PC shipments may have been tepid during third quarter, but servers are up year over year despite the economy -- or perhaps because of it. Shipments grew 7.2 percent, according to Gartner, while revenue rose 5.2 percent. That's not exactly gangbusters growth and might have been greater if not for the drag in Europe, where server shipments declined by 4.9 percent.

PC shipments may have been tepid during third quarter, but servers are up year over year despite the economy -- or perhaps because of it. Shipments grew 7.2 percent, according to Gartner, while revenue rose 5.2 percent. That's not exactly gangbusters growth and might have been greater if not for the drag in Europe, where server shipments declined by 4.9 percent.

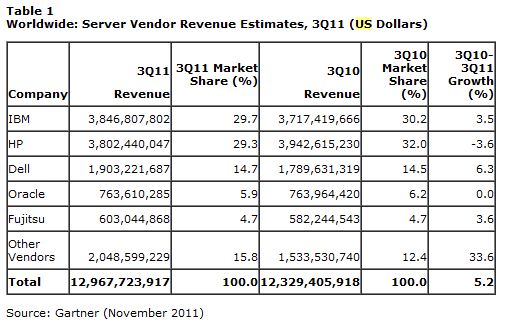

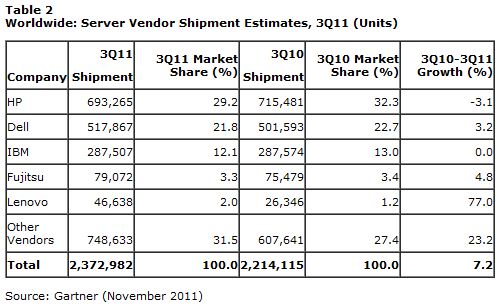

"Asia/Pacific grew the most significantly in shipments with a 23.9 percent increase", Jeffrey Hewitt, Gartner research vice president, says. "Eastern Europe posted the highest vendor revenue growth at 27.4 percent for the period". Globally, vendors shipped 2.37 million servers, generating $12.97 billion revenue.

HP led the quarter in shipments, but IBM generated more revenue -- and from a significantly smaller base. HP shipped 693,265 servers for 29.2 percent market share -- IBM 287,507 servers for 12.1 percent share. However, IBM revenue nudged ahead of HP --$3.846 billion to $3.082 percent, respectively, in a dead heat of 29.7 percent to 29.3 percent revenue share. There's something to be said for big iron. HP revenue fell by 3.6 percent, while IBM's rose by 3.5 percent. Dell posted strongest revenue growth -- 6.3 percent.

Lenovo is the up-and-comer to watch, posting 77 percent year-over-year shipment growth. HP led, but while shipping fewer units -- down 3.1 percent year over year, mostly from sluggish ProLiant server sales. Dell shipments rose by 3.2 percent while IBM's were flat.

Good news for Microsoft software license sales: "x86 servers forged ahead and grew 7.6 percent in units and 9.3 percent in revenue", Hewitt says. "RISC/Itanium Worldwide Unix server shipments declined 6.8 percent, but vendor revenue increased 3.5 percent compared to the same quarter last year. The 'other' CPU category, which is primarily mainframes, showed a decline of 6.9 percent".

Blade server shipments rose by 3.3 percent but more than double in revenue -- 7.6 percent. Rack-mounted servers rose 8.2 percent in shipments and 6.3 percent by revenue.

Servers are undergoing a kind of tug and pull as IT organizations re-evaluate strategies. Virtualization saps some sales, while private and public cloud adoption drives them. There is the push to increase server density to support businesses' rapidly changing needs, whether server consolidation or expansion to support cloud efforts. For example, datacenter hardware spending will reach $98.9 billion this year -- that's up 12 percent from 2010, Gartner predicts. The analyst firm forecasts datacenter hardware spending to reach $106.4 billion next year and $126.2 billion in 2015.

More immediately, the Euro's future as a currency weighs heavily on IT purchases in the region, and collapse could ripple to the United States. Declining server shipments may be the canary in the coalmine that IT spending is retracting across the Euro zone. Another indicator: PC shipments declined 11.4 percent year over year in the region, during Q3, according to Gartner.

Photo Credit: gualtiero boffi/Shutterstock