Early this evening, during a New York soiree, Samsung launched the Galaxy S IV smartphone. The venue is atypical. The South Korean electronics giant usually starts from home, offering new smartphones globally before reaching the United States. Now, in a dramatic change, a flagship Galaxy phone lands on Apple's home turf first.

The companies are in a struggle for smartphone supremacy, with Samsung leading in most countries. With one glaring exception: The United States. Today's venue clearly marks the South Korean manufacturer's intentions to take the share lead from its American rival.

Apple responded to today's launch S4 by sending out marketing chief Phil Schiller to talk down Samsung, its products and Android generally. But big headlines from blogs and news sites fall far short of offering a competitive product. The fruit-logo company rarely sends anyone on such a talking-down door. Surely someone is worried in Cupertino, Calif.

Even a year ago, the electronics giant wouldn't have been so bold as to launch here, but Samsung's brand acceptance is up, in part because of the success of Galaxy S III and Galaxy Note II and some aggressive and creative marketing. Samsung also benefits from high-profile conversions, like prominent Mac journalist Andy Ihnatko switching to the S3 from iPhone 4S.

Samsung Soars

To say Samsung is on a roll is an understatement. During 2012, the company captured the No. 1 spot for all handsets and also smartphones. For the full year, as measured in actual phone sales to end users, Samsung share reached 22 percent -- that's from 385 million units, according to Gartner. Share was a tad higher for fourth quarter: 22.7 percent. Meanwhile Samsung smartphone sales soared 85 percent or nearly four times that of Apple.

Samsung's sales success strongly weighs against Android, not just Apple. During fourth quarter, Android smartphone share rose to 69.7 percent from 51.3 percent a year earlier. By comparison, iOS fell to 20.9 percent from 23.6 percent. Samsung sold so many smartphones, it accounted for 42.5 percent of all Android sales in the category.

"The Android brand is being overshadowed by Samsung's brand with the Galaxy name nearly a synonym for Android phones in consumers' mind share", Anshul Gupta, Gartner principal research analyst, says. Samsung's success is mixed for Android as a platform. The South Korean company, and not Google, largely controls customers' experience via TouchWiz UI and other features.

Dollars and Sense

Mobile makes huge contributions to Samsung's bottom line. For Q4, the South Korean electronics giant reported revenue of about $52.45 billion and $6.55 billion profit. Mobile division revenue was $25.35 billion, and Samsung credits success largely to two devices -- Galaxy S III and Galaxy Note II. Interestingly, Samsung mobile ASPs are rising, and analyst data shows expansion across the globe -- particularly markets once dominated by Nokia, China among them. Samsung credits sales to emerging markets as a bright point for the quarter.

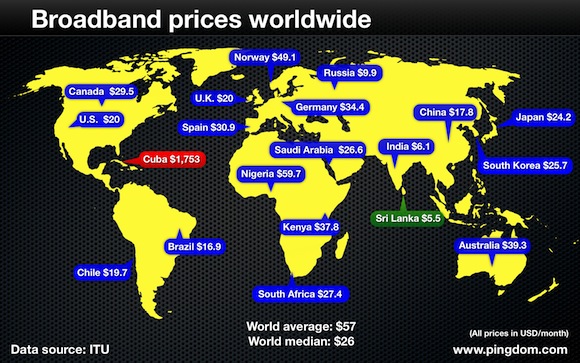

They also happen to be where all the big sales growth is and where Samsung displaces, or replaces, leader Nokia. IDC predicts that emerging markets -- Brazil, China and India, particularly -- will be the biggest growth areas for smartphones, which accounted for 45 percent of all handset sales in Q, according to Gartner.

Apple struggles to get beyond the wealthiest consumers in this markets because:

- Subsidies make selling prices higher

- Contract commitments are required in countries where non traditionally are required

For example, "China is a massive growth prospect, but Apple is not making the market share impact there that it is in other markets", Nicole Peng, Canalys China research director, says. By contrast, Samsung is a top vendor there elsewhere.

Unquestionably, Samsung blindsided Apple, much the way the American company did to competitors BlackBerry and Nokia. They didn't see iPhone coming. Clearly Apple execs expected much less success from the so-called copycat.

On Thursday, Apple rolled out an update for OS X Mountain Lion. The latest iteration, which sports the 10.8.3 version number, delivers a significant number of improvements and bug fixes, among which is support for Windows 8 in Boot Camp as the main highlight.

On Thursday, Apple rolled out an update for OS X Mountain Lion. The latest iteration, which sports the 10.8.3 version number, delivers a significant number of improvements and bug fixes, among which is support for Windows 8 in Boot Camp as the main highlight. Apparently there is some new Samsung phone being announced later today, but for the past 24 hours Google owned the news cycle for all of the wrong reasons. Yesterday the company tried to quietly announce its

Apparently there is some new Samsung phone being announced later today, but for the past 24 hours Google owned the news cycle for all of the wrong reasons. Yesterday the company tried to quietly announce its

On Thursday, Canadian smartphone maker BlackBerry announced plans to secure Android and iOS devices with Secure Work Space for BlackBerry Enterprise Service 10. The company cites evolving needs and "ever-growing variety of devices" that are used within the work space as the main reason for stepping up to fortify the security of the two mobile operating systems.

On Thursday, Canadian smartphone maker BlackBerry announced plans to secure Android and iOS devices with Secure Work Space for BlackBerry Enterprise Service 10. The company cites evolving needs and "ever-growing variety of devices" that are used within the work space as the main reason for stepping up to fortify the security of the two mobile operating systems.

There are plenty of benefits of living in the cloud, but some major downsides too. Nearly five months ago an

There are plenty of benefits of living in the cloud, but some major downsides too. Nearly five months ago an  Two days ago, US carrier AT&T

Two days ago, US carrier AT&T  Web gallery creation tool

Web gallery creation tool  Expressing his disappointment towards

Expressing his disappointment towards  Uptime monitoring firm

Uptime monitoring firm

While YouTube’s vast choice of clips means there’s always something good to watch, tracking down the best videos can take a while. Especially if you’re clicking each clip in turn, checking the ratings, then returning to your search results to try something else.

While YouTube’s vast choice of clips means there’s always something good to watch, tracking down the best videos can take a while. Especially if you’re clicking each clip in turn, checking the ratings, then returning to your search results to try something else. Enable the Highlight option and the best videos on the page will have a blue box drawn around them, so you don’t even have to bother with looking at individual bars.

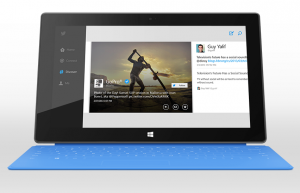

Enable the Highlight option and the best videos on the page will have a blue box drawn around them, so you don’t even have to bother with looking at individual bars. The lack of official apps for Windows 8 led to me describing the Windows Store as being like a

The lack of official apps for Windows 8 led to me describing the Windows Store as being like a  I can live with iGoogle going away -- I never use the service anymore. But this one really hurts, though perhaps more to those of us who write about technology than those who read about it. However, statistics show that many of you also use the RSS feed to easily track your favorite sites. That is why today's execution notice from Google hits below the belt.

I can live with iGoogle going away -- I never use the service anymore. But this one really hurts, though perhaps more to those of us who write about technology than those who read about it. However, statistics show that many of you also use the RSS feed to easily track your favorite sites. That is why today's execution notice from Google hits below the belt.