Next week Apple will announce new iPhones. There will be a backlash. There will be praise. Much of the significance will be lost in the noise.

Instead, Apple’s metrics should focus rivals’ attention on the importance of multi-year strategies.

Competitors are forever seeking to emulate Apple. But too many deploy me-too tactics, rather than following a consistent and sustained long term strategy:

- HP fired its CEO under a year after appointment. There’s only time to kill things, not build them, in such a short period.

- Nokia dithered on MeeGo. In 2009, Nokia partnered with Intel on MeeGo, then killed MeeGo just a year later, to focus on Microsoft Windows Phone instead.

- Samsung’s Galaxy S of 2010 resembles the Apple’s old iPhone 3GS of 2009, not the designed-from-scratch iPhone 4 that the S actually competed against at the time the S arrived in the market.

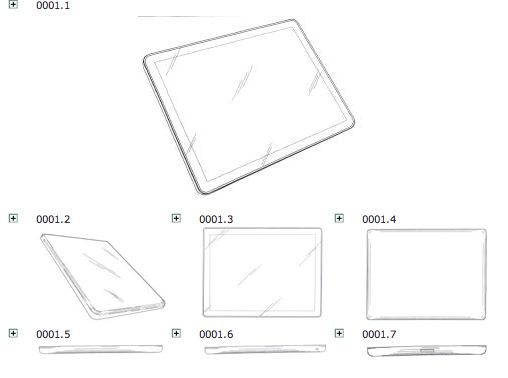

Part of the problem is that Apple keeps its strategy to itself: New products seem to appear out of Apple’s magic hat fully-formed at high profile launch events as if they’ve been born an adult, with no incubation or nurturing period. There are rarely betas or pre-announcements months ahead of availability, unlike the perpetually beta services of others. But we know Apple takes years to create these products. The iPad’s origins pre-date the iPhone and go back to around 2004 -- six years before it launched -- while serious development began in 2007, again years before competitors had anything publicly available that they could copy.

By mistaking tactics for strategy Apple’s many competitors are doomed to poor results. The time needed to build products as deeply and well designed as Apple’s can’t be completed overnight. Software design takes years to do. The supplier relationships that Apple is securing are long term. The investment that Apple is placing in key component design -- moving into chip design with the A4 and A5 -- is not something that any company could achieve without clear multi-year strategy.

Despite the Android evangelists and Apple naysayers, Apple’s metrics are nothing short of outstanding:

- The iPod is almost ten years old, but Apple anticipated its old age, and created a new generation: the iPhone. Apple has sold 315m iPods cumulatively. In just four years, not ten, and at a much higher selling price, the iPhone alone has shipped 129m units. I estimate there are now over 221m iOS devices.

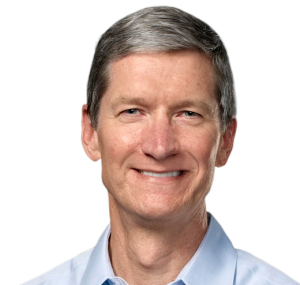

- Apple hasn’t been afraid to disrupt itself by creating a tablet that cannibalizes Mac sales. In five quarters, Apple has shipped 28.7m iPads. New Apple CEO Tim Cook has acknowledge the risk to Mac sales in a recent presentation, but correctly quantified it as greater to other computer makers than to Apple as Apple has a small share of the PC market. If the iPad cannibalizes computer purchases, Apple has more to gain from iPad sales than lost Mac sales. Not many companies would be this shrewd and this prepared to compete against themselves.

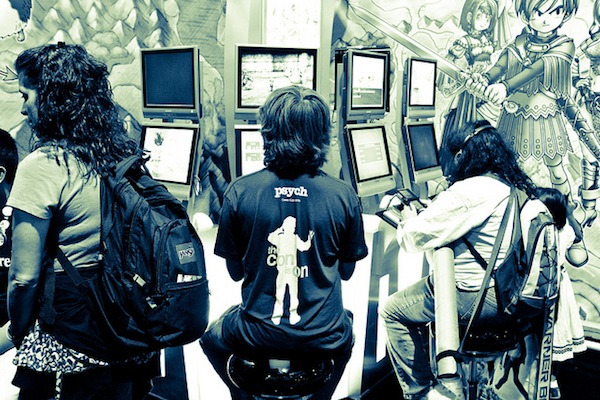

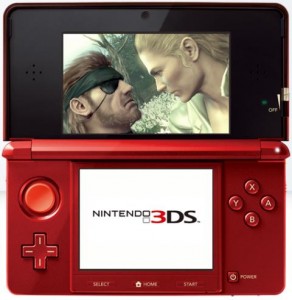

- Apple has become a games company. It has over 50m users for Game Center, its social gaming initiative for iOS. The iPod touch competes head on with Nintendo and Sony’s PSP as a gaming device. In my view, the iPad is an even better games console that’s only being held back by its current high price.

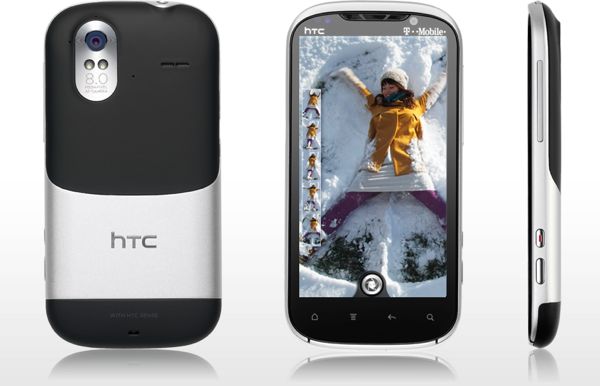

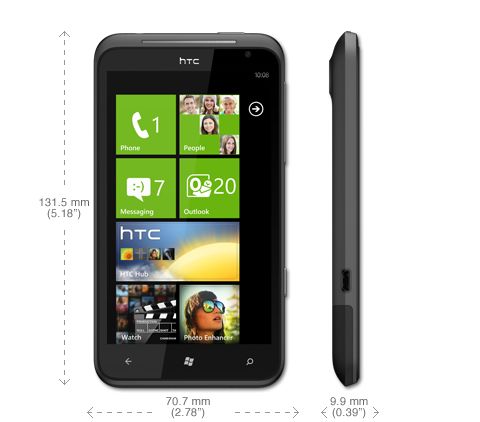

- Apple enjoys an average revenue per phone over $600. By contrast RIM has c$280; SonyEricsson is Euro156; Nokia’s is just Euro62. Only HTC, perhaps the greatest mobile phone maker success story other than Apple, is close with $359.

- The iPhone is the most popular smartphone model bar none, despite the hyped antenna teething problems. Almost a year after the iPhone 4′s introduction Apple shipped 20.3m iPhones in Q2 2011; by contrast Samsung’s Galaxy S II shipped 10m in five months. The iPhone4 is still competitive with the latest designs from rivals although it’s now over a year old.

- Apple has broken out of the idiosyncratic US phone market to be truly global. Two thirds of iPhones ship outside the US. Google-owned Motorola, RIM (at the high end), and HP Palm have struggled except in North America. SonyEricsson and Nokia have failed to break into the US. LG is losing money. Only Apple and Samsung have succeeded in Asia, Europe and North America.

