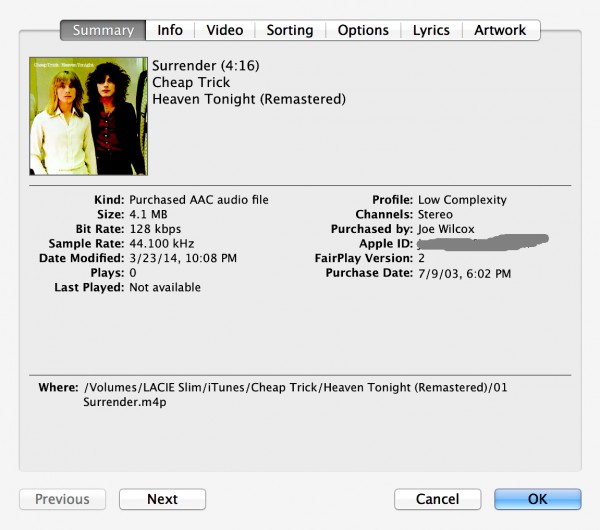

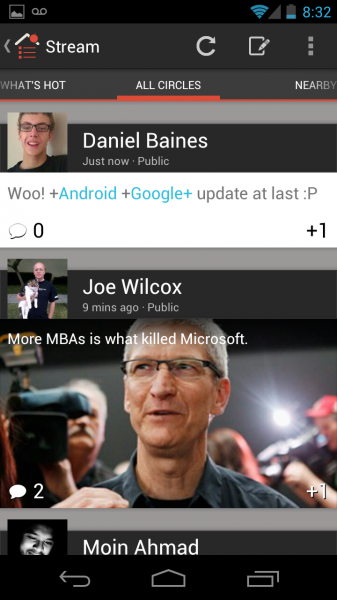

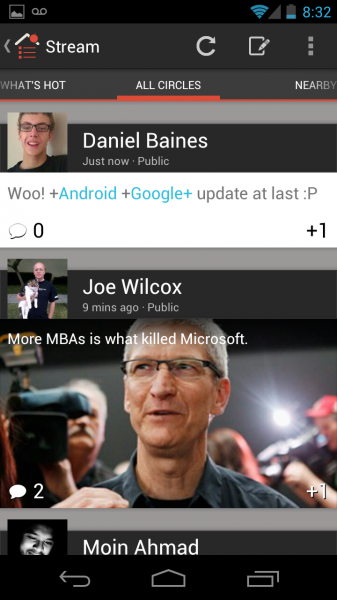

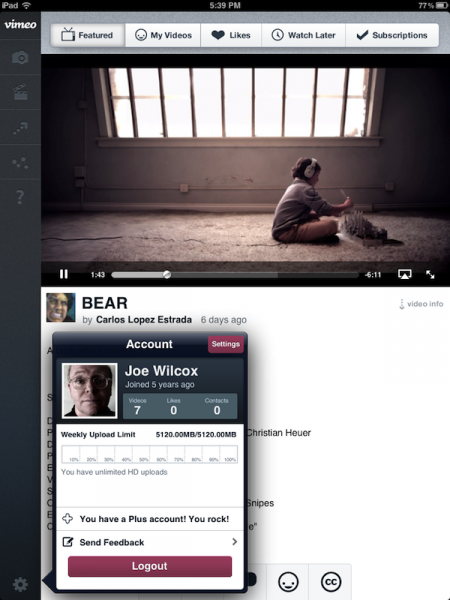

éléments par Joe Wilcox

BetaNews.Com

-

Microsoft's core platform isn't software, it's trust

Publié: mai 7, 2019, 1:04am CEST par Joe Wilcox

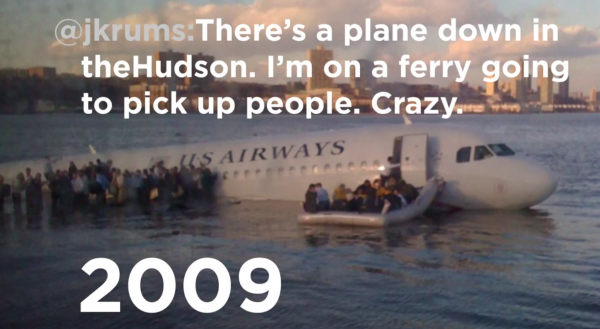

For the first time in a half-decade, I watched a Microsoft Build keynote this morning. Time gives fresh perspective, looking at where the company was compared to where it is today. Listening to CEO Satya Nadella and other Softies, I repeatedly found myself reminded of Isaac Asimov's three laws or Robotics and how they might realistically be applied in the 21st Century. The rules, whether wise or not, set to ensure that humans could safely interact with complex, thinking machines. In Asimov's science fiction stories, the laws were core components of the automaton's brain—baked in, so to speak, and thus… [Continue Reading] -

Grado Labs GW100 wireless headphones [Review]

Publié: décembre 29, 2018, 12:00am CET par Joe Wilcox

When I first opened the box containing the Grado Labs GW100 headphones, one word came to mind: "Cheap". The cans didn't look or feel like the classy Grado RS1i and RS1e, which I once owned, or the GS1000e that are still beloved and possessed. But after connecting to Google Pixel 2 XL (and later the 3 XL), via Bluetooth, I exclaimed: "Priceless". The first offering in the company's "Wireless Series" rises to an audiophile class unmatched by most competing cans; I prefer the GW100 to the GS1000e, which cost four times more to buy. Four words best describe the experience listening… [Continue Reading] -

My AMC Stubs A-List subscription is a bad B-movie

Publié: décembre 22, 2018, 4:27am CET par Joe Wilcox

Earlier this week, movie theater chain AMC dumped coal in my Christmas stocking when I attempted to cancel the $19.95-a-month, watch-three-movies-a-week Stubs A-List subscription. One, and then another, customer representative informed me that at signup, the terms of service explicitly states that commitment is for three months. He, then she, warned that cancellation would trigger immediate charge for the remaining two months. But the ToS restriction shouldn't apply to me, being a returning customer. Everything comes down to the meaning of one word: Initial. When A-List launched, on June 26, 2018, my wife and I joined. We ended our membership… [Continue Reading] -

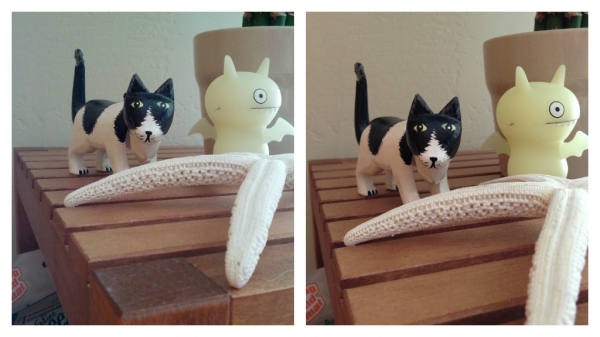

Tuft + Paw Gatto Basket (review)

Publié: décembre 17, 2018, 10:49pm CET par Joe Wilcox

When I think beta testing, low-tech doesn't come to mind. The gadgets that you use demand extensive quality review during design and prefabrication stages, long before ever being manufactured. But, gasp, cat furniture? Seeing this website is still called BetaNews 20 years on—and felines own the Internet—there's strange sense to spotlighting something for your furry friend(s) the week before Christmas. Call it a stocking stuffer, but one where the kitty is stuffed. And, this wool wonder, like other things from Tuft + Paw, was thoroughly beta tested. Cali Cattitude The company contacted me nearly six months ago "to collaborate with… [Continue Reading] -

10 quick observations about Google Pixel Slate

Publié: décembre 3, 2018, 6:10am CET par Joe Wilcox

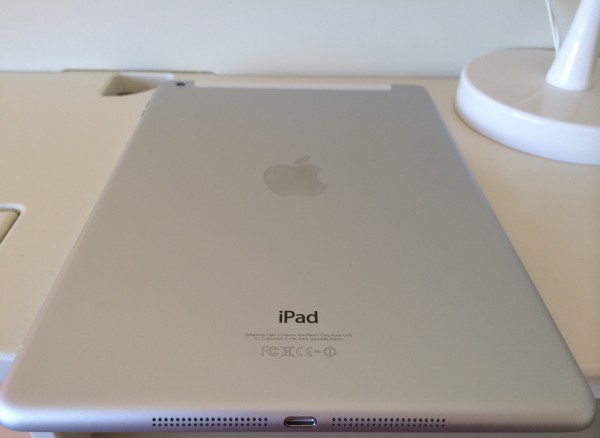

Pixel Slate arrived at the Wilcox household on Nov. 28, 2018, from Google Store, with the order correctly fulfilled. Initial out-of-the-box reaction: "Oh". Underwhelmed. Nearly five days later: "Wow". The Chrome OS tablet is understated in all the ways that matter. My brain just needed a wee bit of time to appreciate the many nuances, rather than one obvious thing flipping the "ah-ha" switch. The Slate will finally complete my move away from Apple products, started in late July. The Chrome OS slab is set to replace iPad 10.5 and possibly could displace my beloved Pixelbook, as well. We shall see… [Continue Reading] -

Worth waiting for, I get satisfaction from Google Store

Publié: décembre 1, 2018, 12:56am CET par Joe Wilcox

Part 3 of three. My six-week saga, where Google Store sent the wrong Pixel phones, is nearly over. I would like to thank the Advanced Support Technician team member who worked with me to end the drama and restore my (previous) confidence purchasing gadgets from the retailer. The generous solution minimizes any further complications and leaves me with a usable phone—with "Preferred Care" that I paid for correctly attached. Sometimes satisfaction is a process, rather than immediacy. To recap: The 128GB Clearly White Pixel 3 ordered on launch day arrived on Oct. 17, 2018 as a 128GB Just Black Pixel… [Continue Reading] -

My Google Store customer service nightmare goes from bad to worse

Publié: novembre 28, 2018, 6:59am CET par Joe Wilcox

For readers who like to criticize and gloat, I have an early Holiday present for you: This story. You can call me an effing idiot, and I couldn't disagree. After Google Store sent me the wrong Pixel phone, I foolishly placed another order, and a similar distribution mishap occurred. Bad is now worse; I also write to caution other potential Google Store shoppers: This could happen to you. To briefly recap the first instance: In October, I ordered Pixel 3 Clearly White 128GB. On the 17th, the Pixel 3 XL Just Black 128GB arrived instead. Google Store couldn't process a… [Continue Reading] -

Microsoft market capitalization (briefly) tops Apple (again)

Publié: novembre 27, 2018, 12:00am CET par Joe Wilcox

In May 2010, I wrote about Apple's market cap passing top-valued Microsoft; it's only fitting to follow up with an analysis about the unbelievable turnabout that, like the first, marks a changing of technological vanguards. Briefly today, the software and services giant nudged past the stock market's fruit-logo darling. A few minutes after 1 p.m. EST, the pair's respective market caps hovered in the $812 billion range, with Microsoft cresting Apple by about $300 million. By the stock market close, a rally for Apple put distance from its rival: $828.64 billion to $817.29 billion, respectively (Bloomberg says $822.9 billion, BTW).… [Continue Reading] -

Google Store sent me kicking and screaming back to Apple

Publié: novembre 15, 2018, 9:32pm CET par Joe Wilcox

Google Store's bureaucratic ineptitude is beyond belief. My recent, unresolved customer crisis is an experience in artificial unintelligence. For a parent company whose core competency is supposed to be indexing, crunching, and disseminating information, it's inconceivable that something so simple as fixing a single order error could escalate into a tragically comic Catch-22. I should have abandoned all efforts long before reaching the point of penning this post and looking back to the Apple Way. To summarize: I received the wrong Pixel phone nearly a month ago. Google Store struggled to process a return authorization, because the device in hand… [Continue Reading] -

Goodbye noisy neighbors, I quit Nextdoor

Publié: octobre 17, 2018, 5:49pm CEST par Joe Wilcox

Six days ago, Facebook notified me that my personal information had been pilfered in a recently revealed hack affecting tens of millions subscribers. Lovely. Why don't you kick me in the head, too, Mark Zuckerberg? Perhaps you would prefer a baseball bat, so you can beat me to death instead? I responded by removing most of the same information from my FB and started a content purge ahead of possible account deletion. Since then, I have been on a social media account rampage, which turned my sights to Nextdoor, where I joined on Aug. 29, 2017 (my Facebook is 12 years… [Continue Reading] -

The price you pay Apple for (so-called) iPhone innovation

Publié: septembre 13, 2018, 9:01am CEST par Joe Wilcox

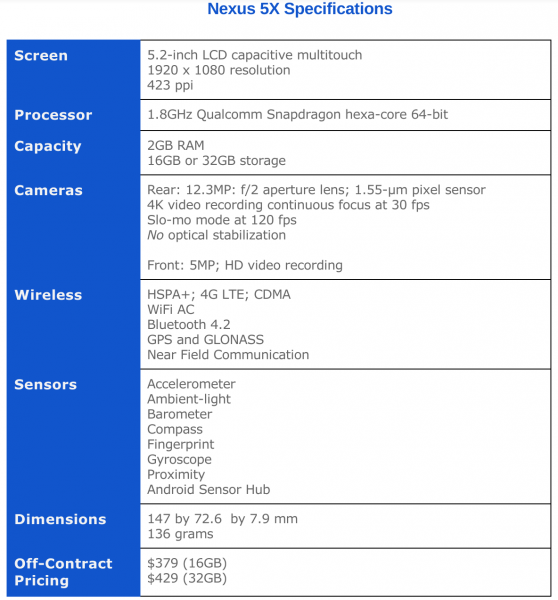

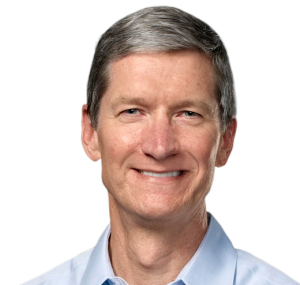

Trendsetter Apple has done it again! Just when you thought there was no innovation left in the smartphone market, CEO Tim Cook delivers the wildly price-disruptive iPhone Xs Max 512GB for heart-stopping $1,449. Smartphones simply don't cost this much. What other company would stoop so low by reaching so high? This thing is a monster with its 6.5-inch (nearly) edge-to-edge display; 2688 x 1242 resolution at 458 pixels per inch (less than Google Pixel 2 XL at 2880 x 1440 and 538 ppi); and dual-SIM support (so telemarketers can ring more often on two numbers). For anyone whose hands aren't… [Continue Reading] -

Google's Two Pixel Problems

Publié: août 31, 2018, 11:30pm CEST par Joe Wilcox

Like unwanted mushrooms popping up after rain, Pixel 3/XL rumors are everywhere. Google gets gravy from all the free fan- and blog-post hype. Am I imagining, or is there even more buzz than for the next iPhone(s), which presumably comes soon (Apple sent out invites yesterday for a September 12 product event). Buzz is the measure of interest—and while iPhone has commanding market share, Pixel's mindshare is formidable. Someone tell me: Is Google's new device really going to be that good? The leaked photos aren't that inspiring with respect to design (little is different). Or perhaps expectations about iPhone X… [Continue Reading] -

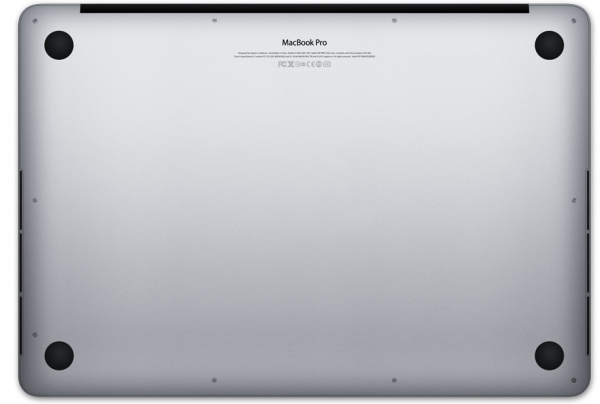

Apple replaced my butterfly keyboard

Publié: août 27, 2018, 12:30am CEST par Joe Wilcox

Yesterday, the local Apple Store emailed that my wife's former 13.3-inch MacBook Pro with Touch Bar was ready. We picked up the laptop hours later. If you haven't heard about specks of debris causing MBP keyboard failure, I can confirm from our experience that such problem occurs. In mid-June 2018, Apple initiated a free repair program, which we used last week with surprisingly positive results. I purchased the custom-configured MBP in mid-November 2016, and right out of the box the spacebar occasionally skipped. The malfunctioning worsened over time, and, coincidentally (or not), reached crisis a few days after Apple admitted… [Continue Reading] -

Two months later, switching to Google from Apple

Publié: août 20, 2018, 6:49pm CEST par Joe Wilcox

Doubt disturbed my commitment to give up the Apple Way for the Google lifestyle two months ago. Preparing to pack up my wife's 64GB white iPhone X, I was taken aback by how pretty it was. She kept the thing in a case, which protected from damage but also obscured beauty. For fleeting seconds, I wondered why switch. Product design that generates joy is another benefit—and one transcending any, and every, feature. But the moment passed, and I boxed up her smartphone along with my 256GB black iPhone X. Google gave great trade-in values, which dispatched the hassle of reselling… [Continue Reading] -

I declare independence from Apple (and mean it this time)

Publié: juillet 4, 2018, 9:45am CEST par Joe Wilcox

Six years ago today I penned my personal Declaration of Independence from Apple, nearly a month after pledging to boycott the company's products and services—and I did, only to quietly stop six months later. They say history repeats, eh? On this July 4th, I forsake the fruit-logo company once more. From Apple I return to Google, choosing one digital lifestyle over the other—and not for the first time, as some commenters will be quick to argue. Past to present: By summer 2012, I viewed various patent assaults by Apple against Samsung and others as competition by litigation, not innovation. Weighing on… [Continue Reading] -

What's wrong with this picture?

