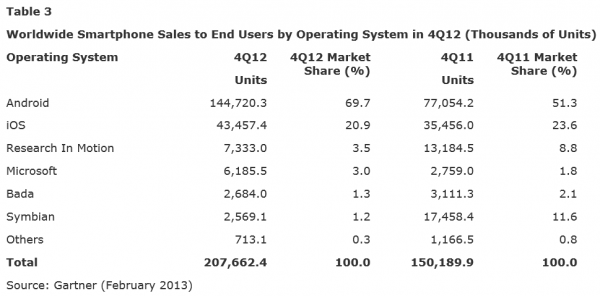

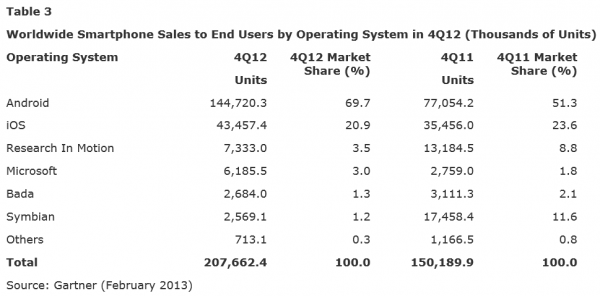

"We're No. 3!" will be BlackBerry's and Microsoft's rallying cry this year. Android and iOS so dominate the smartphone market, the best -- and quite honestly dismal -- hope is third; distant at that. Combined, based on actual phone sales, Android and iOS had 90.1 percent share during fourth quarter, up from 74.9 percent a year earlier, according to Gartner. BlackBerry and Windows Phone are neck-and-neck, with lowly 3.5 percent and 3 percent standings, respectively.

"We're No. 3!" will be BlackBerry's and Microsoft's rallying cry this year. Android and iOS so dominate the smartphone market, the best -- and quite honestly dismal -- hope is third; distant at that. Combined, based on actual phone sales, Android and iOS had 90.1 percent share during fourth quarter, up from 74.9 percent a year earlier, according to Gartner. BlackBerry and Windows Phone are neck-and-neck, with lowly 3.5 percent and 3 percent standings, respectively.

Upstarts want third place, too. Anshul Gupta, Gartner principal research analyst, explains: "2013 will be the year of the rise of the third ecosystem as the battle between the new BlackBerry10 and Widows Phone intensifies. As carriers and vendors feel the pressure of the strong Android’s growth, alternative operating systems such as Tizen, Firefox, Ubuntu and Jolla will try and carve out an opportunity by positioning themselves as profitable alternatives".

Looked at differently, BlackBerry and Windows Phone combined-share was less in fourth quarter (6.5 percent) than a year earlier (10.6 percent). That said, while starting from a small base, Microsoft's platform shows promise, with sales up 124.2 percent year over year.

Individual vendor performance tells the story differently. Apple and Samsung combined smartphone sales share rose to 52 percent from 46.4 percent during the quarter.

It's a free-for-all. "There is no manufacturer that can firmly lay claim to the No. 3 spot in global smartphone sales", Gupta says. "The success of Apple and Samsung is based on the strength of their brands as much as their actual products. Their direct competitors, including those with comparable products, struggle to achieve the same brand appreciation among consumers, who, in a tough economic environment, go for cheaper products over brand".

Samsung and Apple smartphone unit sales rose by 85.3 percent and 22.6 percent, respectively. The fruit-logo company accounts for all iOS, "with Samsung commanding over 42.5 percent of the Android market globally", Gupta says, "and the next vendor at just 6 percent share. The Android brand is being overshadowed by Samsung's brand with the Galaxy name nearly a synonym for Android phones in consumers' mind share".

Samsung's success is mixed for Android as a platform. The South Korean company, and not Google, largely controls customers' experience via TouchWiz UI and other features. That can further fragment Android. On the other hand, consumers generally identify with uber-brands, like Samsung or Galaxy S III rather than Android 4.2.

Samsung's Android lift takes a bite out of Apple. For the second straight quarter, iOS lost smartphone sales share, year over year. Apple's mobile operating system dropped to 20.9 percent from 23.6 percent during Q4. Meanwhile, Android leaped again, from 51.3 percent to 69.7 percent share. But unit sales jumped more than share suggests: 144.7 million from 77.1 million.