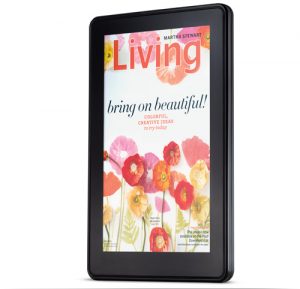

- Apple created the current mobile content market with Apps. Apple have paid $2,500,000,000 to app developers and delivered a total of 14,000,000,000 app downloads. Before Apple, mobile content meant ringtones and wallpapers (mainly) with the odd Java-based game. Now, it’s a massive market that’s so attractive the world’s largest media retailer, Amazon, has created an app store and is becoming a mobile device maker too with the Kindle Fire.

To compete with Apple is far from easy. Those that wish to play that game must focus on the long term at the same time as making money in the present. The real challenge though, is that I’m becoming less and less sure that this battle is one that any company can avoid. Apple is constructing a grand portfolio that ties together publishing, movies, TV, music, telephony, Internet, games, consumer electronics, payments, photography, computing, etc. etc.

Some years ago I would have advised some firms not to compete with Apple, and instead to find a different and less congested market. I’m no longer sure that’s an option for most. The only way to prosper now in this vastly enlarged market is to create a solid long term strategy and then execute it consistently.

Photo Credit: Joe Wilcox

Ian Fogg is a mobile industry analyst, consultant and product manager. He is a former principal at Forrester; research director at Jupiter Research; and marketing and/or product management at Psion, 3/Hutchison and Cable & Wireless Communications.

Ian Fogg is a mobile industry analyst, consultant and product manager. He is a former principal at Forrester; research director at Jupiter Research; and marketing and/or product management at Psion, 3/Hutchison and Cable & Wireless Communications.

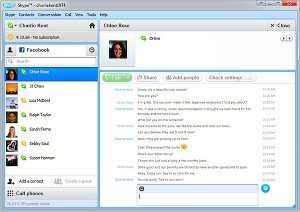

Skype has updated its Windows software to

Skype has updated its Windows software to  German multimedia specialist MAGIX has introduced the next generation of its high-end consumer video editor,

German multimedia specialist MAGIX has introduced the next generation of its high-end consumer video editor,  Adobe has released an update for

Adobe has released an update for  At the close of Elements 2011, Intel's developer conference aimed at the AppUp app store community, AppUp GM Peter Biddle announced that Intel has acquired Israeli navigation and location services provider

At the close of Elements 2011, Intel's developer conference aimed at the AppUp app store community, AppUp GM Peter Biddle announced that Intel has acquired Israeli navigation and location services provider

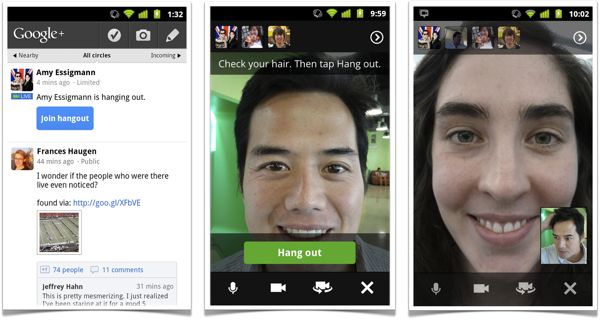

I must have been asleep at the wheel yesterday, because somehow this reporter missed the big Skype for Android upgrade. What? You missed it, too?

I must have been asleep at the wheel yesterday, because somehow this reporter missed the big Skype for Android upgrade. What? You missed it, too?

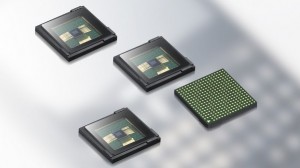

At Samsung's Mobile Solutions Forum 2011 in Taiwan, the South Korean consumer electronics leader revealed some major new components that it will use in its next generation of smartphones and mobile tablets: a new dual-core applications processor, and a new 16 Megapixel CMOS sensor and new forward-facing camera sensor, a new 64 GB flash memory module. and a new 4 Gigabit low power DDR3 DRAM memory unit.

At Samsung's Mobile Solutions Forum 2011 in Taiwan, the South Korean consumer electronics leader revealed some major new components that it will use in its next generation of smartphones and mobile tablets: a new dual-core applications processor, and a new 16 Megapixel CMOS sensor and new forward-facing camera sensor, a new 64 GB flash memory module. and a new 4 Gigabit low power DDR3 DRAM memory unit. Adobe has updated

Adobe has updated  Mozilla has started the Firefox development merry-go-round again, updating its

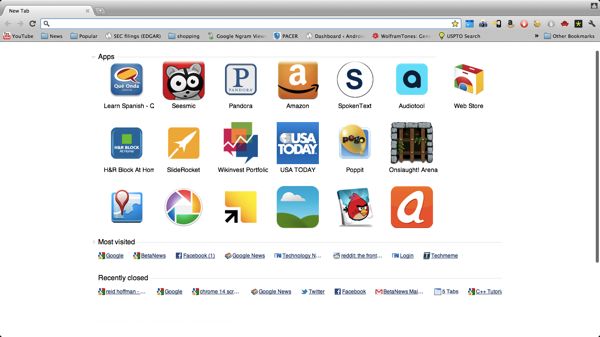

Mozilla has started the Firefox development merry-go-round again, updating its  The newest Firefox 10 build looks much the same as the Aurora build at present, but Mozilla offers a parallel Nightly build, called Firefox 10 UX, that allows you to gain a sneak peek into the interface changes Mozilla hopes to implement by the end of the year. Installing this reveals that some of the tweaks

The newest Firefox 10 build looks much the same as the Aurora build at present, but Mozilla offers a parallel Nightly build, called Firefox 10 UX, that allows you to gain a sneak peek into the interface changes Mozilla hopes to implement by the end of the year. Installing this reveals that some of the tweaks

You were an earlier adopter. You bought

You were an earlier adopter. You bought  Media reform group Free Press has filed suit in the US Court of Appeals for the First Circuit, asking the courts to review the Federal Communications Commission's "Open Internet Rules." Those policies

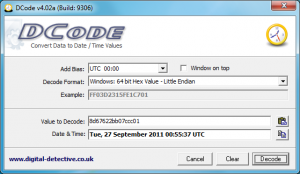

Media reform group Free Press has filed suit in the US Court of Appeals for the First Circuit, asking the courts to review the Federal Communications Commission's "Open Internet Rules." Those policies  Some Registry values are easy to understand. Find a file path, say, and you’ll often be able to figure out its purpose at a glance.

Some Registry values are easy to understand. Find a file path, say, and you’ll often be able to figure out its purpose at a glance. Skype’s iPhone app proved to be incredibly popular, and the recently released

Skype’s iPhone app proved to be incredibly popular, and the recently released  What's that saying about my enemy being my ally?

What's that saying about my enemy being my ally?

