Today's question: Is Apple's CEO hiding weak smartwatch sales or does he demonstrate transcending leadership by positioning for greater platform success—taking the long view? The answer lies perhaps in his comments made during yesterday's fiscal Q3 earnings conference call.

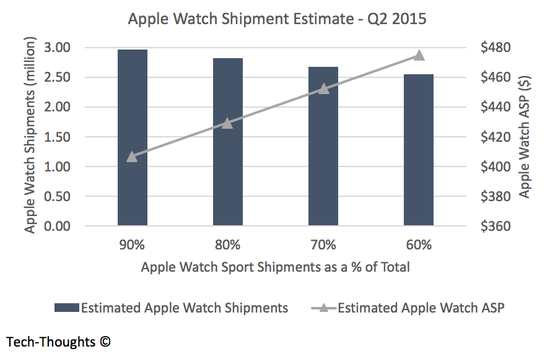

In data released today, Strategy Analytics puts Apple Watch shipments at 4 million for the April quarter. Yesterday, Canalys gave estimate that is 200,000 units higher. Posting to BetaNews just minutes ago, analyst Sameer Singh calculates 3 million devices shipped and 2.5 million sold. Apple doesn't share the real numbers that it surely has. In chief executive Tim Cook's remarks that follow, there are hints—but little more. Something he says later in the conference call is quite provocative; genius and contrary-logistics-thinking. Either he's hiding or abiding.

The Conference Call

Let's begin with Cook's canned remarks given easy-on. They are edited to remove natural pauses like "ah". He is all praise about how great are Apple Watch sales, without disclosing anything quantifiable:

A major highlight of the past quarter for all of us here at Apple was the launch of Apple Watch in April. As you know, we've been very excited to get this revolutionary product to customers. We started taking preorders in nine countries on April 10, and demand immediately exceeded supply by a wide margin.

To prioritize those first orders and to deliver the best experience for our customers, we delayed the availability of Apple Watch in our own retail stores until mid-June. We made huge progress with the production ramp across the quarter and near the end of the quarter expanded into six additional countries—and in just the past few days, we've been able to catch up with demand, enabling us to expand Apple Watch availability to a total of 19 countries currently with three more countries to be added at the end of this month.

The feedback from Apple Watch customers is incredibly positive, and we've been very happy with customer satisfaction and usage statistics. Market research from Wristly measured a 97-percent customer satisfaction rate for Apple Watch, and we hear from people every day about the impact it's having on their health, their daily routines, and how they communicate. Our own market research shows that 94 percent of Apple Watch owners wear and use it regularly, if not every day.

Messaging and activity features are among the most popular, and social networking apps including Twitter, WeChat, and LINE are seeing the most usage among third-party apps.

We believe that the possibilities for Apple Watch are enormous and that's been reinforced in just the first few weeks since it became available to customers. For example, doctors and researchers at leading hospitals in the U.S. and Europe are already putting Apple Watch to work in improving patients' lives. Nebraska Medicine, the latest hospital to adopt Apple Watch, has rolled out new apps that facilitate communication between patients and doctors and provide quick access to important chart and dosage information.

Ochsner Health System of Louisiana is using Apple Watch with hypertension patients to gather important information like daily activity and blood pressure level, and leading cancer centers like London King's College Hospital are incorporating Apple Watch into trials for ongoing care and monitoring of cancer patients.

Great Apple Watch solutions go well beyond healthcare. Users are tracking their fitness, getting breaking news alerts, following their investments, connecting with friends, and living a healthier day. The user experience for Apple Pay and Siri is nothing short of incredible, and customers are enjoying countless other features through the over 8,500 third-party apps available for Apple Watch.

This is just the beginning of what this new platform can deliver. With Apple watchOS 2, developers now have the ability to build richer and more powerful native apps for Apple Watch, taking advantage of the heart-rate sensor, the Digital Crown, accelerometer, and more, ushering in a whole new class of apps designed specifically for the wrist.

During the Q&A, Piper Jaffray analyst Gene Munster asked what surely his colleagues also wondered about: "The watch has been under a lot of interest from investors and some may have wanted a little bit more. You outlined some of the opportunities and some of the progress you've had. But any thoughts that you have for investors who may say that the category is just not taking off as fast as they would have hoped?"

Cook answered:

As you know, we made a decision back in September, quite several months ago, not to disclose the shipments on the watch; and that was not a matter of not being transparent, it was a matter of not giving our competition insight that's a product that we've worked really hard on.

However, let me give you some color so to avoid reaching sort of a wrong conclusion. If you look at the Other products category and look at the revenue in this category, it would not be an accurate thing to just look at the sequential change or the year-over-year change and assume that were the total watch revenue because the aggregate balance of that category, both sequentially and year over year, is shrinking. Obviously iPod is a part of that, but there are other things in there, accessories and so forth, that are shrinking.