Publié: mai 15, 2018, 11:45pm CEST par Joe Wilcox

Earlier today, I needed to get Skype onto my iPhone X to receive an overseas call. So I hauled over to the App Store, like any sensible iOS user would do. I was shocked—absolutely floored—to see an advert for Google Duo taking up about half the screen, and appearing above Skype. You got to ask how many people end up downloading the upper one instead. I don't often go to the App Store and wonder: How long has been this kind of aggressive placement? The Internet has its share of whiners about paid adverts placed on Google search pages—and not… [Continue Reading] -

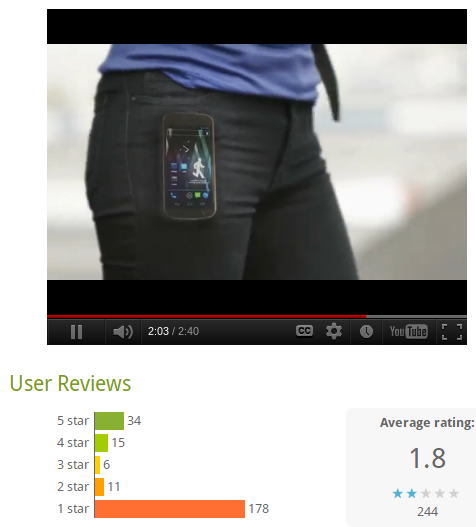

Invasion of the dog-poop phones

Publié: mai 13, 2018, 6:48pm CEST par Joe Wilcox

A few days ago, BetaNews Managing Editor Wayne Williams emailed asking if I could contribute content after being silent for ages, especially as the site's 20th anniversary approaches. He doesn't fathom the potential terror that request will unleash. I have written a total of two tech stories for BN in 2018—surely to the delight of my many commenter critics. Reason: Joe Wilcox is on a self-imposed writing hiatus as he looks distrustfully at the many so-called innovations that he championed during a 25-year technology reporting career. He is disgusted to see how we have become commodities stored in the pantries… [Continue Reading] -

Apple HomePod: 'wow' but 'uh-oh'

Publié: février 11, 2018, 3:01am CET par Joe Wilcox

HomePod arrived yesterday at 9:40 a.m. PST; thank-you UPS for prompt delivery of my preorder. My initial reaction: Wow and uh-oh. The wow harkens back to the original iPod, which Apple released in October 2001. The company's design ethic treated the overall experience as the user interface: Attach FireWire cable to Mac and device, music syncs. iTunes manages music on the Mac; for iPod, a simple scroll-wheel navigates tracks displayed on a small screen. The uncomplicated and understated approach defied the UX of every other MP3 sold by all other manufacturers. HomePod is a defining, roots-return that's well-deserving of the… [Continue Reading] -

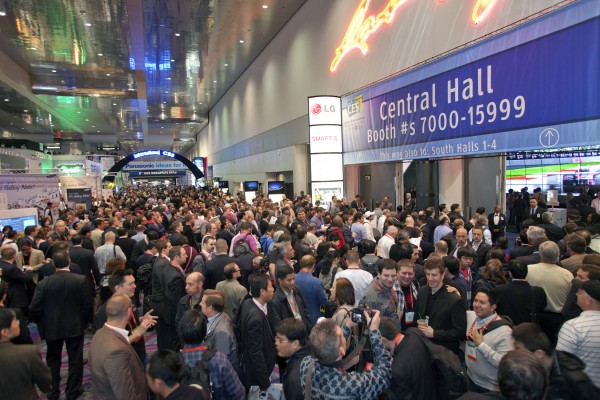

7 things you could do instead of CES

Publié: janvier 8, 2018, 10:56pm CET par Joe Wilcox

The annual scourge is upon us, as tens of thousands of attention seekers descend on Las Vegas for the Consumer Electronics Show. Nowhere else can you watch bloggers and journalists in a constant chase of their public relations foibles, who desperately hunt for all the attention they can get their clients. Think a thousand kids in a small room, calling for mommy and groping her dress. Then multiple ten times. My last CES pilgrimage was 2008. That's right, I haven't gone in 10 years. No-o-o-o regrets. Nothing important ever comes out of the show, even though each year the hype… [Continue Reading] -

Something you gotta know about iPhone X

Publié: novembre 5, 2017, 3:40am CET par Joe Wilcox

I consider myself lucky, although some commenters (you know who you are) will disagree, by successfully ordering from Verizon Wireless the iPhone X for delivery on launch day—November 3rd. A FedEx driver brought the anticipated package to my door yesterday afternoon. I hauled down to Apple Store to purchase AppleCare+ before my grubby paws caressed the steel rims (vroom) and generous glass (screen measures 5.8 inches diagonally). Replacing iPhone 7 Plus, which features and benefits greatly satisfy, is a bit extravagant. But I wanted the X to review and for its smaller size but larger display—understanding caveats: Home button's removal… [Continue Reading] -

Google Store flubs Pixel Product Preorders

Publié: octobre 5, 2017, 12:53am CEST par Joe Wilcox

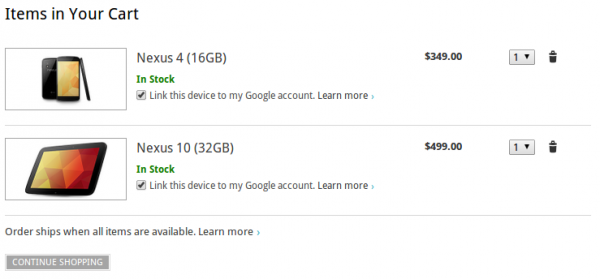

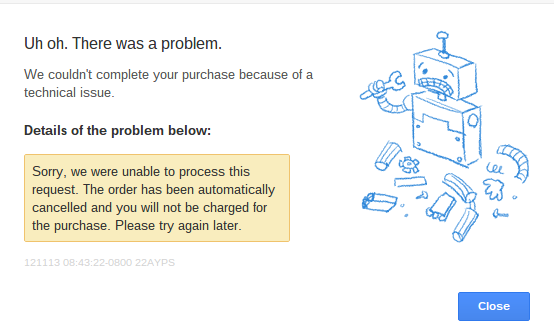

I would like to thank Google for saving me thousands of dollars in needless spending. Near the end of today's gangbuster hardware event, I was ready to order two new Chromebooks and smartphones, one each for me and my wife. But "error 500" pages on the company's store website and long-lead new product availability dates prompted me to cancel the one order successfully made and to delete the others in process from my shopping cart. For a company whose product managers droned on this morning about all the reasons why artificial intelligence is so right, Big G got the store… [Continue Reading] -

Ouch, that hurts! Verizon's new Unlimited plans throttle customers

Publié: août 23, 2017, 11:13pm CEST par Joe Wilcox

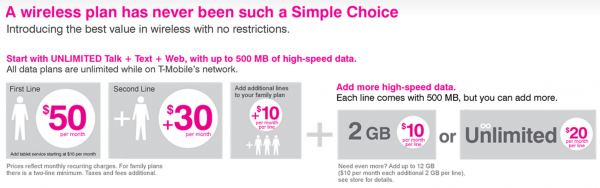

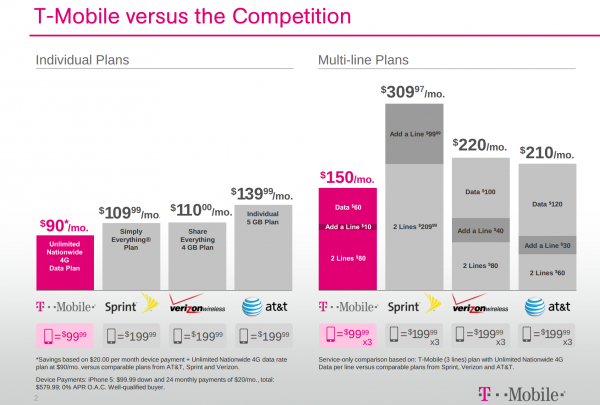

I should have known better. Once burned is supposed to be twice as wary. Right? Disgruntled by pricing and other policies, in autumn 2015, I took my family from Verizon Wireless to T-Mobile, which cut our monthly bill by more than one-third. But in May of this year we made the trek back in part because data speed is so much faster from my apartment than it is with Magenta. Better Red than dead, eh? Wrong. Oh, dumbass me. Un-carrier's aggressive pricing, and Verizon's first-ever quarterly loss of post-paid subscribers, compelled the nation's largest carrier to respond—by, starting in February,… [Continue Reading] -

The iPhone Legacy

Publié: juin 29, 2017, 6:01am CEST par Joe Wilcox

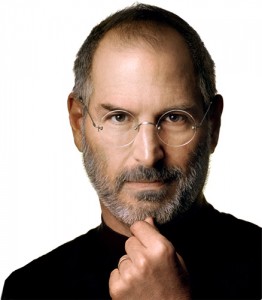

Steve was right, and I don't refer to Apple cofounder Jobs, but to an iPhone buyer I met 10 years ago today. He was among the eclectic group of people waiting outside Apple Store Montgomery Mall to spend $499 or $599 on the fruit logo company's first smartphone. The amount was outrageous at the time for a locked, unsubsidized handset. "I think this is a day that you’re going to see a change in how computers, how handheld computers are done", he told me. "I think we’ll look back in 10 or 15 years, and like on that day the… [Continue Reading] -

Europe guts Google, and that's just wrong

Publié: juin 27, 2017, 7:49pm CEST par Joe Wilcox

Today the European Union gave Apple a great gift to celebrate iPhone's 10th anniversary (on June 29th): The ridiculous, record $2.7 billion fine, and associated sanctions, against Google that once again demonstrates the EU's small-minded oversight that wrongly regulates evolving technologies in a big world. The adverse antitrust ruling finds that the online titan favored its own online shopping services (and paying customers) over rivals. In February 2010, with the EU Competition Commission's preliminary investigation starting, I rightly called "Google a dangerous monopoly". Seven years later, the competitive landscape has dramatically changed, and rapidly evolves. The Commission's action is too… [Continue Reading] -

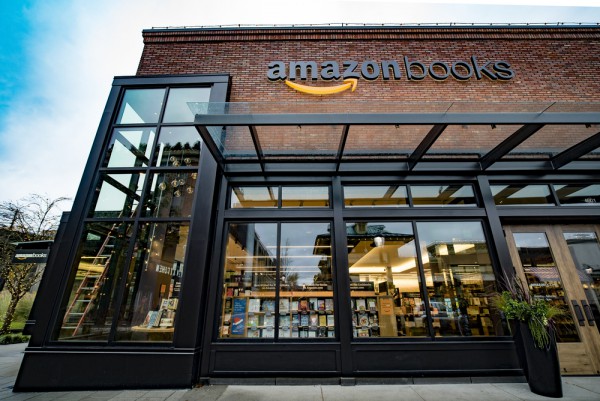

There goes the neighborhood, as snobby 'better-thans' wait for their Whole Foods drone deliveries

Publié: juin 17, 2017, 2:47am CEST par Joe Wilcox

My first reaction to Amazon buying Whole Foods is "Huh?" Few brands could be any more different. The online retailer is all about giving customers the most for the least amount spent, while the grocer is the pricey purview of the alt-organic lifestyle elite. No moment is better metaphor for Whole Foods' clientele than the exchange I heard between a thirtysomething couple standing at the deli holding chicken luncheon meat. "Is it free range?" the women asked her husband. It had to be, or she wouldn't buy. They argued. I silently chuckled: luncheon meat—not a bird! It's all pressed meat,… [Continue Reading] -