Mozilla has updated its popular email tool,

Mozilla has updated its popular email tool,

Patient (or impatient) iPhone aficionados will not have to wait much longer for that

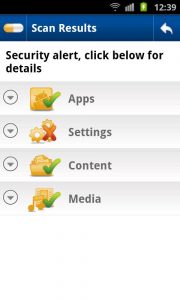

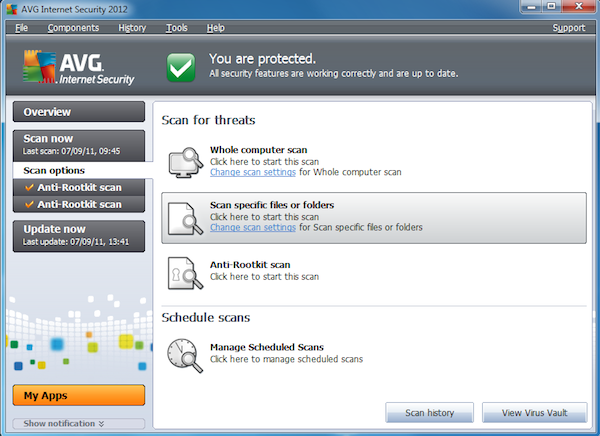

Patient (or impatient) iPhone aficionados will not have to wait much longer for that  PCs are certainly the most common target for virus attacks, but this does not mean that other platforms are immune. The increased use of mobile devices means that platforms such as Android devices are prone to virus infection and antivirus software is now available to help counter this. AVG is most famous for its desktop virus protection software, but

PCs are certainly the most common target for virus attacks, but this does not mean that other platforms are immune. The increased use of mobile devices means that platforms such as Android devices are prone to virus infection and antivirus software is now available to help counter this. AVG is most famous for its desktop virus protection software, but

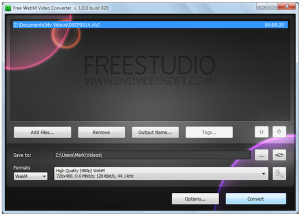

Converting video from one format to another can be a real chore. Whether you are looking to reduce the size of a video file so you can more easily add it to your website, or if you need to have a file in a particular format so you can play it back on your chosen media device, almost everyone will have to battle with video formats and conversion software at some point.

Converting video from one format to another can be a real chore. Whether you are looking to reduce the size of a video file so you can more easily add it to your website, or if you need to have a file in a particular format so you can play it back on your chosen media device, almost everyone will have to battle with video formats and conversion software at some point.

Stated differently: what does Verizon know that you don't?

Stated differently: what does Verizon know that you don't? Mozilla has placed the final, stable build of

Mozilla has placed the final, stable build of  You'd think that Verizon would show more gratitude. Everyone knows how important iPhone is to America's largest cellular carrier. We know because the rabble of pro-Apple bloggers and journalists (and, whoa, there are so many) told us so. Over and over and over again. But, no, Verizon isn't showing gratitude or loyalty to Apple at all. Last week, the carrier filed a legal brief with the United District Court for the Northern District of California asking a federal judge to reject Apple's request for preliminary injunction against four Samsung devices. A hearing is scheduled for the afternoon of October 13.

You'd think that Verizon would show more gratitude. Everyone knows how important iPhone is to America's largest cellular carrier. We know because the rabble of pro-Apple bloggers and journalists (and, whoa, there are so many) told us so. Over and over and over again. But, no, Verizon isn't showing gratitude or loyalty to Apple at all. Last week, the carrier filed a legal brief with the United District Court for the Northern District of California asking a federal judge to reject Apple's request for preliminary injunction against four Samsung devices. A hearing is scheduled for the afternoon of October 13. "An injunction that limited the availability of 4G devices in the market could substantially reduce the number of customers who could or would purchase those devices", Verizon's filing asserts. "Such a loss in sales of 4G devices, in turn, undermines the business justification for continuing to expand Verizon Wireless’s LTE network".

"An injunction that limited the availability of 4G devices in the market could substantially reduce the number of customers who could or would purchase those devices", Verizon's filing asserts. "Such a loss in sales of 4G devices, in turn, undermines the business justification for continuing to expand Verizon Wireless’s LTE network".  All that talk of

All that talk of

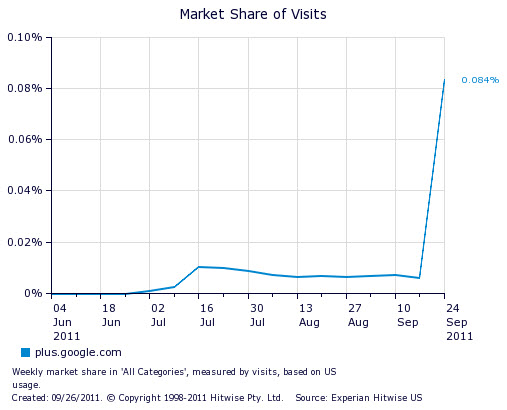

Well, so much for Apple Fanclub antics a few months ago, when a wave of blog and news posts asserted that Verizon iPhone's launch had stalled Android sales and iPhone 5 would beat them back. It's more wishful thinking published as fact, that has spread yet another iPhone urban legend across the web. The truth is far different. Androids continue to gain massively against iPhone, according to data Nielsen released today. This isn't abnormality but a trend Nielsen has tracked for more than a year.

Well, so much for Apple Fanclub antics a few months ago, when a wave of blog and news posts asserted that Verizon iPhone's launch had stalled Android sales and iPhone 5 would beat them back. It's more wishful thinking published as fact, that has spread yet another iPhone urban legend across the web. The truth is far different. Androids continue to gain massively against iPhone, according to data Nielsen released today. This isn't abnormality but a trend Nielsen has tracked for more than a year.

Samsung unveiled a new smartphone based on Microsoft's

Samsung unveiled a new smartphone based on Microsoft's

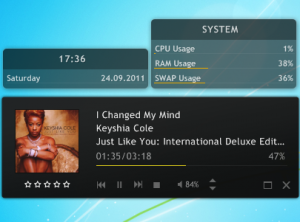

It has taken a while, but after months of beta testing, desktop customization tool

It has taken a while, but after months of beta testing, desktop customization tool  Samsung announced the internal sales record today. But how many really depends on your definition of sold. Samsung certainly shipped 10 million Galaxy S2s since the smartphone's launch in April. But is that sold into the channel, or out to consumers? Samsung's self-congratulatory announcement suggests sales-in rather than sales-out.

Samsung announced the internal sales record today. But how many really depends on your definition of sold. Samsung certainly shipped 10 million Galaxy S2s since the smartphone's launch in April. But is that sold into the channel, or out to consumers? Samsung's self-congratulatory announcement suggests sales-in rather than sales-out.

Another busy week of software updates has passed. What could you possibly have missed?

Another busy week of software updates has passed. What could you possibly have missed?

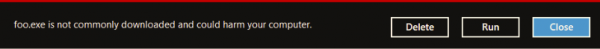

Well, hello Mac users! The 1 billion Windows users of the world welcome you to the wonderful world of malware. F-Secure has identified a new one, and like Mac Defender, this piece of nastiness borrows from malware already released for Windows.

Well, hello Mac users! The 1 billion Windows users of the world welcome you to the wonderful world of malware. F-Secure has identified a new one, and like Mac Defender, this piece of nastiness borrows from malware already released for Windows.

Spending time browsing the Internet can be fulfilling, but it can also be fraught with dangers. Every web browser claims to have a wealth of security options built in, Comodo Dragon goes a little further aiming to not only ensure that life online is as safe as possible, but also that the experience is not dogged by poor performance. Based on a Chromium core,

Spending time browsing the Internet can be fulfilling, but it can also be fraught with dangers. Every web browser claims to have a wealth of security options built in, Comodo Dragon goes a little further aiming to not only ensure that life online is as safe as possible, but also that the experience is not dogged by poor performance. Based on a Chromium core,

Sunday, September 18. Sprint Store, North Jersey.

