Spending on Platform-as-a-Service (Paas), Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) is forecast to reach $118 billion this year, and it's clear the cloud is now big business. Companies are fighting to enter the space with new industry- and marketing-specific offerings. But what effect will this have and will it worry the big players like Amazon Web Services?

We spoke to Scott Swartz, CTO of BUSS at Ericsson and founder of MetraTech, an enterprise billing specialist recently acquired by Ericsson, to find out more about the state of the IaaS space.

BN: Can we expect to see current big players, such as AWS, losing share to more specific offerings?

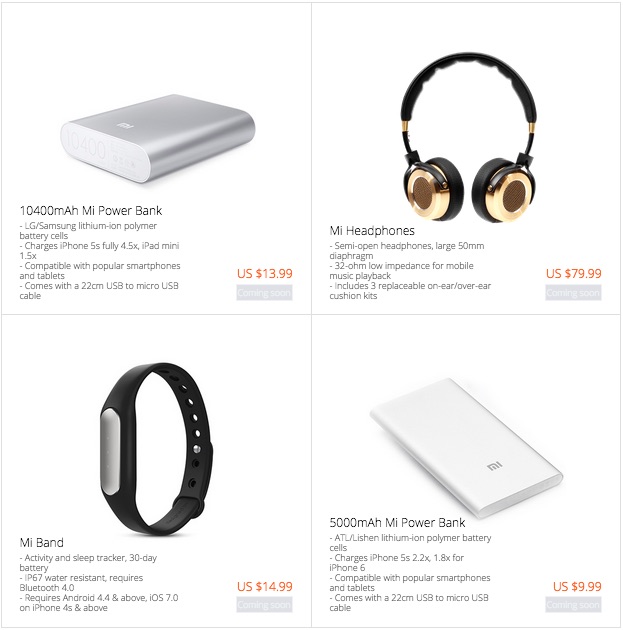

SS: The cloud market is still evolving, and there is plenty of opportunity for nimble players to take market share from leaders. For example, the new battleground for enterprise customers will be value-added IaaS and not simple vanilla offerings. Winners will be determined based on their abilities to provide a platform for partners to build, run and integrate their products and services into the ecosystem. It is a race to develop a network of partners that deliver the desired third-party apps integrated with an IaaS service. The enterprise cloud also creates opportunities for new companies and new alliances targeted at specific verticals. The original players will see competition from marketplaces that deliver industry-specific services. To date, even with the hype, the cloud has been about tackling low-hanging fruit in the test and development areas, but we are now actively seeing the movement of production workloads to the cloud. Also, the ongoing convergence of the cloud and Internet of Things will create opportunities for platforms to support smart cities, energy and utilities, transportation, security, financial services, retail services and many more fields.

BN: Is there a danger that an increasing number of companies targeting specific sectors will lead to a fragmentation of the cloud market?

SS: The market will still be dominated by big players, since they will have the reach and pull to deliver an easily consumable and serviceable application marketplace on top of IaaS cloud. There will be opportunity for targeting offerings to specific industry sectors as specialist clouds (financial services and healthcare are obvious ones given their unique requirements). However, I believe the fragmentation will likely be how partner offerings are managed as part of IaaS. How integrated the partner services will be and how easily accessible and serviceable these are will have a big impact on traction with enterprises. In addition, partnerships need to include services targeted at developers building applications on a provider’s cloud. We are still at the infancy stage when it comes to cloud maturity; the doors will open based on the richness of the partner marketplace.

BN: If solutions become very specific, isn't there a danger of losing some of the advantages of moving to the cloud in the first place?

SS: Once you move past commodity cloud services and start consuming provider-specific services or content you run the risk of not being able to run the load on another cloud. That lock-in may or may not be worth it and that equation will likely change over time. If a cloud provider has added so much value that it’s worth being locked in for certain loads, then they’ve done their job. The beautiful thing about competition is that it drives innovation and, within the cloud, you have the ability to try valued-added offerings quickly and inexpensively.

However, locking yourself to a specific cloud can be a slippery slope. It's critical that you have strong architectural governance to identify and manage lock in proactively. Specifically, you need to abstract and isolate areas of lock in. There are a multitude of frameworks that facilitate this, but, if the one you pick doesn’t provide the correct level of abstraction, you need to look at what other clouds are offering to ensure that your implementation is as generic as possible. It’s also very important to partition the automated tests for the locked in functionality so that you can test on other clouds to ensure the lock in hasn't crept into areas that you didn't except -- that happens with slippery slopes.

If properly managed, specific solutions can provide you with a strategic advantage and a manageable downside.

BN: Will new targeted clouds kill off traditional data centers?

SS: Commodity clouds have already started putting a dent in traditional data centers. The benefit of just paying for utilization with minimal or no infrastructure or software licenses while also gaining elasticity is easily understood. With industry-specific cloud providers, the ability to meter out independent software vendor (ISV) application workloads and the requisite licensing of applications and content makes the cost/benefit equation even more compelling.

It is unlikely to be all or nothing. Hybrid cloud scenarios will continue to be dominant. Depending on the enterprise, there may be regulatory or data sovereignty issues that prevent you from moving databases to the cloud, but you may use a point-to-point VPN from your data center to the cloud provider to connect to your on-premise database cluster.

BN: What are the pitfalls enterprises should be aware of when planning a shift to a cloud-based solution?

SS: Security, regulatory and data sovereignty issues, and cloud sprawl are well documented pitfalls. As more production workloads are moved to the cloud, uptime and service-level agreements (SLAs) will become increasingly important. In addition, the proliferation of value-added and industry-specific clouds creates opportunities, as well as the potential for inappropriate lock in. Picking the right cloud will become more complex because there will be business in addition to the existing technology and operational implications.

BN: What effect will new technologies like the Internet of Things have on the provision of business services?

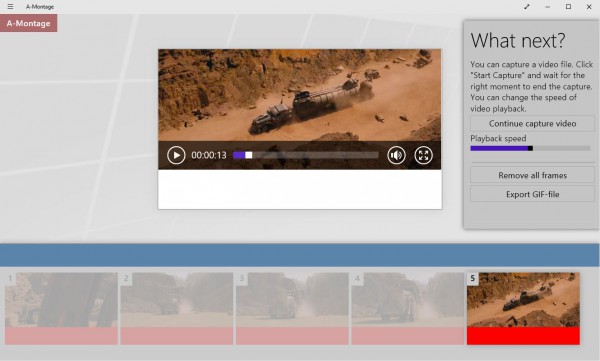

SS: The convergence of cloud, IoT and big data will have a massive impact on the technology and business services landscape as we know it. Things are moving from simple monitoring to providing critical and time sensitive information that can be utilized for analytics and corrective, proactive automated action. The vast amounts of data generated means that the cloud is playing the critical role of enabler for smart things to operate more effectively, and for data to be used by machines themselves to self-diagnose and self-repair. Analytics platforms for managing data produced by intelligent machines and sensors will convert data from machines and turn it into new offerings for consumer and enterprise customers.

An industry-specific cloud provides an opportunity for competitors to pool appropriately cleansed data to gain better insights. This data and the associated analytics can be sold to third parties.

We will see entire industries including aviation, health care, energy production and distribution, transportation and manufacturing have the ability to manage and operate machines in the cloud. We're already seeing a movement from buying to leasing applications on the cloud, as well as the bundling of pooled industry-specific data and analytics, in these industries.

Photo Credit: everything possible / Shutterstock