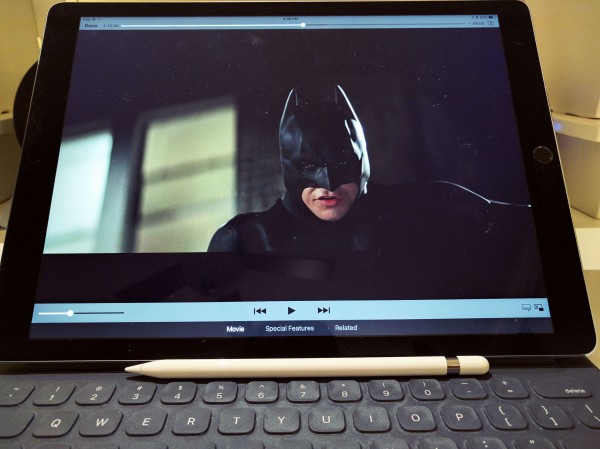

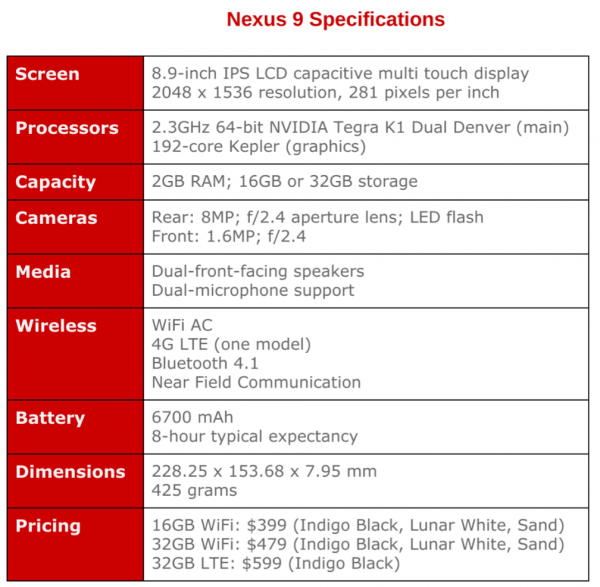

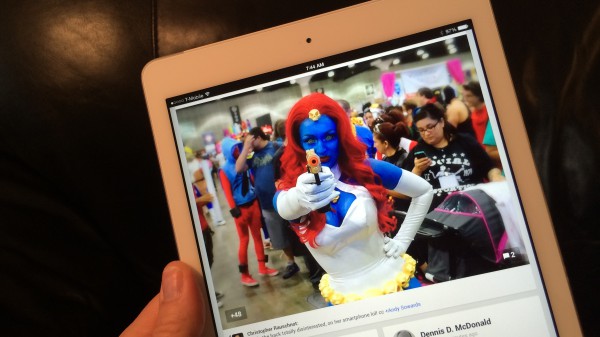

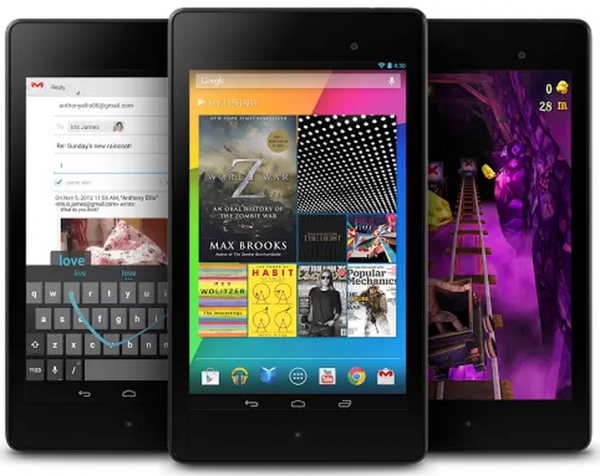

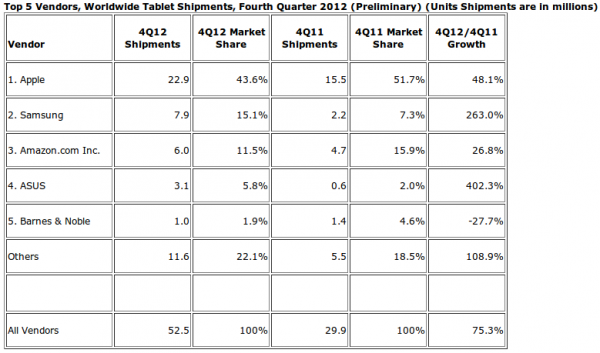

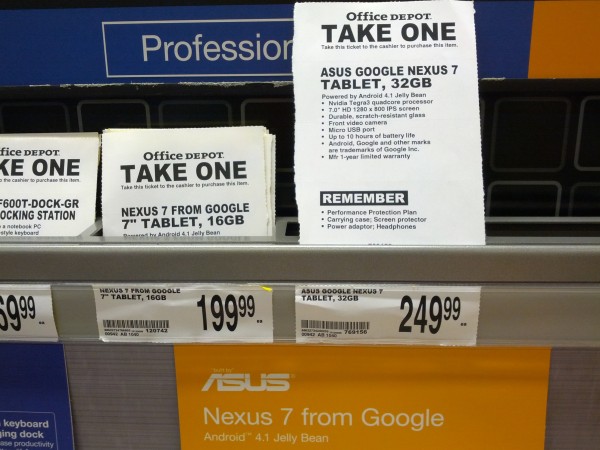

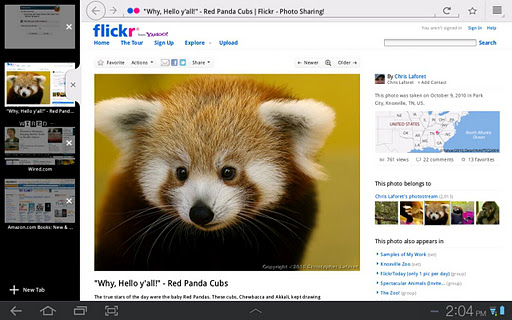

Google, you better up your tablet game before Apple takes you down

Publié: juin 9, 2017, 7:42am CEST par Joe Wilcox

To celebrate the launch of Apple's new 10.5-inch iPad Pro, I ordered Pixel C, which arrived three days ago. Worst case, the tablet can be returned for refund during the buyer's remorse period; there ain't any regrets so far—just the opposite. To my pleasant surprise, the tab is much more enjoyable than I remember, because Nougat is so pretty, efficient, and buttery smooth than was Marshmallow on the device. The screen scorches any available iPad, Pro or otherwise, and the performance is shockingly nimble. My Pixel C shipped with Android 7.1.1 and quickly updated to 7.1.2. I will soon install Android… [Continue Reading] -

May the Moto Z Force Droid be with you [Review]

Publié: juin 3, 2017, 4:34am CEST par Joe Wilcox

If you asked why the Moto Z Force Droid Edition appeals to me, I couldn't identify one thing, which arguably is odd considering this is a review. Benefits and features feel finely balanced, which is a hallmark of good product design. Oh, and that satisfaction is for the pure smartphone experience, which is premium by nearly every measure that matters; I didn't test Moto Mods that expand capabilities. Lenovo/Motorola and Verizon released the smartphone in July 2016, so this exploration is belated—and then some. Apologies, the delay was necessary. In mid-December 2016, Verizon sent a holiday review package unexpectedly. At the time, my father-in-law's health… [Continue Reading] -

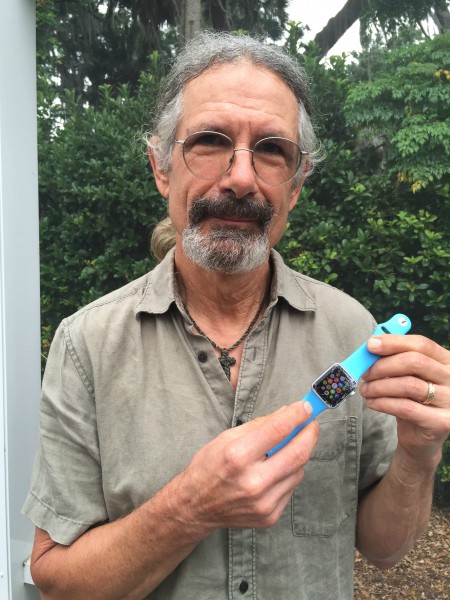

I am slave to Apple Watch no more

Publié: mai 21, 2017, 3:25am CEST par Joe Wilcox

I suffer from phantom smartwatch syndrome -- an ailment that hopefully will disappear over time. Nearly four weeks ago, I put aside Apple Watch 2 stainless steel and replaced it with the simple but appealing ManchesterWatchWorks Iconik 3. Problem: Almost any shifting movement of the timepiece causes me to reflexively flip my wrist and look down; there is false perception of haptic sensation. Apple has trained me well, and I'm tired of being its dog doing tricks. Woof. Woof. Growl. I feel free! Gone are the nagging alerts -- and I had them barreled down to a minimum of approved services: Some… [Continue Reading] -

Meet Fujifilm X100F [Review]

Publié: mai 15, 2017, 1:37am CEST par Joe Wilcox

During the camera film era, Fujifilm battled kingpin Kodak with brighter, more vibrant colors that either photographers loved or hated—perhaps both. That was last century. In the 21st, Kodak is a shadow cast against aged Kodachrome, while its rival has successfully transitioned from print to digital—and with amazing bravado. Fuji's transformation started six years ago with the cleverly-engineered, retro-designed X100, which I reviewed in May 2011. The compact digital camera's success led Fuji to develop a series of additional bodies and lenses; all are designed with professional shooters in mind. The X series family features compact, mirrorless designs that incorporate digital… [Continue Reading] -

Let me tell you about Apple Fiscal Q1 2017

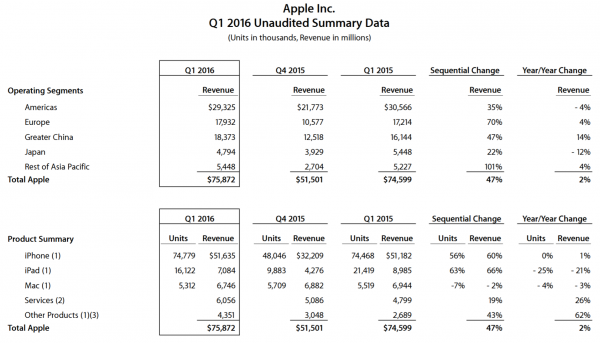

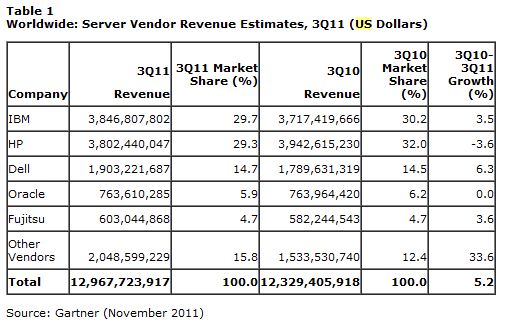

Publié: février 2, 2017, 3:53am CET par Joe Wilcox

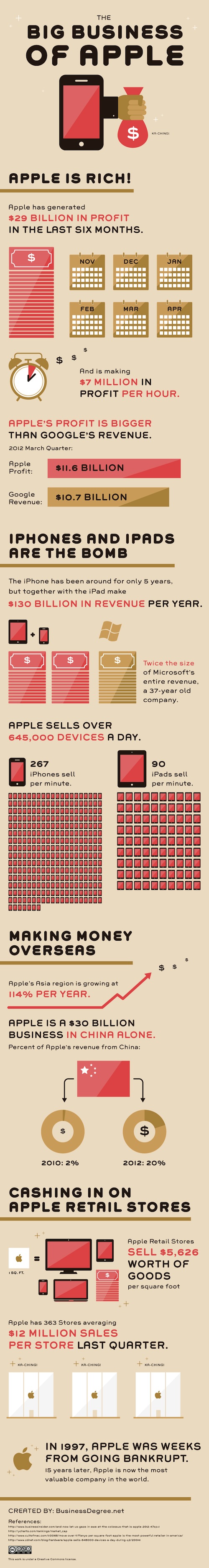

The measure of Apple fiscal first quarter 2017 isn't record revenues ($78.35 billion) but comparison to major competitors: More than three times Google ($26.06 billion) or Microsoft ($24.1 billion). Amazon announces tomorrow, Groundhog Day. Will the retailer's CEO, Jeff Bezos, see his shadow? The 3x multiplier nearly applies to net income: $17.89 billion, versus $6.64 billion and $5.2 billion, respectively, for the two rivals. Looked at differently, compared to Apple's same quarter in fiscal 2010, seven years later, profits exceed total revenues ($15.68 billion). That's an astounding comparison. The results defy pundits' prognostications, including my own, about gravity pulling the… [Continue Reading] -

Master & Dynamic MW50 wireless headphones [Review]

Publié: janvier 24, 2017, 7:08am CET par Joe Wilcox

Headphone manufacturers must make deliberate audio signature decisions when crafting cans. Some shops, like GradoLabs, adopt a house sound. Relative newcomer Master & Dynamic's design ethic seeks to equally please eyes and ears. As such, its flagship wired headphones (MH40) and wireless (MW60) share similar industrial design. Aluminum, lambskin, leather, and stainless steel combine in rugged style that evokes aviators of a bygone era. The newer MW50 Bluetooth headphones strongly resemble the other two, but they're tuned for younger listeners on the move. M&D's earlier cans are over-ear—meaning they cover the lobes, while the MW50 rest on them. The headphones are smaller… [Continue Reading] -

Master & Dynamic MW50 wireless headphones [Review]

Publié: janvier 24, 2017, 7:08am CET par Joe Wilcox

Headphone manufacturers must make deliberate audio signature decisions when crafting cans. Some shops, like GradoLabs, adopt a house sound. Relative newcomer Master & Dynamic's design ethic seeks to equally please eyes and ears. As such, its flagship wired headphones (MH40) and wireless (MW60) share similar industrial design. Aluminum, lambskin, leather, and stainless steel combine in rugged style that evokes aviators of a bygone era. The newer MW50 Bluetooth headphones strongly resemble the other two, but they're tuned for younger listeners on the move. M&D's earlier cans are over-ear—meaning they cover the lobes, while the MW50 rest on them. The headphones are smaller… [Continue Reading] -

The problem with iPhone

Publié: janvier 9, 2017, 8:35am CET par Joe Wilcox

Today we arrive at the first of two 10-year anniversaries regarding iPhone: Steve Jobs unveiling the handset six months before its release -- unusual for Apple's then-CEO to pre-announce something, but necessary, with the federal regulatory rigmarole that cellular devices go through. Jobs and his management team brought the smartphone to market at great risk: Established and entrenched manufacturers, mainly Nokia, had huge distribution channels and massive amounts of research and development invested in their cellulars. iPhone debuted in one market (United States) and on a single carrier (AT&T, which concurrently rebranded). By most measures of business strategies: Insanity. But risk was a… [Continue Reading] -

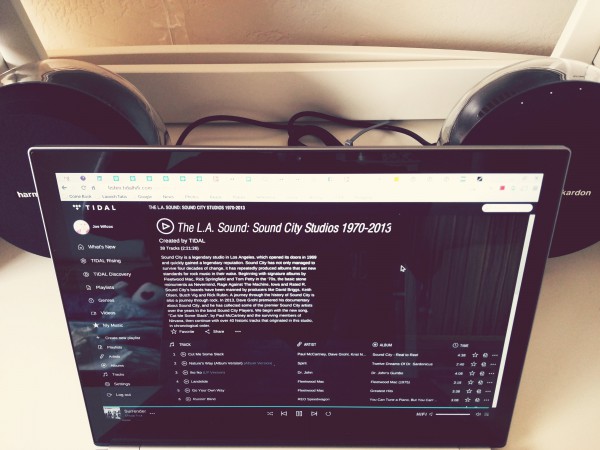

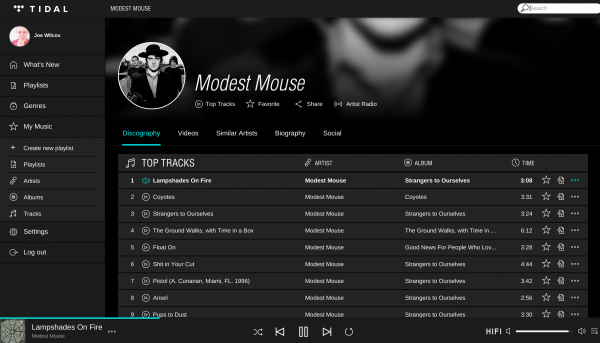

Tidal Masters go their own way

Publié: janvier 6, 2017, 8:49am CET par Joe Wilcox

During Consumer Electronics Show 2017 yesterday, in licensing partnership with MQA, music streamer Tidal announced the new audio-fidelity tier "Masters", which is available for free to existing HiFi subscribers. Early album selection is extremely limited as is access option: macOS or Windows application. Both will expand in time. But wow! I tested skeptically, wiring up my studio cans—Audio-Technica ATH-R70x—to 15.4-inch MacBook Pro with Touch Bar to hear the difference. Hehe, if any. I deliberately started with Fleetwood Mac's "Go Your Own Way" from album "Rumors", which released 40 years ago on February 4th. Tidal claims that Masters recordings deliver "an audio experience exactly… [Continue Reading] -

My favorite tech items of 2016 [Joe]

Publié: janvier 2, 2017, 9:59pm CET par Joe Wilcox

The year 2016 is when the United States sold its soul to Donald Trump and I signed over mine to Apple. How's that for introduction to the five favs series, joining colleagues Alan Buckingham, Brian Fagioli, and Wayne Williams? Yup. I'm an Apple whore as 2017 opens onto its second day. The fruit-logo company won back my business as I gave up the Google lifestyle. Three main reasons: 1) I believed CEO Tim Cook's privacy promises, all while my concerns about Big G information collection increased. 2) I found the visual acuity of Apple fonts and user interfaces to be far superior to Google's, which helped… [Continue Reading] -

Adieu, Yahoo

Publié: décembre 29, 2016, 11:41pm CET par Joe Wilcox

Yahoo, one of the earliest and brightest dot-coms, is a Hellhole at the close of 2016. It stinks of decay and neglect. The 1 billion active user accounts ravaged by hackers is a metaphor for the trendy neighborhood turned into gang-ridden slum. Verizon was, or maybe still is, buying Yahoo. Walk away, I say, unless Yahoo is willing to pay for the privilege of becoming part of the expanding VZN communications and media empire. I typically make many changes at the start of the new year, and as 2017 begins, I take my advice offered to Verizon: Abandon Yahoo. First to… [Continue Reading] -

Got MacBook Pro with Touch Bar? How's your battery life?