Sunday, September 18. Sprint Store, North Jersey. Something struck me as really odd; the phone comes pre-loaded with Sprint Mobile Wallet. I had initially thought it was Google Wallet all gussied up for Sprint in the partnership. This is clearly not the case. Take a look at the photo of the welcome screen. Further down it talks about their partnered retailers. These include Namco Wireless and Skymall with more "coming soon". When you click the signup button you are brought to the EULA where it rambles on about how you give up your rights regarding most disputes, but makes no mention of Google Wallet. After that it takes you to a signup page where you enter your profile information. That is where my investigation stopped. Googling Sprint Mobile Wallet just made me more confused.

Something struck me as really odd; the phone comes pre-loaded with Sprint Mobile Wallet. I had initially thought it was Google Wallet all gussied up for Sprint in the partnership. This is clearly not the case. Take a look at the photo of the welcome screen. Further down it talks about their partnered retailers. These include Namco Wireless and Skymall with more "coming soon". When you click the signup button you are brought to the EULA where it rambles on about how you give up your rights regarding most disputes, but makes no mention of Google Wallet. After that it takes you to a signup page where you enter your profile information. That is where my investigation stopped. Googling Sprint Mobile Wallet just made me more confused. Joseph LoRe is chief of operations for LoRe Sweeping Co., Inc. He is married and a father of three. You can follow him on twitter:

Joseph LoRe is chief of operations for LoRe Sweeping Co., Inc. He is married and a father of three. You can follow him on twitter:

In what could only be considered a full rebuke of Léo Apotheker's leadership, HP's board of directors announced late Thursday that it had appointed

In what could only be considered a full rebuke of Léo Apotheker's leadership, HP's board of directors announced late Thursday that it had appointed

The hallmark of effective security in any field, especially computers, is defense-in-depth. There is always a way around any particular defensive measure, so you need multiple defenses in order to stop attacks with a high level of confidence. Large organizations are full of multilayered defenses, but they are no less essential to small businesses.

The hallmark of effective security in any field, especially computers, is defense-in-depth. There is always a way around any particular defensive measure, so you need multiple defenses in order to stop attacks with a high level of confidence. Large organizations are full of multilayered defenses, but they are no less essential to small businesses. Contrary to testimony given before the US Senate yesterday, Google has not learned lessons from Microsoft's antitrust case -- not enough of them, or the right ones. More importantly, Google is looking at the wrong company. It is Intel's dealing with the Feds that could help Google navigate the shark-infested regulatory waters before it.

Contrary to testimony given before the US Senate yesterday, Google has not learned lessons from Microsoft's antitrust case -- not enough of them, or the right ones. More importantly, Google is looking at the wrong company. It is Intel's dealing with the Feds that could help Google navigate the shark-infested regulatory waters before it.  Finally, the news you've been waiting for from AT&T -- and it's not iPhone 5. The Samsung Galaxy S II goes on sale October 2 for $199.99 with 2-year contract and minimum $15/month data plan. No commitment price: $549.99.

Finally, the news you've been waiting for from AT&T -- and it's not iPhone 5. The Samsung Galaxy S II goes on sale October 2 for $199.99 with 2-year contract and minimum $15/month data plan. No commitment price: $549.99. The man behind the change in strategy at Hewlett Packard may be on his way out. Kara Swisher of All Things Digital

The man behind the change in strategy at Hewlett Packard may be on his way out. Kara Swisher of All Things Digital

Google's executive chairman began his testimony before the US Senate by citing, unnamed, Microsoft and its dominance in the PC industry and how trustbusters stepped in to correct a company that had lost its way. "We get it", Eric Schmidt said. "We get the lessons of our predecessor". Schmidt testified before the Senate's antitrust subcommittee.

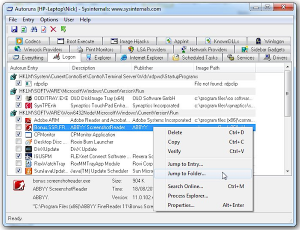

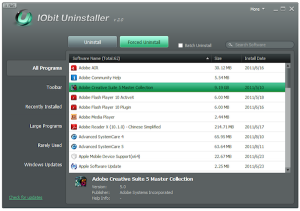

Google's executive chairman began his testimony before the US Senate by citing, unnamed, Microsoft and its dominance in the PC industry and how trustbusters stepped in to correct a company that had lost its way. "We get it", Eric Schmidt said. "We get the lessons of our predecessor". Schmidt testified before the Senate's antitrust subcommittee. The art of streamlining your PC’s startup to reclaim system resources and speed up boot times is an ancient one. Windows even comes with its own built-in tool, msconfig, for tweaking the system startup, but it’s limited and awkward to use.

The art of streamlining your PC’s startup to reclaim system resources and speed up boot times is an ancient one. Windows even comes with its own built-in tool, msconfig, for tweaking the system startup, but it’s limited and awkward to use.

Microsoft has released the first beta of

Microsoft has released the first beta of

Swedish web album creation tool

Swedish web album creation tool

Let the iPhone 5 rumors begin in earnest now. All Things Digital, which has a pretty good track record reporting rumors right, says that

Let the iPhone 5 rumors begin in earnest now. All Things Digital, which has a pretty good track record reporting rumors right, says that  The days of using a drawing board are not quite behind use, and when it comes to sketching out a quick idea for a website, or even a program interface, it is quite common to reach for a pen and paper rather than a computer. But this may change if

The days of using a drawing board are not quite behind use, and when it comes to sketching out a quick idea for a website, or even a program interface, it is quite common to reach for a pen and paper rather than a computer. But this may change if

If you have an iOS device, be it an iPhone, iPod or iPad, you are equipped with everything you need to not only watch, but also record video footage. Just like photos, half of the fun of shooting videos is sharing the content with other people and for many people this will mean turning to YouTube. But having test driven

If you have an iOS device, be it an iPhone, iPod or iPad, you are equipped with everything you need to not only watch, but also record video footage. Just like photos, half of the fun of shooting videos is sharing the content with other people and for many people this will mean turning to YouTube. But having test driven

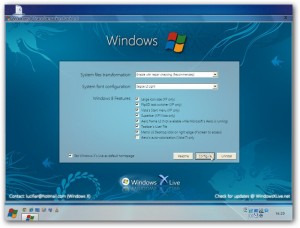

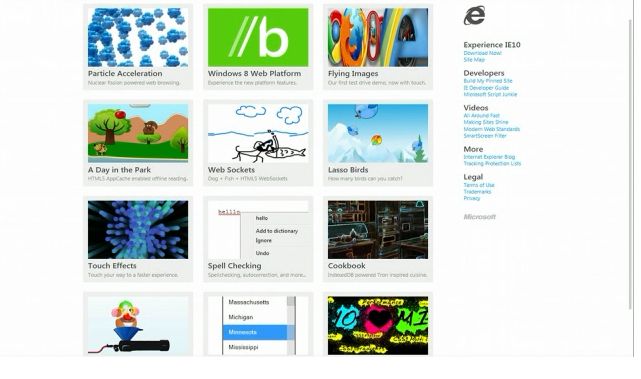

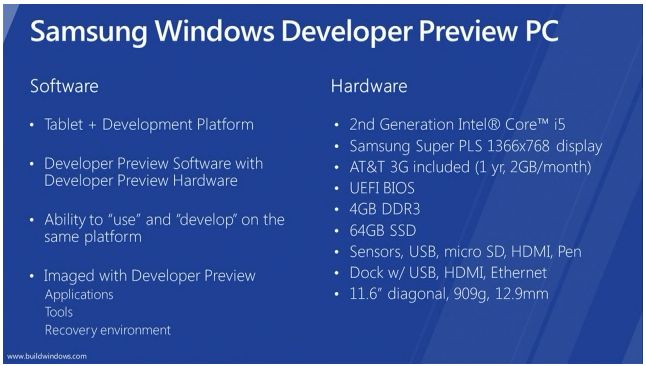

Another week, another slew of software releases and app updates. The undoubted headline stealer is the release of the Developer Preview of Windows 8, but there have been plenty of other releases worthy of investigation for anyone not interested in Microsoft’s up-coming operating system. Available in both

