Google groupies make too much of third quarter tablet shipment estimates released yesterday. By IDC's reckoning, Apple's global share fell from 40.2 percent to 29.6 percent year over year. Meanwhile, Samsung soared from 12.4 percent to 20.4 percent share. The whole Android market grew at iPad's expense -- that's the popular contention smirked across the InterWebs. Yeah, right.

Apple apologists are quick to give the money rebuttal whenever market share tides turn against the products -- that the fruit-logo company earns more per device than rivals, sometimes all of them combined. The revenue rebuttal is exhausting for being so predictable but often also it's right and no truer than the tablet market. Q3 share numbers make lots of sense behind CEO Tim Cook's shocking decision to raise iPad mini 2 prices by $70 over the original -- that's about 22 percent. Profit share is his priority.

Price Hikes

"While some undoubtedly hoped for more aggressive pricing from Apple, the current prices clearly reflect Apple's ongoing strategy to maintain its premium status", Jitesh Ubrani, IDC research analyst, says. "It's worth noting that Apple wasn't the only one to increase the price of its small-sized tablet during this product cycle: Both Google and Amazon increased the price of their newest 7-inch tablets from $199 to $229 to cover the higher costs associated with high resolution screens and better processors".

Samsung and ASUS made commendable share gains, but their tablet shipments increased while Apple's largely remained flat but strong -- 14.1 million units versus 14 million a year earlier. The point: iPad didn't decline, rather the market grew larger. The more significant number isn't Android tablet makers' share gains, but iPad's revenue decline -- from $7.1 billion to $6.19 billion, for fiscal fourth quarter to fiscal fourth quarter (essentially synonymous with calendar Q3) -- while selling about the same number of units.

Apple's smaller tablet pulls down average selling prices and margins with them. By dividing fiscal Q4 revenue by number of units shipped you get:

- 2011: $611.58 (only 9.7-inch iPad available)

- 2012: $508.19 (Lower-cost iPad 2 sells alongside costlier models)

- 2013: $439.37 (iPad mini, starting at $329, available for 11 months)

These ASPs don't take into account channel inventory versus sell-through, which would be the same for comparing competitors. Clearly Apple prices iPad mini to increase margins and with them profit share.

"We continue to view the tablet market as huge", Cook said this week during Apple's quarterly conference call. "We see it as a large opportunity for us. We are not solely focused on unit share as I’ve said many times, but we’re focused on usage in customer’s side, the loyalty and other things that are very important to us".

Android vs. iOS

But the company doesn't abandon the low-end of the market, where share climbs fastest and ASPs decline nearly as quick, reducing the original mini to $299, according to NPD. Using the U.S. market as one measure, retail unit sales rose 38 percent in September, year over year, but revenue fell 3 percent, with ASPs down 30 percent -- from $453 to $318. For the largest growth segment -- 7-inch to 8.9-inch tabs, up 550 percent year over year -- ASPs rose to $229 from $190, according to NPD.

Android and iOS tablet sales were near even, 47 percent and 48 percent, respectively. NPD puts Android share of 7-inch to 8.9-inch tabs at 64 percent -- 35 percent for iOS. For 9-inchers and larger, iOS share was 68 percent and Android 20 percent.

Globally, Android handily leads iOS, according to IDC. The Android army of fanboys claims increased market share dooms iOS, because developers follow the money, which the more popular platforms deliver. But the logic is flawed. If you assess the range and quality of apps available for iPad, Android still trails. Rather, increased Android popularity means better tablet apps for the platform, not necessarily fewer for the other.

Still, developers' preferences make a difference which platform gets apps first. Globally, preferences vary -- often dramatically -- by region, according to Vision Mobile's Developer Economics. Australia, Canada, France, Germany, Russia and the United States are iOS strongholds, for example. Android rules in China, India and much of Eastern Europe.

"In almost all countries there are a significant fraction of developers who treat Android as their primary platform and overall the number of developers with iOS and Android as primary platform is almost exactly even", explains analyst Mark Wilcox (we're not related, that I know of).

Something else: There is the platform's robustness to consider. Lower-cost tablets largely account for Android share gains, making "tablets available to a wider market of consumers, which is good", Tom Mainelli, IDC research director, says. "However, many use cheap parts and non Google-approved versions of Android that can result in an unsatisfactory customer experience, limited usage, and very little engagement with the ecosystem".

He emphasizes: "Android's growth in tablets has been stunning to watch, but shipments alone won't guarantee long-term success. For that you need a sustainable hardware business model, a healthy ecosystem for developers, and happy end users".