Publié: décembre 28, 2016, 12:05am CET par Joe Wilcox

Consumer Reports played nasty, little Santa's helper by plopping a piece of chunky coal into Apple's Christmas stocking, when denying the coveted—and expected—recommendation. Holy Moly. Over the holiday, the InterWebs exploded with stories during an otherwise, slow tech news cycle. CR found widely, or perhaps wildly, inconsistent charge-to-depletion times for MacBook Pro with Touch Bar. Uh-oh. At least the lap-hugger isn't explodin', like the Samsung Galaxy Note 7. B-b-b-boom! Perhaps, like me, you bought or received as present, one of these newfangled Macs. I have some questions about your experience starting with: How's your battery life? Do you get enough… [Continue Reading] -

Apple's 'lump of coal in your stocking' Christmas

Publié: décembre 21, 2016, 6:05am CET par Joe Wilcox

Apple sure knows how to keep its store stocked for the holidays. Ho, ho, ho, bah humbug. The shelves are bare, and you can get your must-have pretty thing some time next year. If you're lucky. Let's start with the delayed AirPods, which went on sale online last week. They arrived in stores on Monday, and whoosh were gone before the waiting line ended. My local shop had about 30 pairs. If you want them, first available retail pickup date is—cough, cough—February 8th. That is 2017. I had to confirm not 2018, because you never know with these dumbfounding delays.… [Continue Reading] -

DirecTV Now is a bargain -- for NOW

Publié: décembre 19, 2016, 10:50pm CET par Joe Wilcox

From the day I received the Oct. 14, 2016 letter about billing changes, AT&T U-verse and Internet cancellation was inevitable. I had auto-pay set up to a credit card, but the service provider wanted access to my bank account, which I didn't want to give. "Beginning in December, your credit card will be charged eight days after your Bill Cycle date", the correspondence reads. The change meant AT&T would take payment on the 8th of the month rather than the 21st. Since the company bills a month in advance, the new date would work out to about six-weeks in fees paid ahead for future… [Continue Reading] -

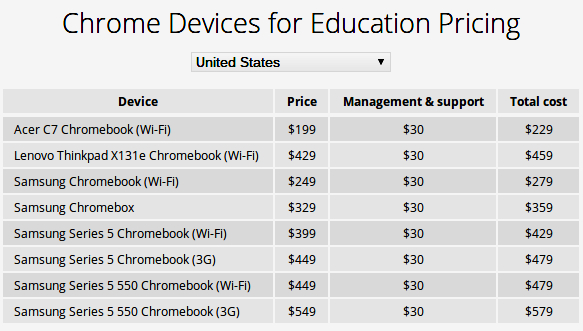

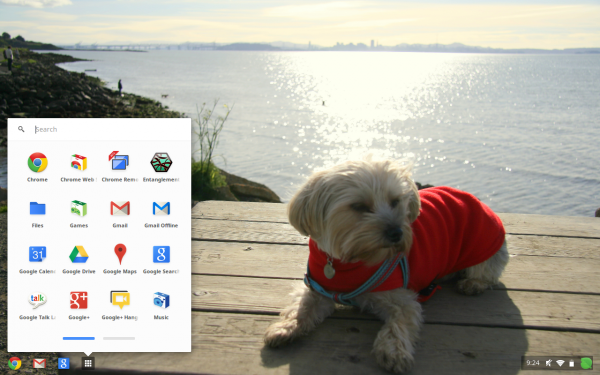

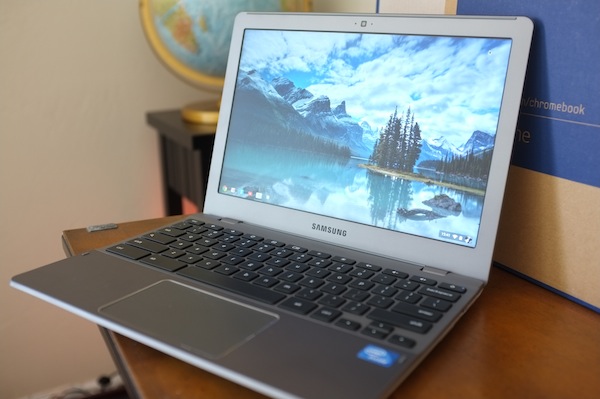

iPhone should replace Chromebook in the classroom

Publié: décembre 17, 2016, 11:32pm CET par Joe Wilcox

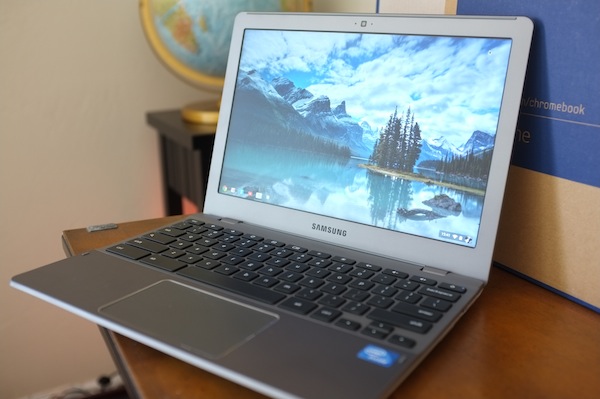

Many educators won't agree, but perhaps students will: The PC, whether desktop or notebook, is obsolete in the classroom. This reality, if accepted for what it is, presents Apple opportunity to retake the K-12 market from Alphabet-subsidiary Google's incursion and sudden success with Chromebook among U.S. schools. If the fruit-logo company doesn't seize the moment, a competitor will—and almost certainly selling devices running Android. Chromebook's educational appeal is three-fold: low cost, manageability, and easy access to Google informational services. For buy-in price, and TCO, no Apple laptop or tablet running macOS or iOS, respectively, can compete. Think differently! Providing students any… [Continue Reading] -

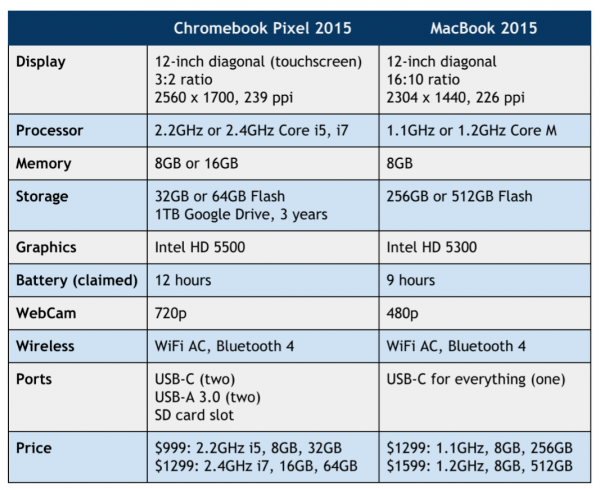

Chromebook's future is bleak

Publié: décembre 15, 2016, 7:19pm CET par Joe Wilcox

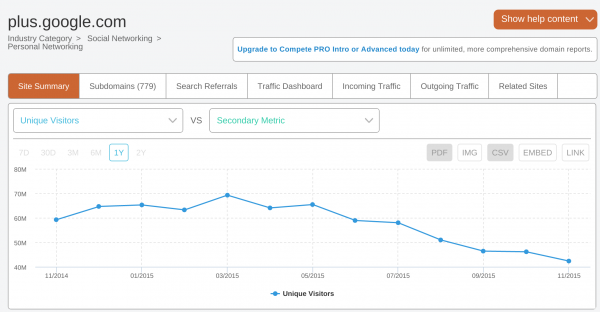

A few days ago, one of my Google+ followers, Steve Kluver, commented on an August 2014 share: "I am shopping for some more Chromebooks this Holiday Season, and found this post via G+ hashtag #chromebook search. How current is your ebook now?" He refers to Chromebook Reviews, which is available from Amazon for sale or for free reading with Kindle Unlimited. I apologized that the tome, published more than two years ago, is "way out of date". If I'm not going to revise, I really should remove the title. I offered to give him buying advice, which got me to thinking… [Continue Reading] -

Would a Trump administration allow Google to sell Motorola to Lenovo?

Publié: décembre 9, 2016, 7:23pm CET par Joe Wilcox

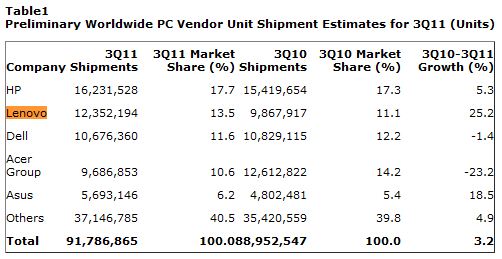

I don't want to start an argument about politics. My sentiment this lovely day derives from what the incoming White House is, not what so many people here in California want it to be. I wonder: If Google bought Motorola during a Trump presidency, rather than Obama regime, would later sale to Lenovo be allowed or closing of the Texas phone-assembly factory about 18 months after opening? The question arises from a pique of sadness as I look at the FedEx tracking information for two Motorola phones purchased directly from Lenovo. City of origin: Wuhan, China. My last Moto came from the Lone… [Continue Reading] -