Another week, another slew of software releases and app updates. The undoubted headline stealer is the release of the Developer Preview of Windows 8, but there have been plenty of other releases worthy of investigation for anyone not interested in Microsoft’s up-coming operating system. Available in both

The Justice Department's move to block AT&T's planned merger with T-Mobile gathered steam today with attorneys general from seven states signing on to the effort. An amended complaint was filed Friday, adding California, Illinois, Massachusetts, New York, Ohio, Pennsylvania and Washington as co-plaintiffs.

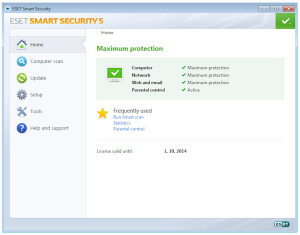

The Justice Department's move to block AT&T's planned merger with T-Mobile gathered steam today with attorneys general from seven states signing on to the effort. An amended complaint was filed Friday, adding California, Illinois, Massachusetts, New York, Ohio, Pennsylvania and Washington as co-plaintiffs. Security vendors will have an increasingly hard time making a case for expensive subscriptions as Microsoft keeps pushing Windows to be "secure enough" out of the box. Windows 8 adds a number of impressive features that really should make a difference in the "ecosystem".

Security vendors will have an increasingly hard time making a case for expensive subscriptions as Microsoft keeps pushing Windows to be "secure enough" out of the box. Windows 8 adds a number of impressive features that really should make a difference in the "ecosystem".

As if Research in Motion's co-CEOs haven't done enough, shareholders inflicted serious pain overnight and early today. RIM shares plummeted, following yesterday's dire earnings report -- by about 22 percent in after-hours trading.

As if Research in Motion's co-CEOs haven't done enough, shareholders inflicted serious pain overnight and early today. RIM shares plummeted, following yesterday's dire earnings report -- by about 22 percent in after-hours trading. Synchronizing files between devices usually entails one of two methods. The first involves establishing a physical connection between the two devices so that the contents of folders can be compared, while the second option takes advantage of cloud storage to act as an intermediary store for files.

Synchronizing files between devices usually entails one of two methods. The first involves establishing a physical connection between the two devices so that the contents of folders can be compared, while the second option takes advantage of cloud storage to act as an intermediary store for files.  If you discover a file type on your system which you can’t open, then you’ll probably start searching the web for applications that might be able to help. But while this will return plenty of information, it’ll probably take a while to sort through everything to discover your best options. And so a better solution may be to try

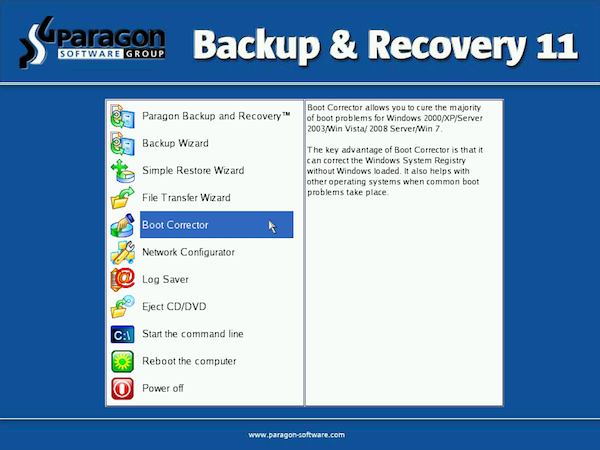

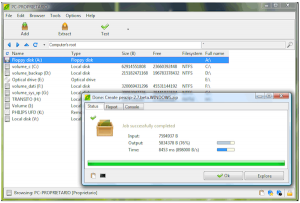

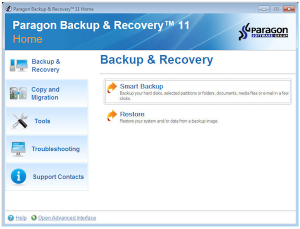

If you discover a file type on your system which you can’t open, then you’ll probably start searching the web for applications that might be able to help. But while this will return plenty of information, it’ll probably take a while to sort through everything to discover your best options. And so a better solution may be to try  Paragon Software has updated its home drive-imaging backup tool,

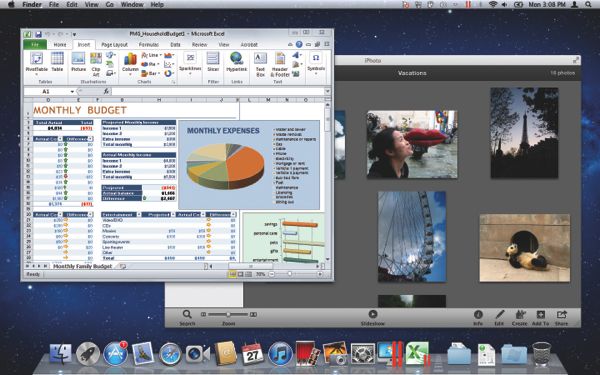

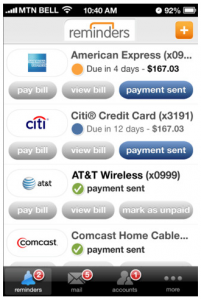

Paragon Software has updated its home drive-imaging backup tool,  Whatever sort of life you lead, there is no avoiding finances. We all have some form of bills to pay each month and bank accounts of one sort or another to keep track of. Keeping on top of what’s coming in and what’s going out and when can be tricky, often meaning having to visit one website after another, each with their own login requirements. Manilla is a great online service that enables you to access details of all your accounts and bills from one place. There are also

Whatever sort of life you lead, there is no avoiding finances. We all have some form of bills to pay each month and bank accounts of one sort or another to keep track of. Keeping on top of what’s coming in and what’s going out and when can be tricky, often meaning having to visit one website after another, each with their own login requirements. Manilla is a great online service that enables you to access details of all your accounts and bills from one place. There are also  It was only last week the

It was only last week the  Nintendo made it clear that

Nintendo made it clear that  Microsoft CEO Steve Ballmer hit me with a club yesterday -- okay, figuratively, but it didn't feel that way. He boomed onto the

Microsoft CEO Steve Ballmer hit me with a club yesterday -- okay, figuratively, but it didn't feel that way. He boomed onto the