Unlike most other analyst firms, Gartner measures actual sales to end users, not shipments into the channel. So there is no room for Apple apologists to argue about some disparity between the phone maker's stated sales and those from others. Like competitors, Apple calls shipments sales. The company reported 47.8 million in Q4. Gartner says actual sales were 43.6 million, or 4.2 million less than the number the company gave last month. So while iPhone 5 still had a big launch quarter, sales missed analyst consensus (50 million) by wider margin.

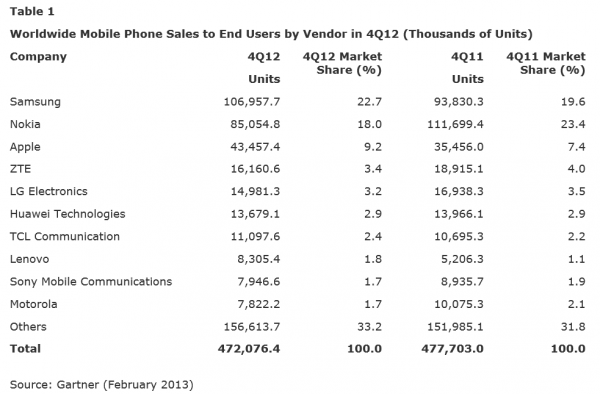

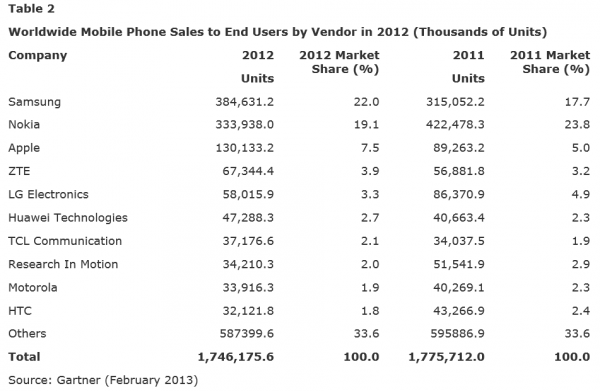

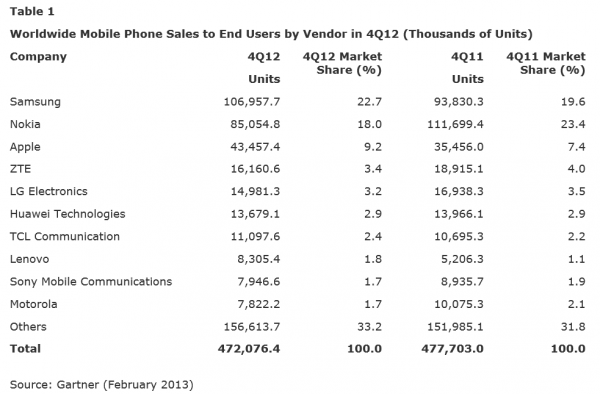

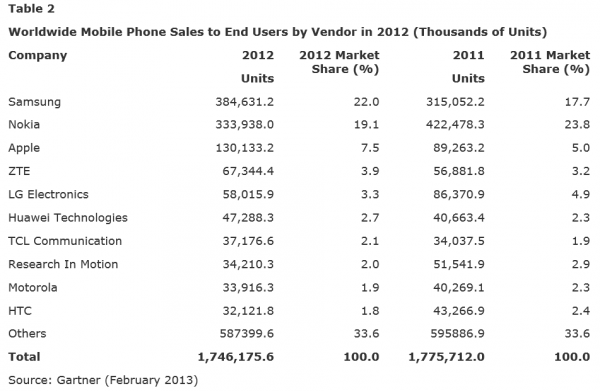

In the broader phone market, Apple share rose to 9.2 percent from 7.4 percent for the quarter and to 7.5 percent from 5 percent for all 2012. The company maintained its third-place ranking for Q4 and the year. Market-leader Samsung grew share to 22.7 percent from 19.6 percent for fourth quarter and to 22 percent from 17.7 percent for all 2012.

More broadly, worldwide mobile phone sales dipped about two percent for the quarter and year, to 1.75 billion and 472.1 million, respectively. Smartphone sales surged 38.3 percent in Q4, to 207.7 million. Meanwhile, feature phone sales fell 19 percent to 264.4 million. At this pace, smartphone sales should surpass feature phones within a couple quarters. Respective share in Q4: 44 percent and 56 percent.