Secondly, to provide a bit more color, sales of the watch did exceed our expectations and they did so despite supply still trailing demand at the end of the quarter; and to give you a little additional insight, through the end of the quarter, in fact the Apple Watch sell-through was higher than the comparable launch periods of the original iPhone or the original iPad—and we were able to do that with having only 680 points of sale; and, as you probably know, as I had reviewed earlier, the online sales were so great at the beginning, we were not able to feed inventory to our stores until mid-June; and so those points of sale pretty much, the overwhelming majority of the low numbers of sales were not there until the last two weeks of the quarter; and so as I look at all of these things, we feel really great about how we did.

Now our objective for the quarter wasn't primarily sales. Beyond the very good news on sales, we're more excited about how the product is positioned for the long-term because we're starting a new category; and as I back up and look at this, we have 8,500 apps.

We've already announced the next operating system, watchOS 2. It will bring native apps which are going to be killer to the watch. Even though the store layout was delayed, we've learned a lot about the buying experience. Based on that experience, we're now planning to expand our channel before the holiday because we're convinced that the watch is going to be one of the top gifts of the holiday season.

Now most importantly of all of this is that customer-sat is off the charts because we've constantly seen if you can get the customer-sat off the charts you can wind up doing fairly well over time. We've also learned a lot about managing quite an assortment and so forth; and so I sort of back up and look at this and I feel fantastic about what the team has done and delivered and I know I never go anywhere without the watch and it's not because I'm the CEO of Apple. I'm that attached to it, and I get lots of notes from a lot of people that feel the same way; and so that's how I look at the watch.

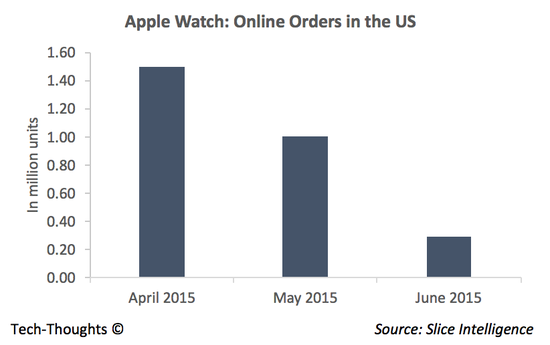

Later in the call, Cook said: "On the watch, our June sales were higher than April or May. I realize that's very different than what some of the, is being written, but the June sales were the highest, and so the watch had a more of a back-ended kind of a skewing".

What Does It Mean?

You can judge the comments for yourself, but consider this: Apple breaks out performance for iPad, iPhone, Mac, and Services. The company stopped separately reporting iPod as sales declined but also for retail stores, even as their revenues rise. Cook and Company choose not to reveal Apple Watch sales, and the competitive-intelligence reason rings hallow given the long-standing propensity to boast shipment numbers for new products—particularly those entering or creating new categories.

One interpretation is easy: The smartwatch's early sales performance is tepid, which if disclosed could create negative perceptions about Apple's future during the post-Steve Jobs era and Cook's first big product launch. By another measure, Cook also said that "our objective for the quarter wasn't primarily sales", which is a great excuse for weak performance. Doh, of course, Apple cares about sales—otherwise why charge premium prices that generate nearly 40 percent gross margin?

Another interpretation is reasonable: The chief executive, in context, emphasized the importance of "how the product is positioned for the long-term, because we're starting a new category". Sales will come later, as the platform goes. Assuming he is being straight, then sales really might not be the early priority, as Apple seeks to build out an ecosystem. In the context of platform-building, withholding sales data really could about competitive intelligence.

That said, platforms need apps and adopters. People generally don't adopt if there are no apps, and developers don't create apps if there is no demand. It's a longstanding chicken-and-egg problem—which comes first: Apps or users? Apple has some leverage from iPhone, but other than, say, HealthKit no real compelling killer app. By contrast, Google Now is a fantastic killer app for Android Wear, which vested hardware partners are many to Apple's one.

The brings Apple to platform building, extending from watchOS 2, and preparing for holiday sales. My prediction: The device fails or sails during the Christmas quarter.

In the present, I see no other conclusion than Apple is hiding smartwatch sales data. The question: From whom? Is it Wall Street or wearable competitors? Or even both? Your answer?

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of

Google is everywhere, you cannot run and you cannot hide. Well, maybe I am being a bit dramatic, but if you use Android or any of Google's services, it is compiling data to track your actions and behaviors. The search giant may know your favorite restaurants, sexual tastes, plus home and work locations too.

Google is everywhere, you cannot run and you cannot hide. Well, maybe I am being a bit dramatic, but if you use Android or any of Google's services, it is compiling data to track your actions and behaviors. The search giant may know your favorite restaurants, sexual tastes, plus home and work locations too.