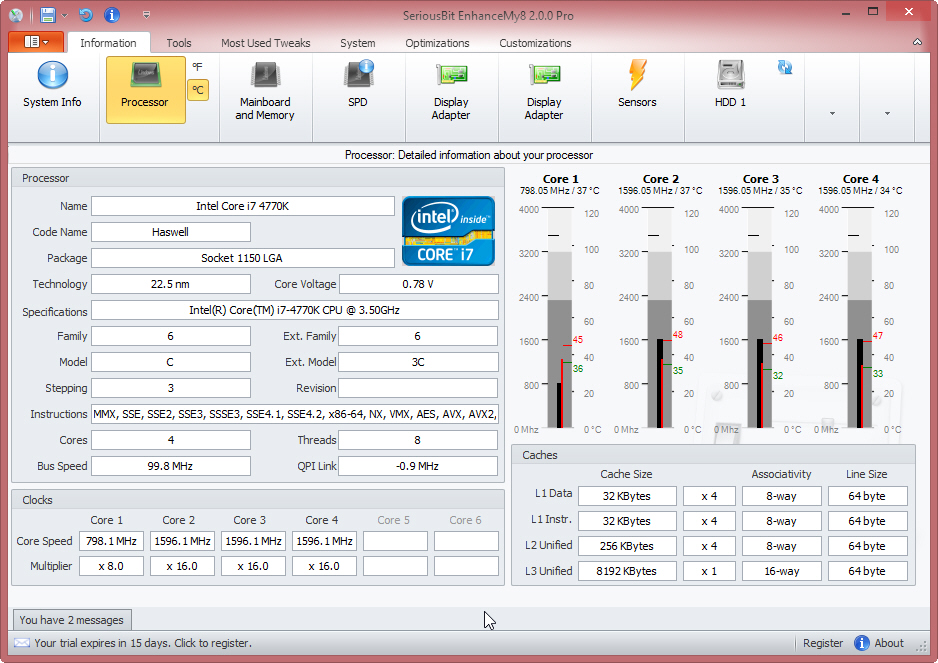

Top Five Tablet Vendors, Shipments, and Market Share, Third Quarter 2013 (Shipments in millions)

| Vendor |

3Q13 Unit Shipments

|

3Q13 Market Share

|

3Q12 Unit Shipments

|

3Q12 Market Share

|

Year-over-Year Growth

|

| Apple |

14.1

|

29.6%

|

14.0

|

40.2%

|

0.6%

|

| Samsung |

9.7

|

20.4%

|

4.3

|

12.4%

|

123.0%

|

| Asus |

3.5

|

7.4%

|

2.3

|

6.6%

|

53.9%

|

| Lenovo |

2.3

|

4.8%

|

0.4

|

1.1%

|

420.7%

|

| Acer |

1.2

|

2.5%

|

0.3

|

0.9%

|

346.3%

|

| Others |

16.8

|

35.3%

|

13.5

|

38.8%

|

25.0%

|

| Total |

47.6

|

100.0%

|

34.8

|

100.0%

|

36.7%

|

Source: IDC Worldwide Tablet Tracker, October 30, 2013

Mac Metaphor

The Mac is excellent measure, often ignored, where Cook leads iPad. Customer satisfaction/retention and preserving margins are top priorities. Apple's PC shipment market is less than 10 percent in most countries -- 11.6 percent in the United States, according to IDC. Nevertheless, there is a vital, robust Mac app ecosystem. In fact, there are in many categories better "native" apps selection than Windows 8.1, because of radical changes Modern UI introduces.

Endpoint analyst Roger Kay argues that for PCs, shipment share obsession ignores the more vital metric: Revenue. By shipments, Lenovo is No. 1, using IDC data. But by revenue, Apple is global PC leader, Kay contends.

"Apple enjoys an operating margin that hovers around 20 percent, while Dell, HP, and Lenovo have to content themselves with operating margins in the low single digits (1-3 percent)", Kay says. "Acer’s earnings have hovered around the zero mark in recent quarters".

Absolutely, Android makes stunning share gains -- and that's good for bringing more affordable tablets to more people and bolstering the larger app ecosystem. But Android's success isn't iPad's doom, and Cook wisely looks to preserve margins and brand equity over gaining market share.

Be honest, would you rather have more pumpkin pie or tastier?

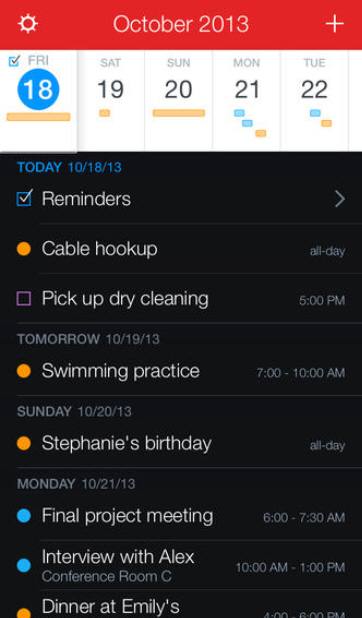

Flexibits has released

Flexibits has released