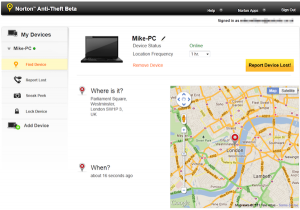

If you’re worried about losing your smartphone or tablet then there’s no shortage of services around that claim they can help you to protect it. There’s not quite as much choice for laptop and PC owners, of course. But if you’re worried about thieves, help is at hand in the shape of a new Symantec web service,

If you’re worried about losing your smartphone or tablet then there’s no shortage of services around that claim they can help you to protect it. There’s not quite as much choice for laptop and PC owners, of course. But if you’re worried about thieves, help is at hand in the shape of a new Symantec web service,

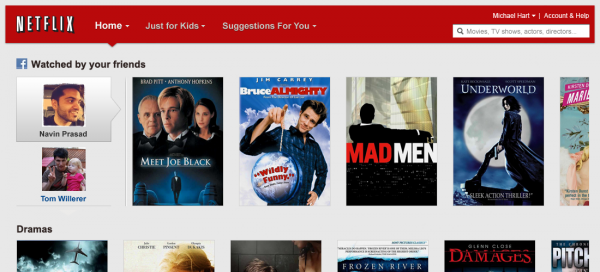

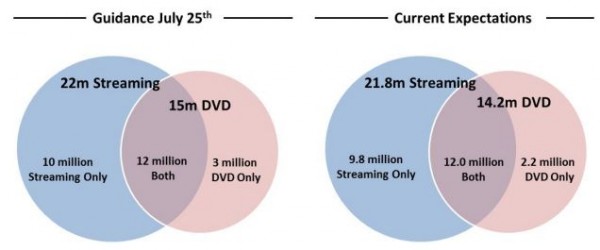

Few people could imagine a TV viewing life that involved the rigid scheduling of a few years ago. The advent of devices such as Tivo and services such as Hulu and Netflix means that TV programms can be watched whenever it suits you. But while it can be useful to be able to timeshift you viewing in this way,

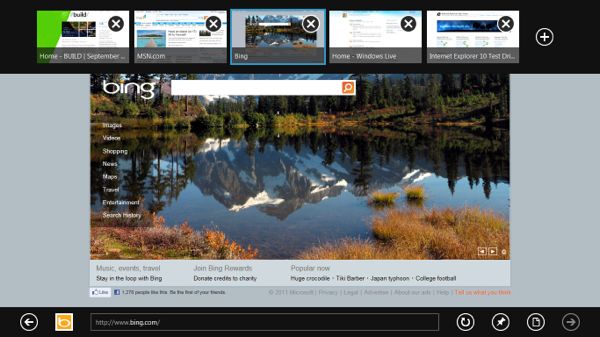

Few people could imagine a TV viewing life that involved the rigid scheduling of a few years ago. The advent of devices such as Tivo and services such as Hulu and Netflix means that TV programms can be watched whenever it suits you. But while it can be useful to be able to timeshift you viewing in this way,  Today, Microsoft dropped the other ball during the second big

Today, Microsoft dropped the other ball during the second big  Microsoft has used its

Microsoft has used its

The 2012 security suite party is now well under way, and Symantec are the latest company to join in with the release of

The 2012 security suite party is now well under way, and Symantec are the latest company to join in with the release of

Digital certificate problems are much in the news, owing to the scandal over compromised certificate authority DigiNotar, but the more common certificate problems are much simpler and more confined. Large, complex organizations often have trouble keeping track of all their certificates.

Digital certificate problems are much in the news, owing to the scandal over compromised certificate authority DigiNotar, but the more common certificate problems are much simpler and more confined. Large, complex organizations often have trouble keeping track of all their certificates.

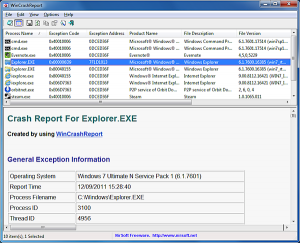

Figuring out exactly why an application has crashed can be tricky. Especially if you don’t see any useful error messages. And while Windows 7 does its best, the most you’re likely to see -- much, much later -- is a message suggesting that you upgrade to a new version.

Figuring out exactly why an application has crashed can be tricky. Especially if you don’t see any useful error messages. And while Windows 7 does its best, the most you’re likely to see -- much, much later -- is a message suggesting that you upgrade to a new version.

As a software developer I do lots of market research into the current trends of both software and hardware. I read, read, read as much as I can about what is going on in the industry, for starters. There's a whole lot of hype about iPad, and near silence about Windows tablets. But there are plenty of them out there.

As a software developer I do lots of market research into the current trends of both software and hardware. I read, read, read as much as I can about what is going on in the industry, for starters. There's a whole lot of hype about iPad, and near silence about Windows tablets. But there are plenty of them out there. Chris Boss is an advanced Windows API programmer and developer of 10 year-old

Chris Boss is an advanced Windows API programmer and developer of 10 year-old

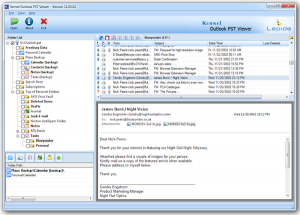

Microsoft Outlook is undoubtedly a powerful app, with its feature set going beyond that of a mere email manager to encompass contacts, calendars and other organizational tools. Everything you do in Outlook is stored in your own personal PST file, but what happens if you find yourself locked out of your PST file, or Outlook no longer recognizes the file?

Microsoft Outlook is undoubtedly a powerful app, with its feature set going beyond that of a mere email manager to encompass contacts, calendars and other organizational tools. Everything you do in Outlook is stored in your own personal PST file, but what happens if you find yourself locked out of your PST file, or Outlook no longer recognizes the file? The importance of backing up your data, settings and even your entire hard drive is finally starting to hit home. With the comprehensive backup tools supplied in Windows 7 and high-end versions of Vista, you may think Microsoft has you covered, but it seems third-party vendors still have different ideas.

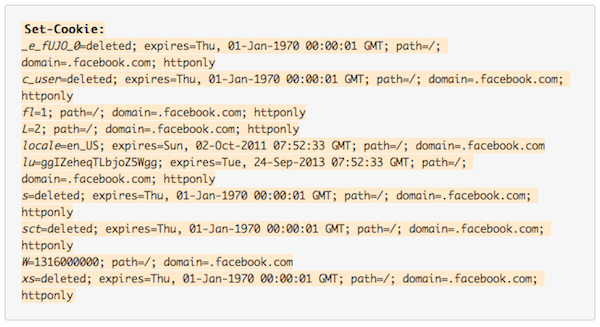

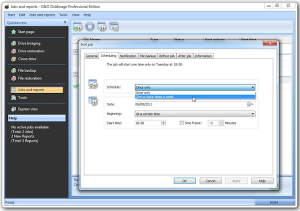

The importance of backing up your data, settings and even your entire hard drive is finally starting to hit home. With the comprehensive backup tools supplied in Windows 7 and high-end versions of Vista, you may think Microsoft has you covered, but it seems third-party vendors still have different ideas. In the real world, you only have to worry about the criminals who live in your city. But in the online world, you have to worry about criminals who could be on the other side of the planet. Online crime is always international because the Internet has no borders.

In the real world, you only have to worry about the criminals who live in your city. But in the online world, you have to worry about criminals who could be on the other side of the planet. Online crime is always international because the Internet has no borders. It's received wisdom in software development generally that you don't write your own code when a perfectly good implementation is there for the taking. It's the old saw about reinventing the wheel. But it's especially true of cryptographic code. Windows programs that utilized the OS standard crypto functions got fast and automatic protection from the rogue certificates distributed during the DigiNotar scandal.

