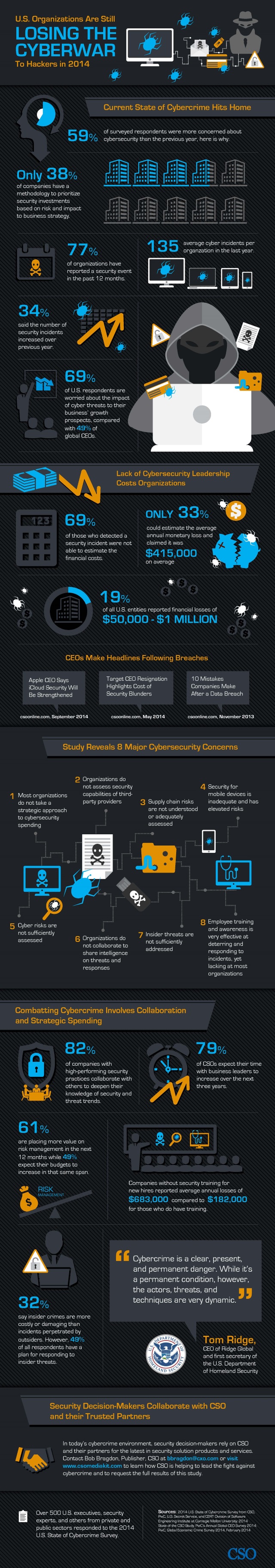

The world's largest smartphone manufacturer is troubled. Overnight, Samsung warned that its third-quarter operating profit could fall as much as 61.8 percent because of weakness in its largest division, mobile, from which phones account for about 60 percent of company profits. Smartphone shipments are up slightly, but the money they generate is down substantially.

For Google, the news is a mixed blessing. In April 2012, I warned that "Google has lost control of Android" -- Samsung's dominance with customized versions of the mobile operating system being major reason. Big G effectively responded by separating core apps and services from Android, spreading them out across versions, and better unifying the user experience. Still, Samsung's TouchWiz UI is the main way tens of millions of people experience Android every day. The South Korean company's problems could eventually be good for Google, but will they benefit Android or pull it down?

I rarely quote from press releases, but Samsung's statement is too chilling to ignore:

3Q earnings is expected to decrease substantially quarter-on-quarter as a result of declines in the mobile business due to intensified smartphone competition...Smartphone shipments increased marginally amid intense competition. However, the operating margin declined due to marketing expenses related to aggressive promotions and lowered ASP (average selling price) driven by reduced proportional shipments of high-end models coupled with price decreases for older smartphone models.

Third quarter global phone sales or shipment data isn't yet available from major analysts, but Samsung's retreat is obvious from past stats. For example, during Q2, Samsung smartphone shipments fell 7 points to 24.9 percent year over year, according to IDC. Apple ranked second with 11.7 percent share. Samsung shipments topped 74 million smartphones -- or more than twice Apple (35.1 million).

The Chinese Connection

Meanwhile, the "Other" category, which includes some Chinese name and white-box manufacturers, rose by about the same number -- 40.7 percent to 46.7 percent -- while Huawei and Lenovo both gained share. I single out smartphones, which is fastest-growing and now largest handset segment. In home market China, Xiaomi smartphone share surged ahead of Samsung -- 14 percent to 12 percent, according to Canalys.

"As the death of the feature phone approaches more rapidly than before, it is the Chinese vendors that are ready to usher emerging market consumers into smartphones", Melissa Chau, IDC senior research manager, said in July. "The offer of smartphones at a much better value than the top global players but with a stronger build quality and larger scale than local competitors gives these vendors a precarious competitive advantage".

Despite Q2 signs of Samsung's misfortunes, Android smartphone share rose to 84.7 percent from 79.6 percent year over year, according to IDC, again based on shipments. So what's bad for the South Korean manufacturer isn't necessarily bad for Android, right? That's the question public company earnings announcements will answer during the next couple of weeks.

Apple's New Crop

More broadly, the question everyone should ask: How resurgent is Apple, and what does the answer mean for the broader smartphone market? During the first weekend of sales, new iPhone models topped 10 million -- in three days 55 percent of Samsung Galaxy S5 in three months (18 million, second quarter, IDC). Apple's margins are higher, and the company refuses to lower prices even to compete in emerging markets. Apple is, so far, impervious to price wars that damage Samsung profits.

Based on early, unqualified analyst estimates, Apple sold in the last two weeks of Q3 more iPhone 6 and 6 Plus models than Samsung did the Galaxy S5 in all second quarter. Rumors resounded for months ahead of Apple's September 9 product launch (store sales started 10 days later). Samsung's warning could mean more than emerging market competition, but sales slowdown of its flagship because of iPhone 6 and 6 Plus rumors and also anticipation of Galaxy Note 4.

Did rumors stall smartphone sales for other vendors? Samsung is unique for delivering pre-guidance weeks ahead of official earnings. But as the largest smartphone manufacturer, Samsung is the canary in the coal mine. The profit decline signals something.

Loser's Dilemma

I strongly suspect Apple will sharply surprise critics and pundits when announcing earnings on October 20 and as analysts tabulate third-quarter device data. Resurgent Apple is bad for Android.

Mindshare is as important as market share for platforms around which third parties build other stuff. Profits trickle down, or they appear to -- and either matters to developers and add-on manufacturers. Then there are all the obvious disadvantages associated with real or even perceived weakness. Samsung signals weakened position, and who really wants to associate with a loser?

If Samsung can't sustain smartphone profits, it can't invest as much in marketing and future product development, which is bad for Android -- at least in the short term. Measured by market share, the second- and third-ranked Android manufacturers are, combined, about even with Apple. So Samsung's decline, by any measure, can't be good for Android.

I rarely violate Betteridge's Law of Headlines, by asking yes or no question. But I see no answer today, just speculation, until the numbers are in and we see where sales went and who profited most.

Photo Credit: nasirkhan/Shutterstock

While I do sometimes wear a watch, it is not for telling time. No, I strictly wear a timepiece as jewelry -- a gold Michael Kors watch on my left wrist to complement the gold bracelet on my right. It's funny, even when wearing a watch, I reach into my pocket to check my phone for the time.

While I do sometimes wear a watch, it is not for telling time. No, I strictly wear a timepiece as jewelry -- a gold Michael Kors watch on my left wrist to complement the gold bracelet on my right. It's funny, even when wearing a watch, I reach into my pocket to check my phone for the time.

![Logitech protection [+] power_S5_WinterWhite_BackRight](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_S5_WinterWhite_BackRight-150x150.jpg)

![Logitech protection [+] power_S5_WinterWhite_Drop](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_S5_WinterWhite_Drop-150x150.jpg)

![Logitech protection [+] power_S5_BlackGunmetal_Back](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_S5_BlackGunmetal_Back-150x150.jpg)

![Logitech protection [+] power_S5_BlackGunmetal_Front](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_S5_BlackGunmetal_Front-150x150.jpg)

![Logitech protection [+] power_iPhone5s_WinterWhite_FrontRight_NoPhone](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_iPhone5s_WinterWhite_FrontRight_NoPhone-150x150.jpg)

![Logitech protection [+] power_iPhone5s_Winterwhite_BackRight](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_iPhone5s_Winterwhite_BackRight-150x150.jpg)

![Logitech protection [+] power_iPhone5s_BlackGunmetal_Front_NoPhone](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-power_iPhone5s_BlackGunmetal_Front_NoPhone-150x150.jpg)

![Logitech protection [+] hand ios](http://betanews.com/wp-content/uploads/2014/10/Logitech-protection-+-hand-ios-600x410.jpg)