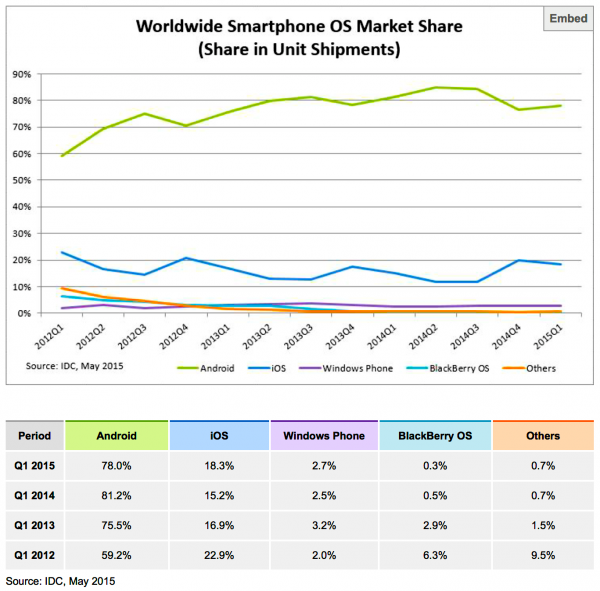

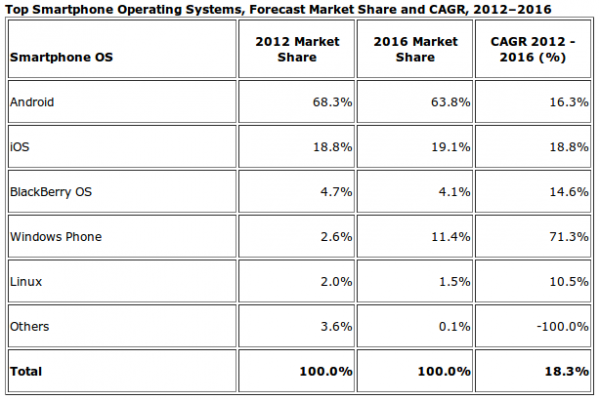

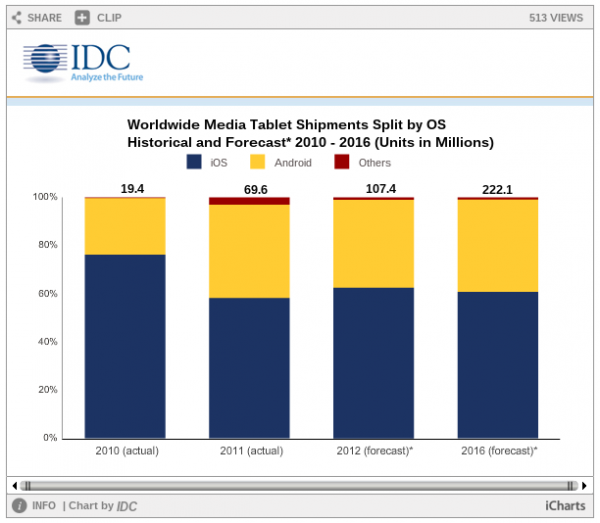

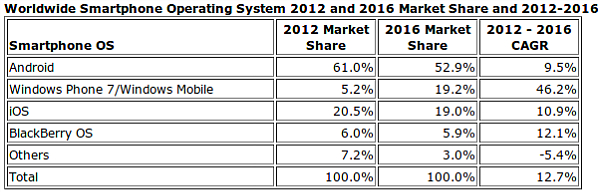

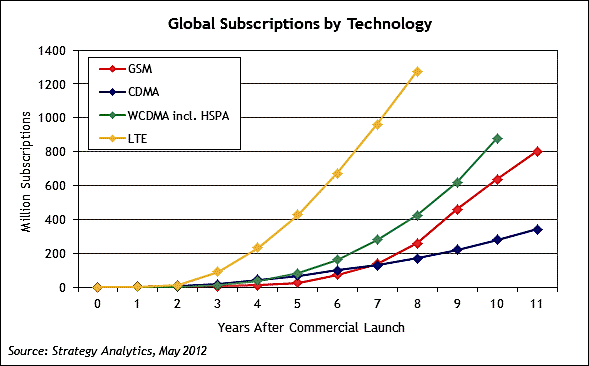

IDC was so wrong about Windows Phone

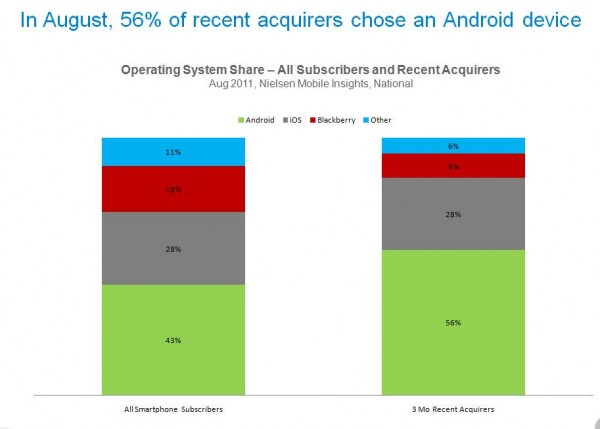

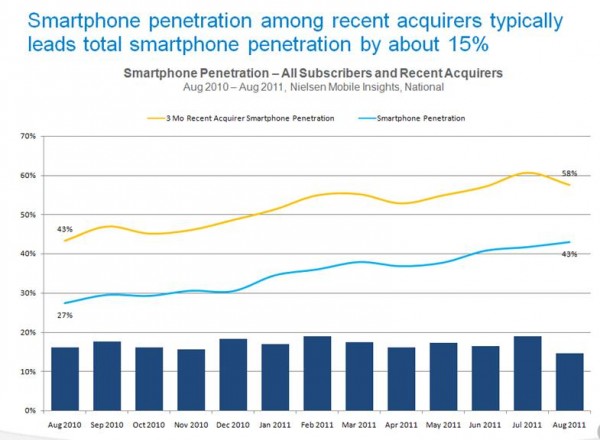

Publié: décembre 8, 2016, 9:19pm CET par Joe Wilcox

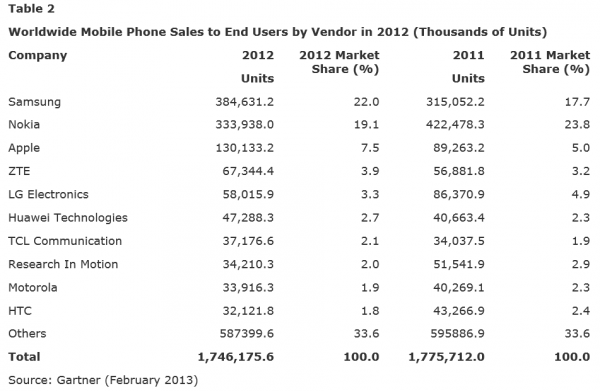

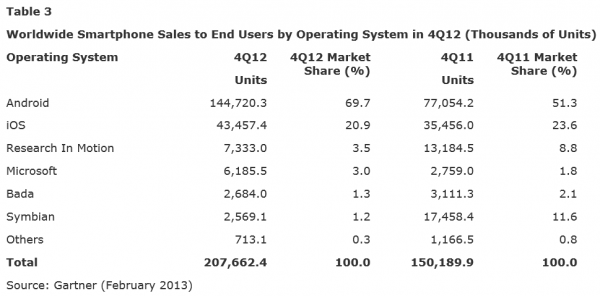

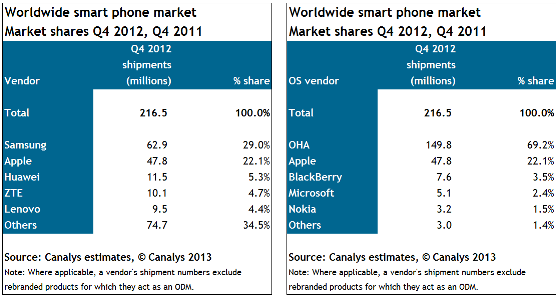

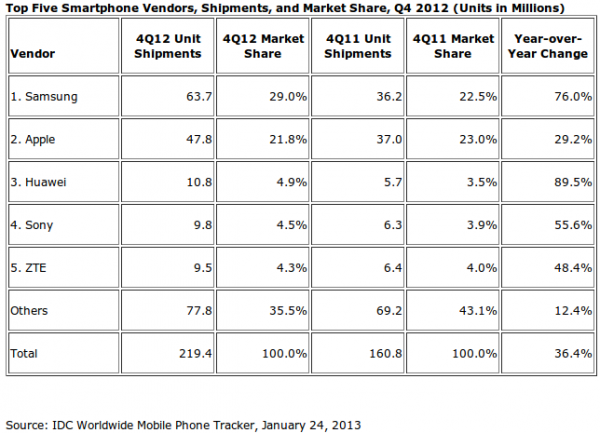

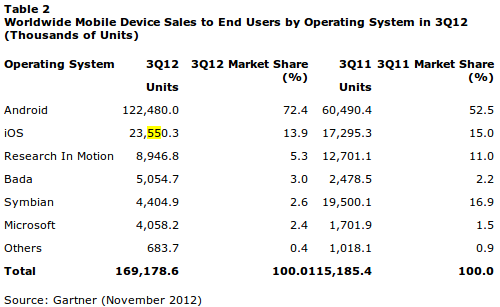

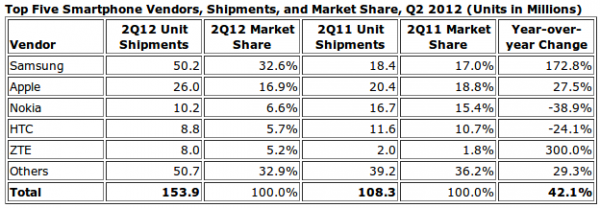

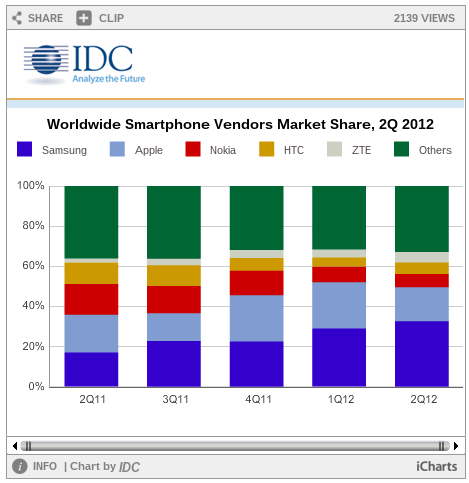

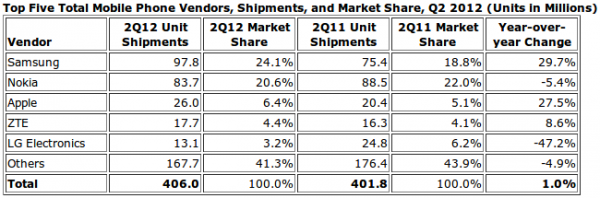

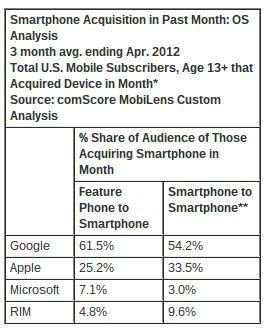

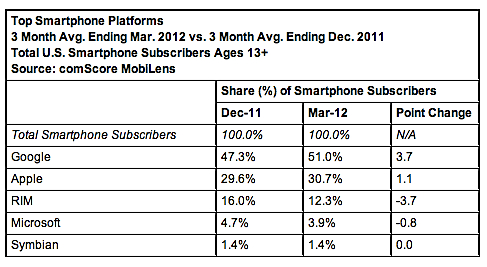

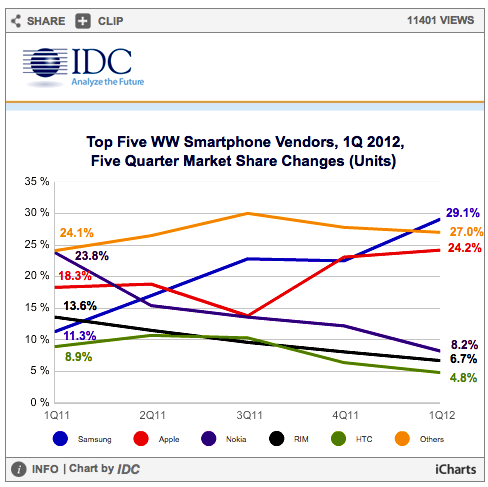

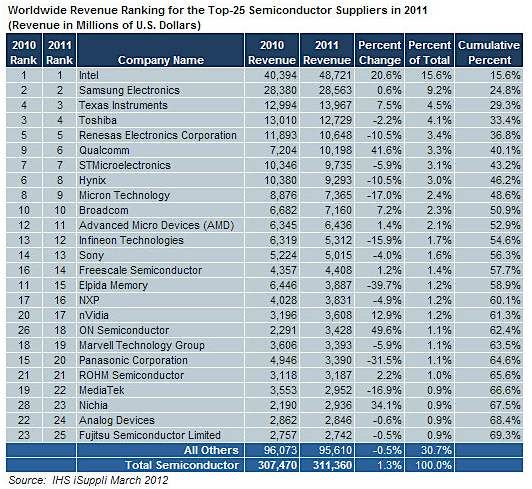

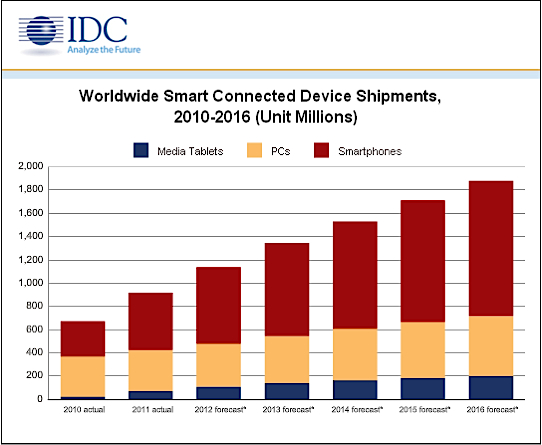

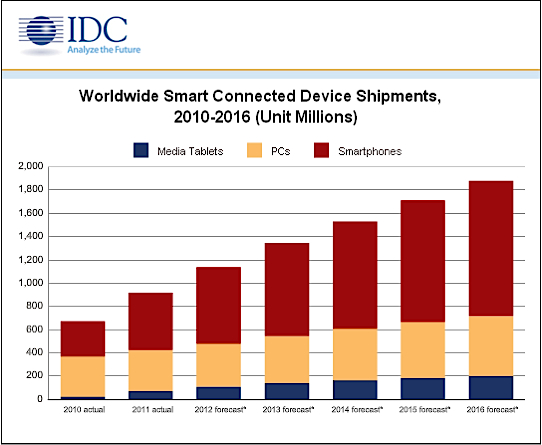

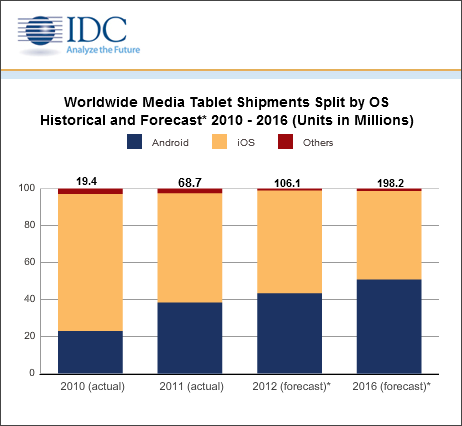

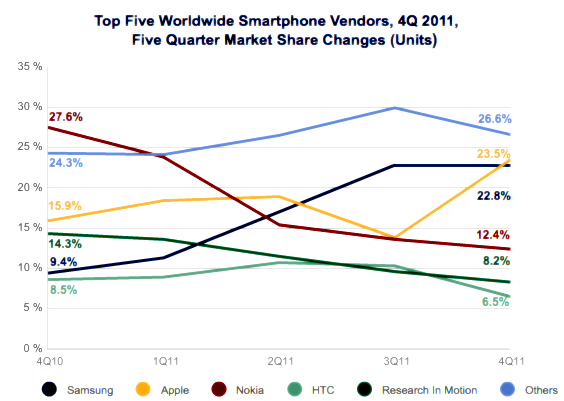

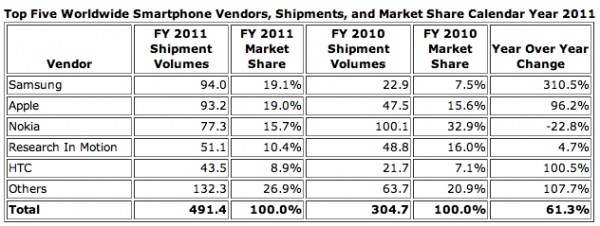

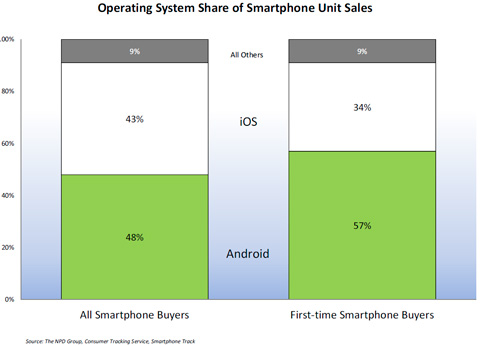

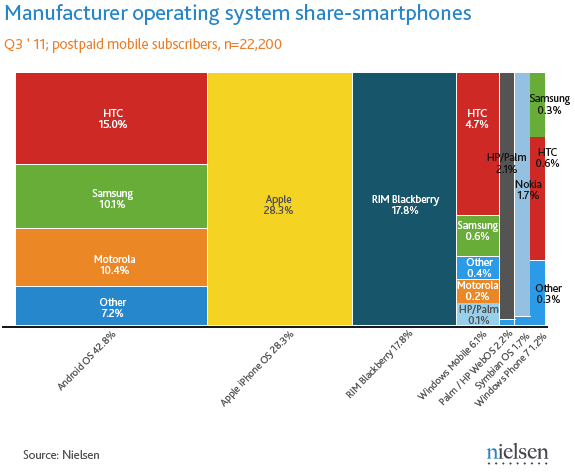

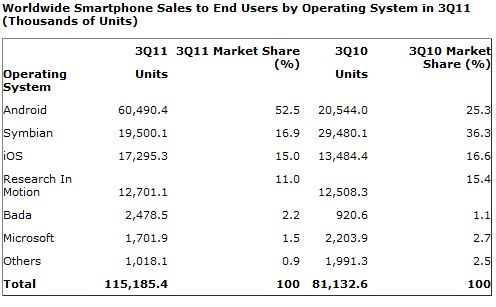

I laughed so hard and so often at IDC's smartphone forecast, my response took nine days to write—okay, to even start it. The future isn't my chuckable—that data looks reasonably believable enough—but the past. Because 2016 was supposed to be the year that Microsoft's mobile OS rose from the ashes of Symbian to surpass iOS and to challenge Android. In 2011, IDC forecast that Windows Phone global smartphone OS market share would top 20 percent in 2015. The analyst firm reiterated the platform's No. 2 status for 2016 in 2012 as well. Not that I ever believed the ridiculous forecasts,… [Continue Reading] -

For the audiophile: Grado Labs RS1e [Review]

Publié: novembre 8, 2016, 8:36pm CET par Joe Wilcox

Late last month, I sold my beloved Grado RS1e headphones, which get my highest recommendation. Parting ways, time is long overdue for a review, even if post-mortem. I let go the cans mainly because my lifestyle changed. Being tethered by wires is too confining; I listen to music more on the move now. As such, fine-fidelity Bluetooth cans—Master & Dynamic MW60—give great sound with more flexibility and mobility. I purchased the RS1e direct from manufacturer Grado Labs in late July 2014, soon after release. Grado is a family-owned/run Brooklyn, New York-based business that opened in 1953 offering turntable cartridges. In 1990,… [Continue Reading] -

Meet Master & Dynamic MW50 Wireless on-ear headphones

Publié: novembre 2, 2016, 12:18am CET par Joe Wilcox

I am a big fan of on-ear headphones, which attitude bucks the noise-cancellation trend. The design is a nice compromise between over-ear and open-back styles—the latter of which can present the best soundstage. Cans that rest on the ears, rather than cover them, tend to be lighter and confer airier, more natural sound. However, they also leak noise both ways, which makes them less appealing for commuter trains or air travel. Since I reviewed MW60 Wireless last week, I simply must point out that Master & Dynamic launched MW50 on-ear Bluetooth headphones today. Yes, I plan to review them in the near future. The company… [Continue Reading] -

If you're a recent MacBook Pro buyer, Apple just did you a HUGE favor

Publié: octobre 28, 2016, 6:57pm CEST par Joe Wilcox

People wanting a shiny new MacBook Pro are in for sticker shock. The entry-level for the cheapest, newest 13-incher is $200 or $500 more than its predecessor, depending on whether or not opting for the newfangled TouchBar and TouchID. That's $1,499 or $1,799. Yikes. MBP 15 is a $400 price hike, $2,399, for current tech. But if you already own MacBook Pro, particularly the 13-incher released in March 2015 or the larger model two months later, Apple increased the laptop's value by not accelerating its depreciation. No kidding. That's because the new entry-level SKUs are the same as before. The $1,299… [Continue Reading] -

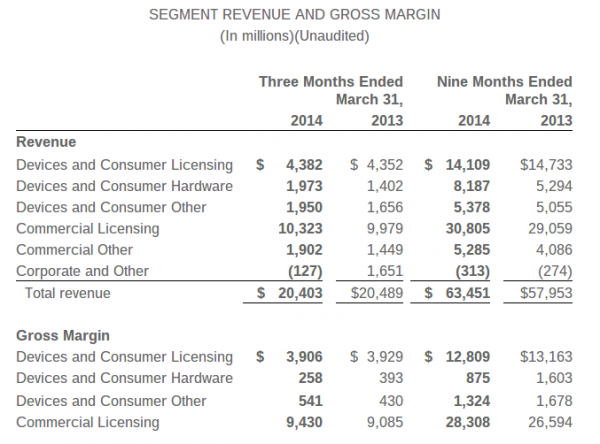

Apple fiscal Q4 2016 by the numbers: $46.9B, $1.67 EPS

Publié: octobre 25, 2016, 10:51pm CEST par Joe Wilcox

Two days before Apple's next media event, where long-overdue new laptops presumably arrive, the Cupertino, Calif.-based tech giant released fiscal fourth quarter and closed full-year 2016. You could feel the anticipation after the Bell closed on Wall Street today—and, honestly, it had been palpable for weeks. Shares closed $118.25, up .51 percent. The drama is a TV thriller: Release of iPhone 7 and 7 Plus set against a backdrop of saturated global smartphone sales; launch of Apple Watch Series 2 into an already declining market for smart timepieces; analyst data showing calendar third quarter to again be bad for PC shipments—with even… [Continue Reading] -

Say, what's going on at Intel Capital Global Summit 2016?