It's received wisdom in software development generally that you don't write your own code when a perfectly good implementation is there for the taking. It's the old saw about reinventing the wheel. But it's especially true of cryptographic code. Windows programs that utilized the OS standard crypto functions got fast and automatic protection from the rogue certificates distributed during the DigiNotar scandal. Today, around the globe, people are, sadly, commemorating the 10th anniversary of the September 11, 2001 terrorist attacks. In posting

Today, around the globe, people are, sadly, commemorating the 10th anniversary of the September 11, 2001 terrorist attacks. In posting

If you like the idea of getting creative,

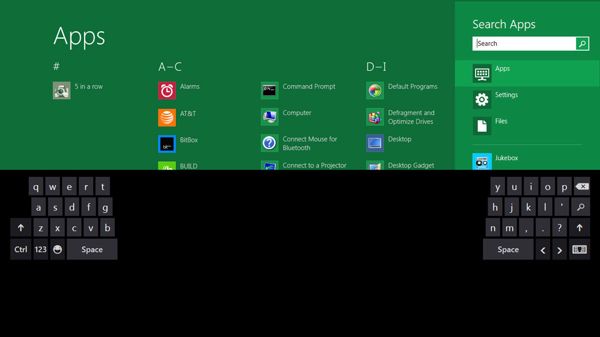

If you like the idea of getting creative,  Can you hear it? Can you hear it coming? Microsoft's Windows developer conference is almost here. BUILD kicks off September 13 in Anaheim, Calif., and it's going to be big, big, BIG. Microsoft will give Windows 8 its formal unveiling -- everything else before was just movie previews. No new Windows version is really official until Microsoft presents it to developers.

Can you hear it? Can you hear it coming? Microsoft's Windows developer conference is almost here. BUILD kicks off September 13 in Anaheim, Calif., and it's going to be big, big, BIG. Microsoft will give Windows 8 its formal unveiling -- everything else before was just movie previews. No new Windows version is really official until Microsoft presents it to developers.

As the launch of Windows 8 draws closer and closer, and increasingly tantalising details creep out about the operating system, the number of tools that enable you to mimic the look or copy the features of the next version of Windows also increases. One such tool is

As the launch of Windows 8 draws closer and closer, and increasingly tantalising details creep out about the operating system, the number of tools that enable you to mimic the look or copy the features of the next version of Windows also increases. One such tool is

If you’re a data-heavy smartphone user, you belong on Sprint. That’s the findings of

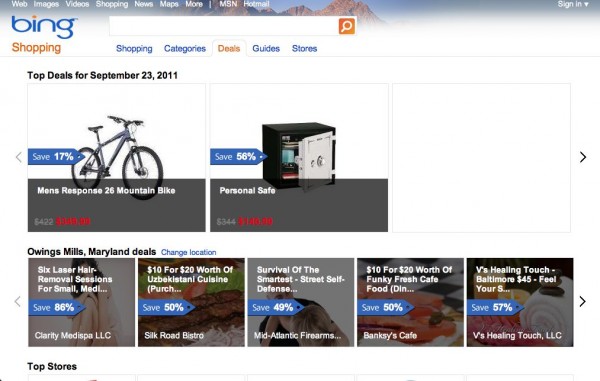

If you’re a data-heavy smartphone user, you belong on Sprint. That’s the findings of  It has been a year since Bing

It has been a year since Bing

The security requirements for certificate authorities have, so far been, well, there haven't been any. Mozilla is attempting now to impose some and giving CAs precious-little time to come up to standard. Could the Mozilla "death sentence" be imposed?

The security requirements for certificate authorities have, so far been, well, there haven't been any. Mozilla is attempting now to impose some and giving CAs precious-little time to come up to standard. Could the Mozilla "death sentence" be imposed?

If you have an iPhone or an Android phone, the chances are that you frequently connect to the internet using a 3G connection. The same is true for some iPad users, although there are more WiFi-only Apple tablets in circulation. Whether you are working with a device that only offer WiFi connectivity, you are out of range of a 3G signal or you just need faster Internet access, there are numerous reasons you might want to find a wireless Internet connection when you are out and about, and this is something that

If you have an iPhone or an Android phone, the chances are that you frequently connect to the internet using a 3G connection. The same is true for some iPad users, although there are more WiFi-only Apple tablets in circulation. Whether you are working with a device that only offer WiFi connectivity, you are out of range of a 3G signal or you just need faster Internet access, there are numerous reasons you might want to find a wireless Internet connection when you are out and about, and this is something that

For the past few years, IcoFX has lain apparently dormant, despite noises from the developer that a new version was in development. This powerful icon editor has suddenly resurfaced, however, with a major new version number,

For the past few years, IcoFX has lain apparently dormant, despite noises from the developer that a new version was in development. This powerful icon editor has suddenly resurfaced, however, with a major new version number,  The simple fact that iPhone, iPod and iPads have been designed specifically with portability in mind, they are perfectly suited for use as task management tools. As you are likely to have your iOS device with you at all times, it makes sense to store details of upcoming appointments, information about the projects you are working on, and to keep track of everyday data such as income and expenditure. Two of the most well received iOS apps in this category are

The simple fact that iPhone, iPod and iPads have been designed specifically with portability in mind, they are perfectly suited for use as task management tools. As you are likely to have your iOS device with you at all times, it makes sense to store details of upcoming appointments, information about the projects you are working on, and to keep track of everyday data such as income and expenditure. Two of the most well received iOS apps in this category are  From the offset Weave is at a major advantage by virtue of being free. This gives the app instant appeal, and the fact that trial versions of iOS app do not exist, save for so-called ‘lite’ versions of apps, it is more likely to be installed by someone browsing the App Store.

From the offset Weave is at a major advantage by virtue of being free. This gives the app instant appeal, and the fact that trial versions of iOS app do not exist, save for so-called ‘lite’ versions of apps, it is more likely to be installed by someone browsing the App Store. Microsoft's

Microsoft's

Fresh off

Fresh off

The good news:

The good news:  Ed Oswald argues that TechCrunch embodies some of the worst ethics in journalism today. In counterpoint "

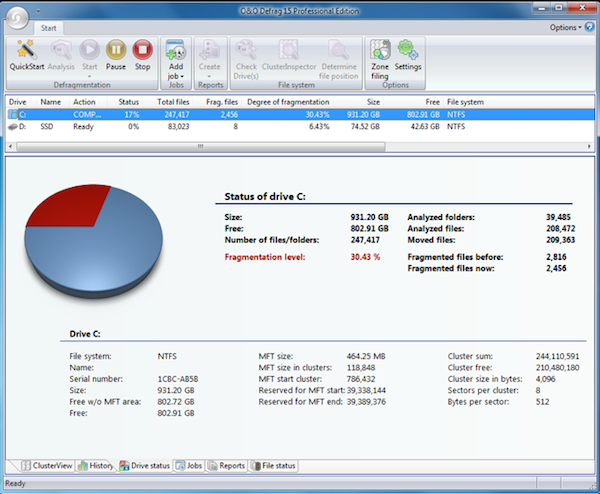

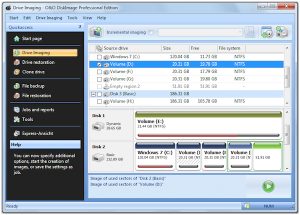

Ed Oswald argues that TechCrunch embodies some of the worst ethics in journalism today. In counterpoint " German developer O&O Software has announced the immediate release of

