Today, I formally begin covering Google earnings, as I have done for Microsoft (a decade) and Apple (about six years). This first report won't be as thorough as the others, as I get my head around the financials, which share little in common with APPL and MSFT other than money. Today's earnings announcement is refreshing respite from third quarter's, when an incomplete press release pushed out early and while the market was open.

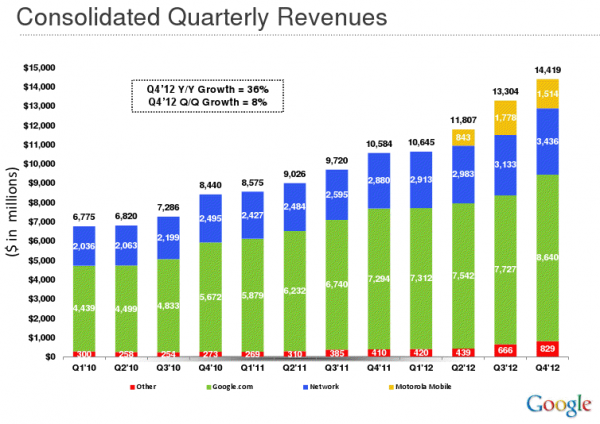

For calendar fourth quarter, revenue rose 36 percent to $14.42 billion, year over year; net revenue, excluding Traffic Acquisition Costs, was $9.83 billion, up from $8.13 billion. Net income climbed to $2.89 billion up from $2.71 billion. That's $8.62 earnings per share, including costs associated with discontinued operations. Operating income was $3.39 billion, down from $3.51 billion year over year.

Average analyst consensus was $12.36 billion revenue and $10.52 earnings per share, for the quarter. Revenue estimates ranged from $11.74 billion to $12.72 billion, with estimated year-over-year growth of 52 percent.

Advertising accounted for 94 percent of Google revenue, down from 96 percent a year earlier.

For the year, Google revenue reached $50.18 billion, up 32 percent from $37.9 billion. Motorola contributed $4.14 billion. Net income: $10.74 billion or $32.81 earnings per share. Average analyst consensus was $41.41 billion revenue and $39.73 EPS.

Following the announcement, and while the earnings call was still underway, Google shares rose nearly 5 percent in after-hours trading. Shares closed at $702.87 but traded at $736.75 at 5:32 PM EST. At 6:18 PM, increase topped 5 percent, with Google trading at $738.39.

CEO Speaks

"We ended 2012 with a strong quarter", Google CEO Larry Page says. "Revenues were up 36-percent year-on-year, and 8-percent quarter-on-quarter. And we hit $50 billion in revenues for the first time last year -- not a bad achievement in just a decade and a half. In today’s multi-screen world we face tremendous opportunities as a technology company focused on user benefit. It’s an incredibly exciting time to be at Google".

Page's voice sounded surprisingly weak during today's earnings conference call. But this isn't new. He boasts about the pace of innovation, which he claims is as great now as the dawn of the PC era. While bragging about new devices, he offers no explanation for Nexus 4 product shortages or explanation why "Nexus 7 continues to define the 7-inch tablet category".

The chief executive praises his company's work on the major competing mobile platform: "Google Maps for iOS was downloaded over 10 million times in the first 48 hours. In fact, six Google apps were included in Apple’s App Store Best Free Apps of 2012: including YouTube, Chrome, Google Search and Gmail".

"We're still in the early stages of that", Page says in response to a question about Knowledge Graph, which launched a quarter ago in seven languages. "We provide much better answers for people, which really grows the business". Analysts are interested in Google's push to offer answers over links, and how the approach changes the dynamics of the search business and how the company plans to monetize it.

Page is enthusiastic about Google Now. "Wouldn't it be great for the earnings call, if we answered all your questions without asking them".

Another analyst asked about the monetization of Google Maps. Page describes the service as "critical to search. To understand those queries, we have to understand where things are in the real world". So from that perspective, Google Maps already generates revenue, he says, by supporting search. Related to Maps, Page highlights Voice search as another valuable ancillary technology that indirectly generates revenue: "The importance of that is mobile, which is finding things".

Page describes the $249 Chromebook as the "holiday highlight. I love mine. It’s super easy to use, and it almost maintains itself. Open a Chrome tab on your phone, and everything syncs on your laptop with no extra effort required".

He boasts that "2012 was an amazing year for Google and he is "incredibly optimistic" about the year ahead.

Financial Highlights

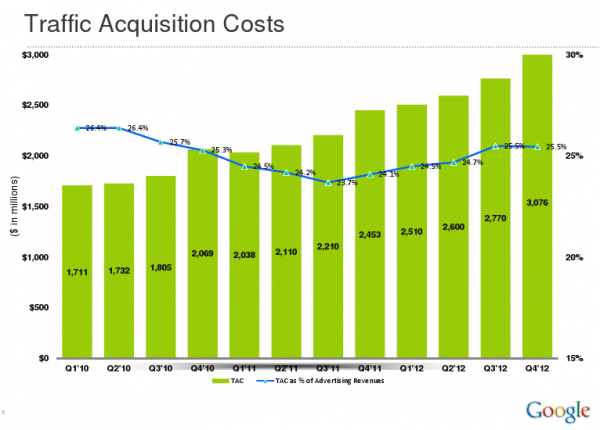

TAC. Google's financials include Traffic Acquisition Costs -- that's revenue shared with partners. For Q4: $3.08 billion, compared to $2.45 billion a year earlier. TAC was one-quarter and 24 percent, respectively.

Paid Clicks increased 24 percent year over year and 9 percent sequentially.

Cost-Per-Click fell 6 percent yearly but increased 2 percent quarterly.

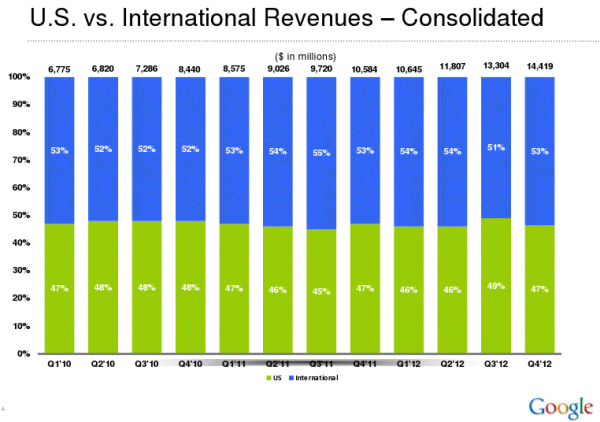

International: $6.9 billion outside the United States, accounting for 54 percent of revenues -- that's up 1 percent by year and quarter.

Motorola Mobile revenues reached $1.51 billion, or 11 percent for consolidated Google results.

Google revenue (excluding Motorola) was $12.91 billion -- that's up from 22 percent from $10.58 billion a year earlier.

Google-owned sites: $8.64 billion, up 18 percent from $7.29 billion.

Google Network (e.g., partner sites): $3.44 billion, up 19 percent from $2.88 billion.

Other: $829 million, up 102 percent from $410 million.

Google did not include Motorola Home, which the search giant recently agreed to sell. Motorola revenues would have been $2.3 billion, when including Home. Broader Google total revenue would have been $15.24 billion, up 44 percent year over year and 8 percent sequentially, if including Motorola Home.

Credits: meneame comunicacions, sl (photo); Google (charts)