Publié: octobre 25, 2016, 1:35am CEST par Joe Wilcox

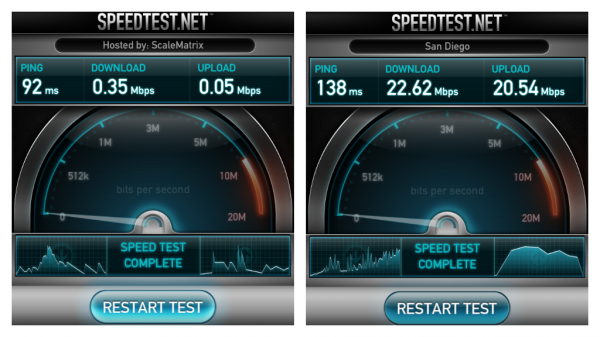

San Diego, Calif. As a general rule I never connect to public WiFi networks, which is fine except when attending an event at a hotel ballroom where T-Mobile cellular is like an apparition dancing around a Halloween grave. So as Wendell Brooks, CEO of Intel Capital, begins his speech, I sit typing narrative offline rather than tweeting live. There’s irony, I suppose, reporting old style, about investments in new innovations. Welcome to the trials and travails of the Intel Capital Global Summit, which kicks off today and goes through October 26. Looking at the lineup, I expect to hear about… [Continue Reading] -

Master & Dynamic MW60 wireless headphones [Review]

Publié: octobre 24, 2016, 7:17pm CEST par Joe Wilcox

For Christmas 2015, I bought myself a new pair of Bluetooth headphones. After trying several sets, I settled on Master & Dynamic MW60, which were a fantastic choice then and are still my top recommendation nearly a year later. The wireless cans replaced my beloved Grado RS1e -- no small feat. Read no further and buy the M&D cans, if wireless listening is priority -- and should be if using iPhone 7 or 7 Plus, which lack 3.5 mm jack. Authentic audio, spacious soundstage, and full fidelity (without over-punchy bass) make the MW60 the gold standard for Bluetooth cans. Nostalgic and… [Continue Reading] -

How do you FEEL about Samsung Galaxy Note 7's demise?

Publié: octobre 19, 2016, 9:36pm CEST par Joe Wilcox

I sold my sister's T-Mobile HTC M9 earlier today. Nan lives in Vermont, where Verizon delivers consistently better coverage and where the market for a used smartphone is much smaller than here in San Diego. The buyer had previously owned the Samsung Galaxy Note 7, which she really enjoyed. While waiting until late November or early December for her matte black iPhone 7 Plus order, the woman has a Samsung Galaxy J7 loaner and hates it. She is familiar with the M9 because her mom owns one. This lady is the fifth person I've met in just a few days who had… [Continue Reading] -

When is stupidity fraud?

Publié: septembre 25, 2016, 9:38pm CEST par Joe Wilcox

Next month I return from my first—and hopefully last—summer sabbatical. I resume writing with a question for you: "When is stupidity fraud?" I ask because someone is using my gmail address to sign up for a humungous number of newsletters and websites. At first, I presumed someone trolled me. But that no longer appears to be the case. This guy, presumably living in North Carolina, either uses my address randomly to hide his identity, or he mistypes one that is similar. Given many of the services are for an unidentified widower looking for love, I assume the latter. Behind my… [Continue Reading] -

Google should Brexit

Publié: juillet 15, 2016, 7:32am CEST par Joe Wilcox

Yesterday, Europe's Competition Commission expanded its legal assault against Alphabet and major subsidiary Google. Four monopolies are under fire: AdSense, Android, search, and shopping services. Trustbusters allege that Google uses anticompetitive tactics to protect its market dominance, which share ranges from 80 percent to 90 percent in each category. Behind the charges is a hoidy-toity attitude typical of overly-protectionist EU regulators. What if the information giant gave them what they want? Imagine this: Google shuts down operations across the entire Euro zone—in a Brexit-like departure, but suddenly with no preparations. Switch it off. Search and other services could remain available in… [Continue Reading] -

European trustbusters torpedo Google

Publié: juillet 15, 2016, 1:15am CEST par Joe Wilcox

Alphabet Admirals Sergey Brin and Larry Page had better tell Captain Sundar Pichai to close the watertight doors—lest the search and advertising ship sink in the North Sea, where depths reach 700 meters (2,300). Brrrr. Are the lawyers handing out life preservers? Will paralegals man the water pumps? Today's expansion of the European Union Competition Commission's investigation into Google business practices makes a really bad situation much, much, much worse. Problems are these: Adding advertising to anticompetitive charges; expanding investigation to four monopolies (AdSense, Android, search, shopping services); citing exclusive contracts as violation of the law; and narrowing the applicable market for search… [Continue Reading] -

How much storage does your laptop need?

Publié: juillet 7, 2016, 9:08am CEST par Joe Wilcox

The question nags as I prepare to review TarDisk Pear flash memory expansion. The doohickey is available in 128 or 256 gig capacities for either MacBook Air or Pro. It fits neatly and snuggly into the SDXC card slot, which is required; color and finish match, too. Windows users must look elsewhere, though, and many may be glad to. The tech lists for $149 and $399, respectively. But, hey, the Apple fan club is accustomed to paying more for everything. I will test TarDisk Pear on my 13-inch MacBook Pro with Retina Display, 3.1GHz Intel Core i7 processor, 16GB RAM,… [Continue Reading] -

Apple should buy Tidal

Publié: juillet 3, 2016, 11:24pm CEST par Joe Wilcox

As a Tidal subscriber. I welcome Apple acquisition—assuming lossless tracks are made available through the fruit-logo company's music services. Not that anyone should seriously believe the rumors. But one can hope. Merger talks are typically silent affairs. When they're serious, you don't hear about them until there is a deal. Reasons are many, with regulatory being among them when public companies are involved. Acquisition rumors often mean something else: Principal party leaks information about preliminary or ongoing discussions to gauge customer and shareholder reaction; one side or the other is dissatisfied with progress/terms and seeks to apply pressure. I don't doubt there… [Continue Reading] -

Seven things I learned from Apple's WWDC 2016 keynote

Publié: juin 14, 2016, 7:46pm CEST par Joe Wilcox

Apple's annual developer conference is underway in San Francisco. Yesterday's opening keynote was the best since before cofounder Steve Jobs' death nearly 5 years ago. While pundits poo-poo what's missing (shiny gadgets), new and improved software and services matter more—and they showcase priorities properly placed. CEO Tim Cook kicked off the event, by asking attendees to stand and offer a moment of silence for the mass murder victims the previous day in Orlando, Fla. Forty-nine people are confirmed dead and as many hospitalized from the nightclub shooting. He then went on to lay out a clear agenda for the keynote… [Continue Reading] -

Is Microsoft trying to steal Apple's WWDC thunder?

Publié: juin 13, 2016, 6:27pm CEST par Joe Wilcox

Timing is everything, particularly in business marketing tactics. Surely it's no coincidence that hours before Apple's big developer conference, where questions about iPhone's future and product innovation loom large, that Microsoft announces plans to buy social network LinkedIn. Hehe, how do you like them apples? The merger will split tech news and analysis coverage this fine Monday and spill over to tomorrow, robbing Apple of the attention it needs now to subdue rising negative perceptions about the future. Global smartphone sales are slowing and iPhone accounts for 65 percent of total revenues. Meanwhile, the fruit-logo company hasn't perceptually lifted the… [Continue Reading] -

Goodbye, Yahoo!

Publié: juin 8, 2016, 12:29am CEST par Joe Wilcox

My oldest Internet ID, three letters, is vintage 1996. Yahoo's impending demise, which could be to Verizon, almost certainly will mark the end of our long relationship. We mutually will abandon one another. I'm sorry that it comes to this. Yahoo sealed its fate when cutting the deal to outsource search to Microsoft during summer 2009. The disaster I predicted then will soon end the iconic brand, what little remains of it. Many people will blame CEO Marissa Mayer, but she was but steward of the sinking ship. Doom was a certainty after Yahoo surrendered crown jewel search. That the company limped along… [Continue Reading] -

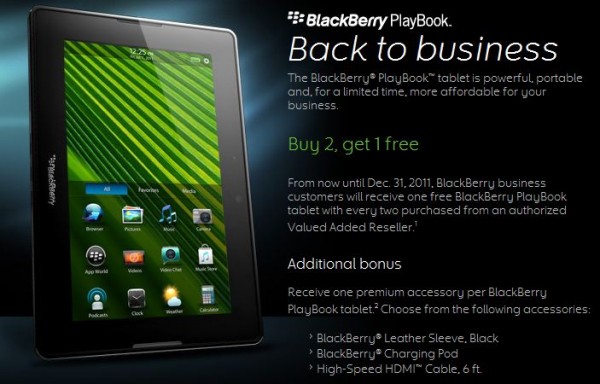

Apple is the new Nokia

Publié: mai 24, 2016, 9:05pm CEST par Joe Wilcox

Washington Post reporter Hayley Tsukayama asks, following up on a commentary by software developer Marco Arment: "Is Apple really at the risk of becoming BlackBerry?". The answer absolutely is No. But the concept is right. The fruit-logo company's dire straight is much more profoundly catastrophic. The risk is becoming Nokia, and the path to that destination is already well-trodden. Arment calls BlackBerry "king of smartphones", referring to its market position before Apple released iPhone nine years ago in June. The description is apt enough. "BlackBerry’s success came to an end not because RIM started releasing worse smartphones, but because the new… [Continue Reading] -

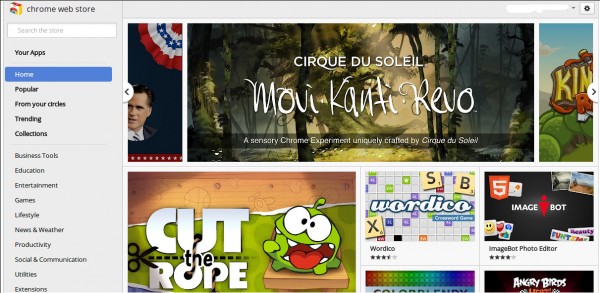

Why is Google bringing Android apps to Chromebook?

Publié: mai 20, 2016, 9:56pm CEST par Joe Wilcox

Answer: Your kids. Chromebook leads laptop and desktop sales through U.S. commercial channels to schools, according to NPD. Education is overwhelmingly the primary market for the computers. The institutions can't buy enough of the thangs, for their utility and low-cost compared to notebooks running either OS X or Windows. That cost is as much about extended webapps and services from Google (or its developer partners), available for free or comparatively next-to-nothing, set against software for the other platforms. Wrinkle in the Google firmament: iPhone and Chromebook are like water and dirt. The sediment settles unless shaken up. Sure youngsters can… [Continue Reading] -

Remembering Apple Store at 15, and marveling its changes

Publié: mai 20, 2016, 4:14am CEST par Joe Wilcox

Fifteen years ago today, the first Apple Store opened at Tysons Corner Center in McLean, Va. I was there, covering the event for CNET News. Four days earlier, then CEO Steve Jobs briefed journalists—bloggers, bwahaha, no—across the way at upper-scale Tysons Galleria. Most of us thought his scheme was kind of nuts, as did analysts, and news stories reflected the sentiment. Recession gripped the country and rival Gateway was in process of shuttering more than 400 retail shops. Timing was madness. But companies that take big risks during economic downturns are most likely to reap rewards later. Retail would be Apple's… [Continue Reading] -

Apple and Google: Two developer conferences, one matters

Publié: mai 18, 2016, 9:58pm CEST par Joe Wilcox

Depending on the day, Apple or Alphabet is the world's most valuable company as measured by market cap, and both manage the two dominant computing platforms used anywhere: iOS/OS X and Android/Chrome OS, respectively. As I write, Alphabet-subsidiary Google holds its annual developer conference. Apple's event starts June 13. During the opening keynote, Google CEO Sundar Pichai frames the conference and the company's direction by rightly focusing on two fundamentally future-forward concepts: Voice and context. Google gets what Apple likely won't present to its developers, and we'll know next month. But based on product priority to date, the fruit-logo company is… [Continue Reading] -

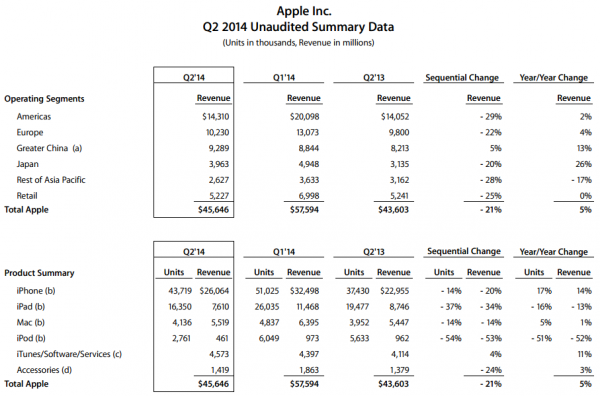

Can we dispense with the 'Apple is dead' meme -- other CEOs would lose a limb to have a bad quarter like this

Publié: avril 27, 2016, 2:00pm CEST par Joe Wilcox

Listening to Apple's fiscal second quarter 2016 earnings conference call yesterday was like attending a funeral—where the eulogy is for someone whom you know has gone to Hell. There's no way to sugarcoat that the good days are over and an eternity of burning flesh awaits. I kid you not. Haul over to iTunes and download the replay. You'll feel the grim reaper looking over your shoulder while CEO Tim Cook talks as joyfully about Apple's performance as a man granted last words before the gallows. And I wonder why? So what that Apple reported its first revenue decline in… [Continue Reading] -