Photo Credit: David Andrew Larsen/Shutterstock

Cloud backup provider SugarSync, Inc has announced the release of

Cloud backup provider SugarSync, Inc has announced the release of  I had a nice surprise Valentine’s Day gift delivered to my door this morning -- a box of ten copies of my new novel (

I had a nice surprise Valentine’s Day gift delivered to my door this morning -- a box of ten copies of my new novel (

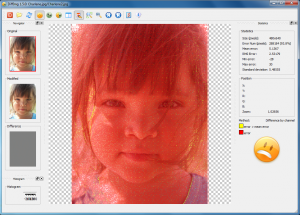

If DiffImg simply displays a blank grey pane then that means it’s found no differences, so there’s nothing to display -- your two images are the same.

If DiffImg simply displays a blank grey pane then that means it’s found no differences, so there’s nothing to display -- your two images are the same. The vast majority of us use multiple cloud services for email, social media, and file storage, which means having to regularly switch between different websites or apps to access our data.

The vast majority of us use multiple cloud services for email, social media, and file storage, which means having to regularly switch between different websites or apps to access our data.  Nitro PDF Pty Ltd has launched two major updates for its flagship PDF reader and authoring products.

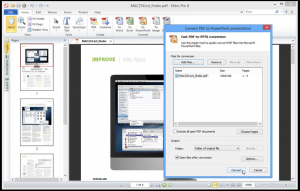

Nitro PDF Pty Ltd has launched two major updates for its flagship PDF reader and authoring products.  Other changes in these latest builds apply equally to Nitro Reader 3.5 as well as Nitro Pro 8.5. First, there’s added support for XML Forms Architecture, allowing users to not just view, but also fill out and save dynamic XFA forms.

Other changes in these latest builds apply equally to Nitro Reader 3.5 as well as Nitro Pro 8.5. First, there’s added support for XML Forms Architecture, allowing users to not just view, but also fill out and save dynamic XFA forms. When you’re having problems understanding an idea, or conveying it to someone else, then building a mind map can often help. Just the process of defining the core concepts and showing how they’re related will often make things very much clearer.

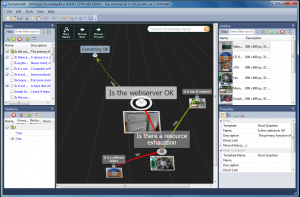

When you’re having problems understanding an idea, or conveying it to someone else, then building a mind map can often help. Just the process of defining the core concepts and showing how they’re related will often make things very much clearer. Not every mind map requires this dynamic approach, of course, but if you’d prefer a more static view then that’s possible, too. Just keep clicking "More Details" at the top of the map pane and KnowledgeBase Builder will expand the map, showing more and more information, until it’s all visible (subject to your screen size, anyway).

Not every mind map requires this dynamic approach, of course, but if you’d prefer a more static view then that’s possible, too. Just keep clicking "More Details" at the top of the map pane and KnowledgeBase Builder will expand the map, showing more and more information, until it’s all visible (subject to your screen size, anyway). British broadcaster ITV has agreed to a deal with Shazam -- the popular music identification service -- allowing viewers of this year’s The Brits music awards to access exclusive content during the live broadcast -- a UK first.

British broadcaster ITV has agreed to a deal with Shazam -- the popular music identification service -- allowing viewers of this year’s The Brits music awards to access exclusive content during the live broadcast -- a UK first. "We're No. 3!" will be BlackBerry's and Microsoft's rallying cry this year. Android and iOS so dominate the smartphone market, the best -- and quite honestly dismal -- hope is third; distant at that. Combined, based on actual phone sales, Android and iOS had 90.1 percent share during fourth quarter, up from 74.9 percent a year earlier, according to Gartner. BlackBerry and Windows Phone are neck-and-neck, with lowly 3.5 percent and 3 percent standings, respectively.

"We're No. 3!" will be BlackBerry's and Microsoft's rallying cry this year. Android and iOS so dominate the smartphone market, the best -- and quite honestly dismal -- hope is third; distant at that. Combined, based on actual phone sales, Android and iOS had 90.1 percent share during fourth quarter, up from 74.9 percent a year earlier, according to Gartner. BlackBerry and Windows Phone are neck-and-neck, with lowly 3.5 percent and 3 percent standings, respectively.