German developer O&O Software has announced the immediate release of

Music creation software has something of a poor reputation, with many people regarding it as being expensive to buy and complicated to use. This is a reputation that MAGIX is trying to change with its Music Maker program, and the latest version,

Music creation software has something of a poor reputation, with many people regarding it as being expensive to buy and complicated to use. This is a reputation that MAGIX is trying to change with its Music Maker program, and the latest version,

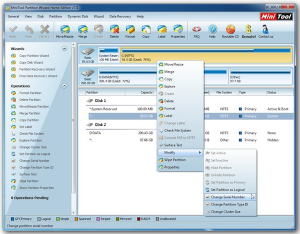

MiniTool Solution Ltd has released a brand new version of its non-destructive partitioning software. MiniTool Partition Wizard 7.0, available as a free-for-personal-use

MiniTool Solution Ltd has released a brand new version of its non-destructive partitioning software. MiniTool Partition Wizard 7.0, available as a free-for-personal-use

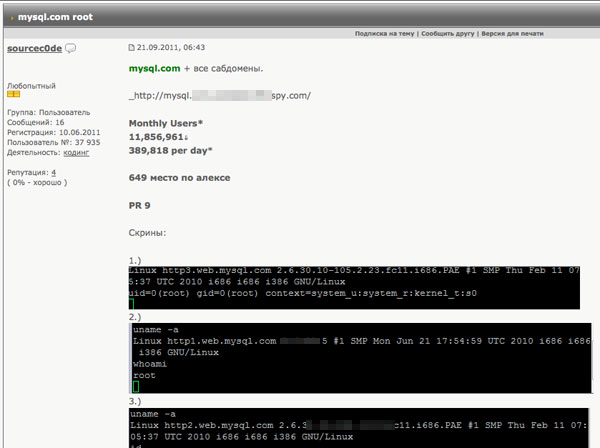

The hacker who breached the DigiNotar certificate authority

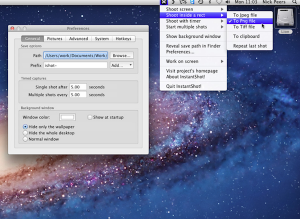

The hacker who breached the DigiNotar certificate authority  It’s a strange quirk of OS X that it boasts not one, but two separate screen-capture utilities. One is triggered simply by pressing [Cmd] + [3] or [4] depending on whether you want a full-screen shot or a portion of the screen. While configurable, you’ll need to fiddle about with the command line each time you want to change a setting.

It’s a strange quirk of OS X that it boasts not one, but two separate screen-capture utilities. One is triggered simply by pressing [Cmd] + [3] or [4] depending on whether you want a full-screen shot or a portion of the screen. While configurable, you’ll need to fiddle about with the command line each time you want to change a setting. "So the next day, my father went to see him; only this time with Luca Brasi -- and within an hour, he signed a release, for a certified check for $1,000...Luca Brasi held a gun to his head and my father assured him that either his brains, or his signature, would be on the contract". -- Michael Corelone, "The Godfather" movie.

"So the next day, my father went to see him; only this time with Luca Brasi -- and within an hour, he signed a release, for a certified check for $1,000...Luca Brasi held a gun to his head and my father assured him that either his brains, or his signature, would be on the contract". -- Michael Corelone, "The Godfather" movie. I like reading my spam. Sounds strange? Perhaps it is, but from the perspective of an eCrime investigator, there's often something interesting inside a spam folder.

I like reading my spam. Sounds strange? Perhaps it is, but from the perspective of an eCrime investigator, there's often something interesting inside a spam folder.

Moscow-based optical character recognition specialist ABBYY has released a major new update of its renowned OCR application.

Moscow-based optical character recognition specialist ABBYY has released a major new update of its renowned OCR application.  It has been obvious for some time that Google's app standards for Android are lenient to say the least. That's why Android is the favored platform for mobile malware. But it turns out that Chrome extensions are a huge, and similar problem that I'm beginning to really worry about.

It has been obvious for some time that Google's app standards for Android are lenient to say the least. That's why Android is the favored platform for mobile malware. But it turns out that Chrome extensions are a huge, and similar problem that I'm beginning to really worry about. Irene's assault on the Eastern Seaboard earlier this week is just the beginning of what is expected to be another heavy season of hurricanes and tropical storms. What happens to your data if raging rains or flooding waters damage your computer? The electronics may be gone but your precious files are likely recoverable.

Irene's assault on the Eastern Seaboard earlier this week is just the beginning of what is expected to be another heavy season of hurricanes and tropical storms. What happens to your data if raging rains or flooding waters damage your computer? The electronics may be gone but your precious files are likely recoverable.

The choice of browsers for iOS is hardly overwhelming, so any new additions are always welcome.

The choice of browsers for iOS is hardly overwhelming, so any new additions are always welcome.

Windows 8 is just around the corner and it seems that almost every week there details emerge about just what can be expected from the latest version of Microsoft’s operating system. With every new Windows that is announced, there follows a rush to mimic the look and features long before the software hits the shelves, and things are no different with Windows 8.

Windows 8 is just around the corner and it seems that almost every week there details emerge about just what can be expected from the latest version of Microsoft’s operating system. With every new Windows that is announced, there follows a rush to mimic the look and features long before the software hits the shelves, and things are no different with Windows 8.

Aiming to fight Apple's MacBook Air on one of its primary advantages -- its size -- Lenovo on Thursday introduced its Ultrabook, claiming it is thinner than Apple's signature ultra-thin laptop.

Aiming to fight Apple's MacBook Air on one of its primary advantages -- its size -- Lenovo on Thursday introduced its Ultrabook, claiming it is thinner than Apple's signature ultra-thin laptop.

In an age where our phones seem to be getting bigger and our tablets smaller, Samsung's latest addition to its Tab family is no exception. The Korean company introduced a 7.7-inch version of its popular tablet, complete with Android 3.2 and Super AMOLED Plus display.

In an age where our phones seem to be getting bigger and our tablets smaller, Samsung's latest addition to its Tab family is no exception. The Korean company introduced a 7.7-inch version of its popular tablet, complete with Android 3.2 and Super AMOLED Plus display.

CyberLink has released a new major update to its

CyberLink has released a new major update to its  The new operating system, which is expected in developer beta in about two weeks, will take not one but two approaches to main user interface. Windows 8 will come with the streamlined, touch-friendly Metro and quasi-traditional file system. It's quasi because Microsoft is replacing major elements of Windows Explorer with the Office Ribbon.

The new operating system, which is expected in developer beta in about two weeks, will take not one but two approaches to main user interface. Windows 8 will come with the streamlined, touch-friendly Metro and quasi-traditional file system. It's quasi because Microsoft is replacing major elements of Windows Explorer with the Office Ribbon.

If you’ve felt that AVG’s security tools have become a little bloated in the last few years, then we’ve some good news: the

If you’ve felt that AVG’s security tools have become a little bloated in the last few years, then we’ve some good news: the  At first glance,

At first glance,  The Document Foundation has announced that

The Document Foundation has announced that