Apple fiscal Q2 2016 by the numbers: $50.6B sales, $1.90 EPS

Publié: avril 26, 2016, 10:59pm CEST par Joe Wilcox

The spotlight shines on the world's most-valuable company this fine Tuesday, as Apple revealed results for fiscal second quarter 2016. Wall Street expected the first revenue growth decline in more than a decade and iPhone's first-ever sales retraction . Is the sky finally falling? Eh, not yet. But the sun slowly sets over the vast smartphone empire. Ahead of today's earnings announcement, Wall Street consensus put revenue down 10.4 percent year over year to $51.97 billion, with earnings per share down 14.2 percent to $2. Apple actual: $50.557 billion sales, $10.5 billion net income, and $1.90 EPS. Three months ago, the… [Continue Reading] -

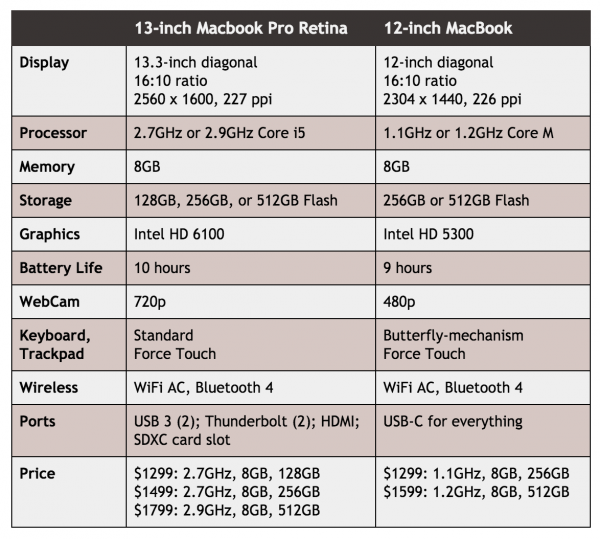

12-inch MacBook's three flaws that Apple could've fixed but didn't

Publié: avril 22, 2016, 7:58pm CEST par Joe Wilcox

Earlier this week, Apple finally updated its svelte laptop that launched 13-months ago. I am awe-struck by the company's design-audacity—not for brash innovation but bumbling compromises that make me wonder who needs this thing. The 12-inch MacBook offers much, wth respect to thinness, lightness, and typing experience (the keyboard is clever tech). But baffling is the decision to keep the crappy 480p webcam. These days, not late-1990s state-of-art, 720p is the least a pricey computer should come with, and is it too much to ask for 1080p or 4K when modern smartphones can shoot just that? This shortcoming, and two… [Continue Reading] -

Deja Vu! Google's antitrust offenses are like Microsoft's (and the defense, too)

Publié: avril 21, 2016, 1:09am CEST par Joe Wilcox

Once again, as it has done in the past, Google makes the classic monopolist defense for its competitive—or anticompetitive, depending on perspective—behavior with respect to Android. Today, the European Union's Competition Commission formerly charged Alphabet and its major subsidiary, which has 12 weeks to provide satisfactory legal response before the Commission issues corrective sanctions. Simply stated, the EC finds that the company abused its dominant position, in part by contracts compelling Android licensees to preload Google apps and related services, including search. Microsoft ran into similar bundling headaches starting in the late 1990s with respect to Windows. Responding today, Kent Walker, Google… [Continue Reading] -

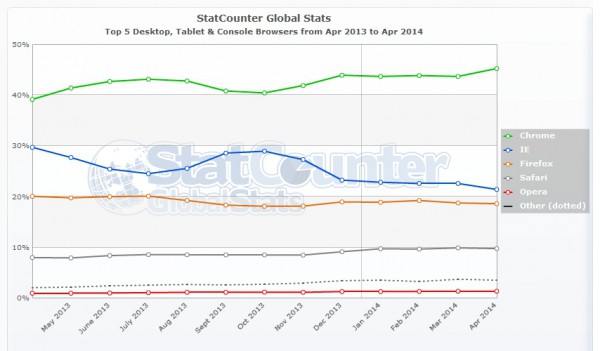

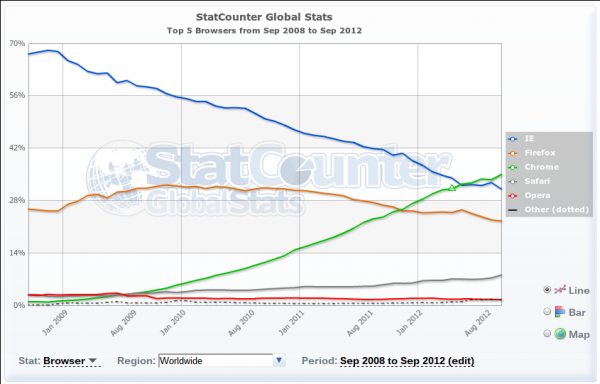

Google Chrome turns 50

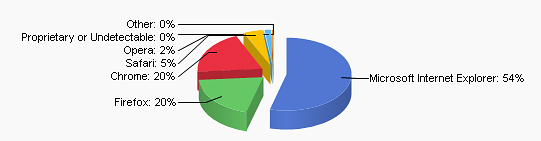

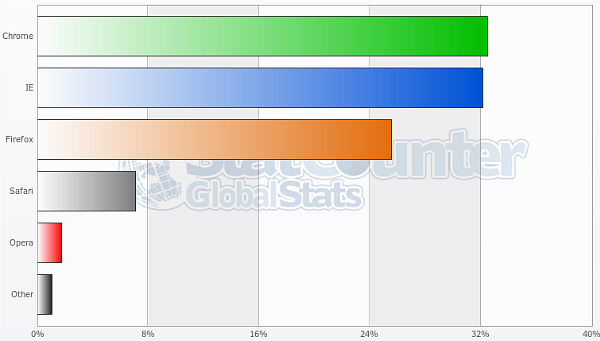

Publié: avril 20, 2016, 7:00pm CEST par Joe Wilcox

Dog years is too slow a measurement when it comes to the Internet, which pace maturing makes Moore's Law look like a skeleton sitting at a feast (it's too feeble a metric). Case in point: Google Chrome 50 officially releases this fine Wednesday, which is a long way from its late-2007 alpha. Whew, where did the years go? Now before you quibble about who's how old when, let's clarify. By my math, and an official blog post, Chrome turned 50 one week ago. Maybe none of us noticed. I write this the afternoon before Big G rolls out the birthday cake,… [Continue Reading] -

9.7-inch iPad Pro Preview

Publié: avril 17, 2016, 7:19pm CEST par Joe Wilcox

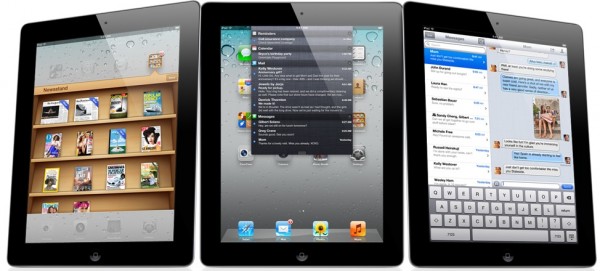

The more I use Apple's smaller Pro tablet, the less likely I am to reach for the larger one. I have tested the 9.7-inch and 12.9-inch tabs side-by-side since March 31st—and the bigger one is my primary PC (most days). Unquestionably, the behemoth is capable of replacing a laptop, as Apple CEO Tim Cook asserts. The smaller-size model is a fine notebook companion, and certainly can substitute sometimes. But more than two weeks using this surprisingly satisfying kit, I can't yet (and may never) recommend it as your next PC. The 9.7-inch iPad Pro, which screen measures like all its forebears,… [Continue Reading] -

Master & Dynamic teams with Rolling Stones for 'special edition' MH40 headphones

Publié: avril 12, 2016, 4:12am CEST par Joe Wilcox

If you're headed to London, or live there, the Rolling Stones have a new exhibit (opened last week) at the Saatchi Gallery. Exhibitionism will be there until early September. After which, the gala moves on to 11 other cities, including New York and Paris. Adults can expect to pay £22 (more than US $30, depending on exchange rate that day). VIP tix are £60.

The memorabilia-filled exhibit is meant to be a nostalgic look at the iconic, aging rock band, which youngest member is (cough, cough) 66. But Exhibitionism is as much about selling collectibles, one of which I can't resist calling attention to: "special edition" MH40 headphones. I reviewed the standard set, which sound exactly the same, on March 29th.

The MH40 typically sell for $399. The Stones' Exhibitionism-branded pair cost about $100 more. You wear the tongue! The tongue! Say, shouldn't Mick Jagger and Company update the symbol—give it some modern bling with big piercing? That would be more in tune with younger concert goers; surely the mosh pit isn't filled with the middle-aged and elderly—who might now more than their youth relate to songs like "(I Can't Get No) Satisfaction".

Okay, ribbing agism aside, the MH40 are excellent headphones for listening to the Rolling Stones. During 2016, the band rampaged Central and South America in a tour ending in Cuba last month. The Stones celebrate more than 50 years together, and the Master & Dynamic cans are so retro they could have been used by the rockers a half-decade ago—or by their male relatives flying in World War II bombers.

But audio signature matters more. The MH40 are among the better-balanced headphones for the price. Rather than being bassy, the cans emphasize finer details from the audio source, particularly music engineering during the 1960s, 70s, and 80s.

The MH40 driver is huge—45 mm—with Neodymium transducer. Frequency response is 5Hz to 25kHz, which punches up the midrange, while balancing well against the lows and highs. To repeat: Bass isn’t overbearing but present and clear rather than muddled.

If you're a Rolling Stones fan, the MH40 are great cans. But if you can live without the collector's branding, you could save $100 plus the price of the Exhibitionism ticket.

I'll say this: The MH40 are the tanks of the headphone market. They're sturdy and built to last decades. If you do go for the tongue, the Exhibitionism pair could be an heirloom for your descendants listening to the truly golden oldies in another 50 years. And with the Rolling Stones gone to the afterlife, perhaps your great-grandchild can listen and for a moment feel a little "Sympathy for the Devil".

Photo Credits: Master & Dynamic

-

There's something you should know about 12.9-inch iPad Pro [seventh in a series]

Publié: avril 5, 2016, 6:43am CEST par Joe Wilcox

April 3, 2016 marks the first day that I truly could use Apple's over-sized tablet to replace my laptop. But I had to spend another $84, before California tax, to do it. Gadget reviewers who say that iPad Pro cannot be your computer are wrong. The apps, performance, and utility are there. Anyone creating content should consider this device as compliment to, or replacement for, an existing PC. The problem with 12.9-inch iPad Pro isn't what it can do but how much it costs to assemble what you need. This kit is far from budget-friendly, which also can be said of Microsoft's competing Surface Pro 4.

I started my iPad Pro sojourn on Groundhog Day, planning to use the device as my primary PC for 30 days. The objective: Apple CEO Tim Cook says the big-ass tablet can replace a personal computer, I want to see if he is right. The experiment isn't my first journey like this. I tried something similar during summer 2011 with one of the first Chromebooks. The path was a dead end. But Spring 2012, when new commercial models released, I started down the path again and never looked back. Google's Chromebook Pixel LS was my main computer before adopting the iPad lifestyle.

Money, Honey

The tablet's biggest foible as laptop replacement isn't apps, hardware, or operating system but the charging system. The 12-watt brick that Apple ships in the box is inadequate. While battery life is excellent, and enough to last a workday for common tasks, recharging takes a long time. More perplexing, you can't really use iPad Pro and charge simultaneously; there isn't enough juice. An Apple Store specialist recently acknowledged the problem, noting that display models often drain the battery even when plugged in.

But there's a fix. Last month, the company released a lightning-to-USB-C adaptor that lets iPad Pro charge using 12-inch MacBook's 29-watt brick, and the changeover makes a huge difference. In my testing, battery recharges in less than half the time—comparable to my experience with MacBook Pro. The tablet also adequately recharges when in use, as you would expect with any laptop. But to get that utility, you pay extra: $49 for the brick, and either $25 or $35 for the cable, depending on length (1 or 2 meters, respectively). Most users will want the longer cord, which is comparable-length to the one they already have.

That extra cost leads into the price equation and where the math adds up for some buyers but not for many others. The overall kit is pricey. The value is there, and on this point I disagree with most other reviewers. That said, price-wary shoppers can get as much, or more, computing benefit elsewhere by spending lots less.

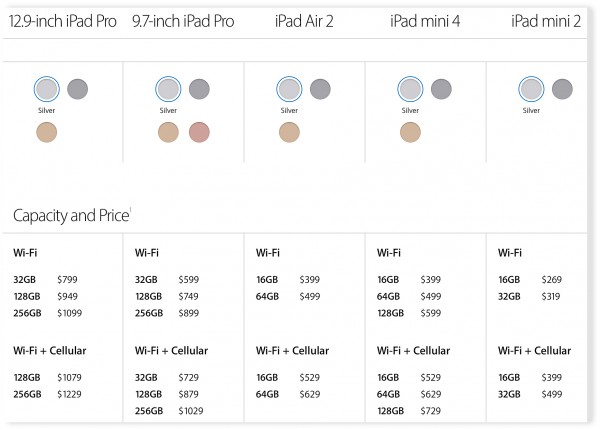

Last month, Apple released a second, iPad Pro that packs same-size screen as the Air 2—9.7 inches. I am testing one of these, too, and with similar objective as the bigger model; seeing what role it can assume alongside, or instead of, a laptop. Preview reaction: Pretty good kit. With the new model's availability, the Pro line now ranges from $599 to $1,229. It's the high-end models that are more suitable for comparing with a laptop; for price and performance.

The 128GB and 256GB WiFi configurations are $949 and $1.099, respectively. Adding cellular radio jumps the prices to $1,079 and $1,229. Pencil and keyboard add $99 and $169 to the kit's cost, and don't forget the 29-watt charger and cable. Add it up and top-of-the-line model runs $1,581, or $1,451 without LTE. For comparison, the 13.3-inch MacBook Pro Retina Display with 256GB storage is $1,499. Display resolution is similar, but there is no touchscreen, cellular radio, or Pencil (e.g. stylus).

Modularity is a benefit, but it comes with a higher price that also applies to Surface Pro 4, which screen is 12.3 inches. From Microsoft Store, 256GB WiFi configuration with i5 processor sells for $1,299 and includes the stylus. Type Cover keyboard adds $129.99 to the price, or $159.99 with fingerprint reader (which is more comparable to iPad Pro). Final cost works out to either $1,428.99 or $1,458.99.

None of these devices is exactly low-cost for the utility given. Microsoft Store sells a broad selection of Windows 10 laptops with touchscreens and 256GB SSDs for under $1,000; many go for less than $800. Selection is broader still from Amazon. While Windows users can choose touchscreen models at most major price points, Mac buyers get nothing. For touch in a laptop-class device, iPad Pro is the only option.

Apples and Oranges

Notice that my comparisons focus on storage, and also screen size and resolution—12.3 inches and 2736 x 1824 resolution for Surface Pro 4; 12.9 inches and 2732 x 2048 for iPad Pro; 13.3 inches and 2560 x 1600 for MBP Retina. Processor and RAM are purposely ignored, because in my testing comparison is meaningless—even using benchmarks. iPad Pro's A9X chip and 4GB RAM deliver subjectively fantastic performance in day-to-day use. There is no perceptible lag compared to my Chromebook LS or MacBook Pro Retina Display, both of which pack i7 processors and 16GB RAM. The larger iPad Pro brings Apple back to the PowerPC era, when comparison to Intel chips quite literally was apples to oranges.

Modular design, powerful performance, and bountiful apps put the iPad Pro in PC replacement territory. But you will pay for the luxury. Whom should that be? Pencil pushers will love the fine control drawing or annotating. I am no artist and yet still see the nuances given; pen-to-paper like. Content creation is sometimes frustrating because of the file system, or lack of meaningful direct access to it. Nevertheless, keys, stylus, and touch open lots of control for editing photos or videos and creating documents, for example.

The keyboard is delightful. That is for me, I can't say for you. As expressed in previous installments in this series, my fingers find the keys by touch typing more accurately than any other keyboard, Responsiveness and travel are excellent. There is only one angle for the screen, when using Apple's keyboard cover, and it's perfect for me. I'm a short guy; 1.68 meters tall (5 feet 6 inches). I sit low enough to the screen without slouching while level enough with the keys to accurately type. But I wonder about taller folks. Then again, Tim Cook is 1.9 meters (6 feet 3 inches) tall. If Apple's CEO doesn't tower over the rig such that the angle is bad, then maybe most anyone can comfortably use the branded kit. Still, a cheap laptop or Surface Pro 4 gives greater flexibility adjusting angle of the screen.

To my surprise, for typing, iPad Pro comfortably sits on my lap, without tipping off. I expected topsy-turvy, which would be a deal breaker for replacing a notebook. I suspect, and someone can correct me, that Apple's single-angle placement in the keyboard as holder maintains balance when the device is used off the desk and on the lap.

In a future installment, I will discuss the app experience and explain why it's surprisingly good enough for most needs, but by no means all. Apple News is a killer content consumption app. Then there is the Pencil and what you do with it.

Returning to the topic of cost, and what you get, I'm aghast that Apple ships such a dinky charging brick with iPad Pro. From about 10 percent level, setting the tablet aside, recharging often takes as long as 6 hours. The MacBook 29-watt brick pulls back the time to under 3 hours, which is good enough. Benefit maybe, but buyers investing so much in the kit shouldn't have to spend another $74 to $84 to get what Cook contends is possible: Tablet that replaces a laptop.

This post is seventh in a series; Parts One, Two, Three, Four, Five and Six.

Photo Credit: Joe Wilcox

-

Tidal: one year and 3M subscribers later

Publié: avril 2, 2016, 7:26am CEST par Joe Wilcox

April 1st marks my first-year anniversary subscribing to Tidal, which relaunched the same day last year, under new ownership of Jay Z. I love and loathe the music streaming service, which I cancelled at least five times and always renewed—typically before the billing cycle ticked over. But checking archived emails, I see that my sub completely expired thrice but not since July.

Gotta ask: What fool starts a business on April Fools, and what does the day foreshadow; if anything? Apple did it, 40 years ago today. Many commentators have called Jay Z the fool for buying Tidal, which competes against established players like Spotify and newcomer Apple Music. The service claimed to have 540,000 subscribers when acquired last year. This week, Tidal revealed globally there are now 3 million subscribers. Someone correct my math—456 percent increase, right? If Jay Z's the fool, gimme some of that foolishness.

Still, Tidal trails rivals. As of February 2016, Apple Music topped 10 million subscribers; Spotify reached 30 million last month. Both figures come from publicly released data.

Origin Story

In January 2015, Jay Z and his investment partners paid $56.2 million for Tidal, which history goes back to February 2010, when Aspire Group and Platekompaniet debuted the WiMP music service in Norway. The subscription streamer aggressively expanded to other European countries, and among portable and music devices, before adding lossless, CD-quality music under the WiMP HiFi brand on Oct. 1, 2013. A year later, the rebranded Tidal opened for business in the United Kingdom and the United States, focused on higher-fidelity encoding and streaming.

By March 2015, before relaunch under new management, Tidal was also available in Austria, Belgium, Canada, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, South Africa, Sweden, Switzerland, and Turkey.

Unlike some other streamers, Tidal does not offer a free option; elsewhere, freemium means advertisements. You pay to play—$9.99 per month for 320kbps compressed MP3s. Big spenders, those plunking down $19.99, get big sound. HiFi.

Music Lesson

Tidal's appeal is twofold: HiFi encoding and artist exclusives, of which there are many. Competing stores or services claiming CD-quality usually deliver bitrate of 320kbps. They lie about what that is. The compressed files aren’t even close to the source material. Using the Free Lossless Audio Codec, Tidal promises the real thing: 44 kHz, 16 bit, and 1411kbps bitrate. I listen with higher fidelity headphones—Grado Labs RS1e and Master & Dynamic MW60, which I bought with birthday and Christmas money, respectively, in 2014 and last year.

I hear the difference, and you may not, between the lossless and compressed AACs or MP3s tracks—even from Tidal. Detail is finer, overall ambiance is brighter (e.g. less muddy), vocals are crisper but also flatter, and bass is more natural rather than pounding. Because I can hear the difference, and really like it, Tidal pulls me back every time I try to cancel. I'm committed now; stopped trying to quit months ago.

Here and Nowhere Else

Exclusives are the other selling point. Among them, as I write: TWENTY88, a collaboration between Big Sean and Jhene Aiko; Edward Sharpe & The Magnetic Zeros' single "Perfect Time"; and exclusive playlists compiled by artists, including Gwen Stefani and Jay Z. Kanye West's album "The Life of Pablo" debuted on Tidal, exclusively during February, generating 250 million streams over 10 days. Exclusivity ended yesterday.

The sound should be a big draw, but there is the price as barrier. According to Tidal, only 45 percent of the 3 million subscribers pay for pricier HiFi. Too bad, because lossless listening is the service's distinctive feature, and it's one sure to be obscured. I expect Apple Music to offer something similar sometime this year.

Likes and Gripes

My major problem with Tidal: Justify spending the $19.99 monthly fee; I have too many different monthly services, and some competing streamers offer family plans for $5.00 less than Tidal's single-subscriber price. So, for example, six people can share the same Apple Music account for $14.99 monthly. Tidal does cut the price for additional users by half. Primary subscriber plus one other would be $29.98 per month, with both getting HiFi. The service does offer select discounts. Student: $4.99 for compressed and $9.99 for lossless. Military: $5.99 and $11.99. Available only to new, standard subscribers: First six months (after 30-day trial) discounted when paid as one sum. That averages out to either $8.49 or $16.99 monthly, depending on encoding.

Besides price, some of my other gripes:

- The web player requires Adobe Flash.

- The music catalog isn't as extensive as Apple Music.

- The default playback setting on mobile apps is Normal not HiFi.

- Music playback doesn't sync across devices; you can't stop listening on one and resume on another.

What makes me a Tidal subscriber:

- HiFi is just that.

- Playlists are superbly curated.

- The video collection is superb, as is playback.

- Tidal feels like an artist showcase, not record labels'.

- Exclusive content is plentiful and frequently updated.

- Tidal X live concerts connect artists and fans—fidelity rocks!

- Many albums are available in U.S. and/or international versions.

Listen Up

Tidal claims its music library tops 40 million tracks, while there also are 130,000 music videos. The user experience is excellent across interfaces. I have used the Android and iOS apps, as well as the website. Features are comparable to Apple Music and other competitors, which makes Tidal's apps immediately usable.

Wrapping up, exclusives are fine, but any service can offer them. Audio encoding sets apart Tidal—for now—from major competitors. Wanna hear? I suggest testing Tidal by streaming The Beatles catalog from there and somewhere else. Vocals aren't as crisp, bass is punchier, and high notes are more muted on Apple Music, for example. The questions: Can you hear the difference? If so, do you like it, and would you say twice as much for the pleasure?

Photo Credit: Joe Wilcox

-

An Apple 40th birthday reflection

Publié: avril 1, 2016, 6:12am CEST par Joe Wilcox

Summer 1984, Chapel Hill, N.C., I learned something about prejudice and discrimination in America and saw my first Macintosh. Strangely, looking back at Apple, which celebrates its 40th birthday today, the two things connect.

As I reflected in Jan. 18, 2004, personal post: "Racism and Naiveté", I never thought much about skin color growing up in a region of America where most everyone is Caucasian. Northern Maine is a white wonderland for more than abundant snowfall. Strangely, though, my best friends had last names like Chung and Zivic. The local Air Force base, Loring, added color to the populace, and when it came to people I was decidedly colorblind.

Because I witnessed so little racism, or discrimination, firsthand, I had no context to understand -- even when learning about slavery or the Civil Rights Act of 1964 in school. Twenty years after that landmark legislation came to be, I watched the film “From Montgomery to Memphis“, and it changed my perspective. First, there was the shock about black and white buses, then black and white waiting rooms at bus stations, and segregated bathrooms. Separate water fountains!

The same afternoon I watched the film, I wandered around the University of North Carolina campus contemplating the documentary. I ambled into the college bookstore, where placed prominently for anyone and everyone to see was Macintosh. I knew nothing about Apple, nor should I have not being a computer geek -- then or even now. But I nevertheless marveled at the graphic display. I had seen movie "WarGames" a few months earlier and recognized the dramatic differences between this machine and the one used by actor Matthew Broderick. (Hehe, Loring Air Force Base plays a role in one of the climactic scenes.)

The next year, I moved to predominately black Washington, D.C. for work, coincidentally. You don’t grow up white and male and suddenly have a feeling for what it’s like to be a minority or female of any race. One movie wouldn't change that, nor my long-time living in the D.C. metro area.

Hello, Mac

While residing there, I bought my first computer -- January 1994 -- months after reading a compelling story in Washington Journalism Review about the coming era of online publishing. I made a career change from general-interest magazine editor to tech-industry reporter. Except for a brief flirtation with IBM OS/2, I exclusively used Windows until December 1998, when I hauled a Bondi Blue iMac out of the local CompUSA. Curiosity -- and interest in expanding tech reporting beats -- prompted the impulsive purchase.

I came to love the fruit-logo company's products, while as a tech journalist developing a reputation for being anti-Apple -- which I am not. Several Apple fanboy bloggers fan the flames of hate through their criticism, sarcasm, and witlessness; they are defenders of the forbidden fruit and tolerate little real or perceived criticism.

I am not much bothered, as I don't typically read their posts or those from their accolades commenting on my stories (and other writers'). I abide by the "be hardest on those whom you love most" principle and therefore understand (and excuse) the misplaced "anti-" accusations. Few of my stories are kind, I concede.

I am not then, nor at anytime, have been a fanboy of Apple or any other tech company. The products are all just tools to me, and I use what makes sense at the time. Google gives greater contextual utility that matters to most everyone, but Apple does deliver things that make people happy to hold, look at, and use in a more human-like, responsive, and immersive way.

Apple Activism

In the nearly 18 years since I booted my first Mac much has changed. Apple has gone from being the little company that could to the behemoth that couldn't -- my first iMac is example of the one and the March 21st "Are you in the Loop?" event as metaphor for the other. CEO Tim Cook's innovation focus is customer retention rather than expansion, and maybe in the end that will prove to be the "can do" strategy.

Apple's empire is built on iPhone, which accounted for 67.4 percent of revenues during fiscal Q1 2016. Yesterday, Gartner warned that global smartphone sales would be flat in the two largest markets -- China and the United States. Existing iPhone owners in those countries could become larger customers, if Cook and Company deftly execute.

During this decade, Apple is also an activist, aggressively and vocally taking positions on real and perceived discrimination, equality, gender bias, and human rights issues, particularly in the United States. That includes the recent ruckus with the FBI about iPhone encryption. By contrast, the company showed little public social activism under Steve Jobs' leadership.

So the two threads tie together from that afternoon in 1984, when I saw America's bad past behavior magnified and a glimmer of the future displayed from a beige box. Prejudice and discrimination aren't easily swept away, and the United States still grapples with both. Eliminating either enables huge portions of our population.

Technology enables everyone, if iPhone's success means anything. No matter what Apple's future, over 40 years the company has succeeded to humanize technology and diminish the complexity using it. Nokia invented the smartphone two decades before Apple brought to market iPhone, which fundamentally changed the cellular handset market -- directly and by way of derivative, imitative devices released by other vendors.

Happy Birthday, Apple.

Photo Credit: Shutterstock/Sean Locke Photography

-

Master & Dynamic MH40 headphones [review]

Publié: mars 29, 2016, 7:03pm CEST par Joe Wilcox

Newcomer is the only way to describe Master & Dynamic, which on Dec. 31, 2015 completed its first full year of revenue. Young or not, its audio gear is vintage and refined. Wanna see? You can find the MH40 headphones, which look like something World War II bomber pilots would wear, inside any Apple Store. Distribution partnership of that caliber from a near start-up says much about M&D earphones and headphones—design, price, and sound.

The signature sound is full, which is atypical in a market where booming bass ranks among headphone buyers’ top priorities. But for those listeners who delight in the faintest tap of the symbol, warmest treble, and deep lows that reveal details rather than thump, thump, Master & Dynamic delivers. For Christmas I bought the company’s MW60 wireless headphones, which I will review soon. Today's topic is the MH40, which are wired.

Origin Story

Both cans share obvious design heritage, and you could easily mistake one for the other. There are also many audio similarities, where both present rich range rather than pumping bass. I am super picky about headphones. The $549 MW60 are the best wireless cans ever to touch my ears. The MH40 are best-of-class in the price range—$399.

So I am surprised to hear CEO and founder Jonathan Levine’s startling confession: "I have no prior professional connection to music or audio". He’s not a music producer, audio engineer, or anything close to either. At age 16, Levine’s oldest son started learning how to produce music and later to teach others how to deejay. So the dad put together a makeshift music studio. “I’ve had music studios in my businesses for years”.

At 53, Levine stands at the generational divide from Millennials, which gap the home studios and audio company help bridge. About his two sons, Levine says: “They won’t admit it, but they think I’m slightly cool now”.

Levine’s inexperience proved to be an asset and testimony to the concept that fresh ideas come from people with little or no preconceptions. What’s that stereotype about hiring someone who hasn’t developed bad habits, or in this case hires oneself?

In developing the first headphones, Levine wanted to “build something that is iconic and will last”. He chose forged aluminum and leather as the principle materials. only to learn from M&D chief engineer Drew Stone Briggs, after developing the MH40, that aluminum has unique audio characteristics that are beneficial to producing pure sound. Levine then intuitively chose brass for the ME05 earphones. Think of all the musical instruments, like my middle school trumpet, that are made of brass.

I ask Levine how he chose Master & Dynamic, to which he asks: “Have you ever tried to name a company?” I have, and pretty much every good name is claimed. Being iconic is nomenclature, too—using a multiple name, Many grand old brands are such, he says, like A&M records, Arm & Hammer, Black & Decker, Johnson & Johnson, and Proctor & Gamble.

The name derives from several concepts. “In music there is dynamic mastering” Levine explains. “We love to engage with the masters in any endeavor. And we like to engage the up-and-coming dynamics in that particular field".

Behind the Jargon

Before moving to the MH40 audio and design characteristics, let's dispense with some technical talk—terms that are good to understand:

- Soundstage is how instruments are spatially placed in audio recordings. The MH40 present dynamic soundstage, such that you often can visually place the instruments and singers, and even feel like you are in the room with them.

- Active noise-cancellation uses microphones to capture and largely eliminate ambient, background noise. The MH40 use passive noise-cancellation by way of the closed-ear design. This approach gives purer, more balanced audio than does the active type.

- Open-back headphones let in the most background noise or leak sound to those people nearby. Open-backs also typically present the best soundtage of headphone styles.

- On-ear headphones are as named. They sit on the lobes rather than enclose them. Whether or not as comfortable as, or more than, over-ear is a matter of taste. Without active noise-cancellation, like open-back, the wearer will hear sounds in the room.

- Over-ear headphones typically cover the ear, making a soft seal that improves the aural experience while blocking out most background noise. Many people find this style to be the most comfortable to wear, particularly for long periods of time. The MH40 are this type.