In October 2009, I explained why "Apple cannot win the smartphone wars". That was just a year after Google launched the first Android handset, the G1, on T-Mobile and days after Verizon debuted the hugely-successful Motorola Droid. By end of that year, Android had paltry 3.9 percent smartphone sales share, according to Gartner. My prediction drew loads of criticism from the Apple Fan Club of bloggers, journalists and other writers.

In October 2009, I explained why "Apple cannot win the smartphone wars". That was just a year after Google launched the first Android handset, the G1, on T-Mobile and days after Verizon debuted the hugely-successful Motorola Droid. By end of that year, Android had paltry 3.9 percent smartphone sales share, according to Gartner. My prediction drew loads of criticism from the Apple Fan Club of bloggers, journalists and other writers.

Fast-forward to second quarter 2012 and Android's global sales share is 64.1 percent for all phones, not just smart ones. iOS: 18.8 percent. My how times change. Increasingly, Android and iOS look exactly like Windows and Mac OS in the 1980s and 1990s, as I predicted would be the case.

By the way, three years ago, Gartner prediced that for 2012, Symbian would be top-ranked with 37.4 percent share, followed by Android (18 percent) and iOS (13.6 percent). Opps.

Two days ago, Android chief Andy Rubin revealed startling data: Cumulative device shipments reached 500 million, putting Google's OS ahead of Apple's for the first time. During Apple's calendar second quarter earnings call, CFO Peter Oppenheimer put cumulative iOS sales at 410 million through June 30. Strangely, yesterday, CEO Tim Cook reduced the number to 400 million. WTH?

Looking ahead, IHS iSuppli now predicts that cumulative Android smartphone shipments will reach 1 billion next year, but iOS not until 2015. The war is over, and Android won.

That puts context behind Steve Jobs statement to his biographer about beating Android: "I'm willing to go thermonuclear war on this". Hence Apple's willingness to bomb competitors with patent lawsuits and risk fallout, in the form of legal precedents, that could hurt all tech companies for years. Apple lost the conventional, competitive war. Nuclear is last resort.

Clone Wars

Apple never really had a chance. iPhone was too good to start, encroaching on territory dominated by too many established players.

But what a start. Humanness made the original iPhone stand apart from all competing cellular handsets. Apple used a variety of sensors to imbue the quality. Touch, and its intimacy, and the way the handset responded to your proximity gave it the human quality. There really was nothing like iPhone in June 2007. A year later, Apple launched the App Store, opening way for a mobile computing platform in a way more compelling than rivals like Nokia. Competitors were sure to line up behind something else, and they did. Android. And Apple set the stage to repeat the history of an earlier competing era.

Apple brought to iPhone (and later iPad) many of the strengths and weaknesses that made Macintosh an early success only later to fail. As I explained three years ago, iPhone is to Android like Macintosh was to DOS/Windows PCs. The IBM PC launched in mid-1981. About 18 months later, Compaq announced the 12.5 kg clone nicknamed "luggable". A year after Compaq started selling its IBM PC clone, Apple announced the Macintosh, in January 1984.

Macintosh proved to be an industry-changing platform, but not sustainable. Microsoft licensed DOS, and later Windows, to anyone and everyone, while Apple controlled Macintosh. That everyone expanded rapidly, as Dell, HP and others released their own IBM clones. Apple couldn't win the "Clone Wars", because the competing platform allowed many more third-parties to make much more money. The resulting clone attack, essentially every other PC manufacturer against Apple, was too much for Macintosh. The PC ecosystem prevailed.

Three years ago, I warned: "Another everyone else against Apple battle is coming, with Android looking to be the better OS around which an ecosystem grows and thrives. There's a Star Wars metaphor here somewhere. Apple lost out to DOS/Windows because of the attack of the PC clones. Now the droids are coming for iPhone".

The Borg

But perhaps there is a more appropriate sci-fi metaphor for Android. The Borg. Android is open source, and even with Google's leadership is developed as a collective. Apple wages war against a hive mind and companies that made mobiles long before iPhone. These competitors are motivated to win, and rapidly accelerating designs and breadth of models put Apple to task. The fruit-logo company produces at best one new phone a year. How many new Androids debut in a month?

Then there is the expansive market opportunity. Thanks in part to iPhone, there is underway a rapid, global transition from feature phones to smart ones. Companies like Samsung and ZTE are motivated to grab as much market share as humanly possible during the transition. Conversion can only take so long before the market saturates.

Two days ago, Stephen Baker, NPD's vice president of industry analysis, warned that US smartphone saturation would mute iPhone 5 sales: "While the new iPhone may be a gigantic success around the world, the inevitability of similar success in the US is not quite so pre-determined".

Markets are fast-changing. IDC predicts that smartphone shipments to the People's Republic of China will pass the United States this year, with Android being the big beneficiary. In 2011, US smartphone share was 21.3 percent compared to 18.3 percent for China. This year, China is expected to reach 26.5 percent, while the United States falls to 17.8 percent.

iPhone's second-place status is assured, but consider that Android's sales share is already more than three times larger than that of iOS.

Assembly Imitation

But there is another fundamental problem, which like Apple's control-oriented approach to platforms, undermines its long-term competitive position -- that despite now being largest company in the world by market capitalization.

Apple is credited for being an innovator, when in fact the company is a follower. Apple didn't invent the personal computer, laptop, MP3 player, software media player, app store, music store, smartphone or tablet. Apple partly, or quite shockingly, reinvented these categories. But the company was by no means first, even though there is much revisionist history asserting otherwise.

Oded Shenkar says "Apple is itself a consummate imitator", in his book Copycats: How Smart Companies use Imitation to Gain a Strategic Edge. Apple has long practiced what he calls imovation -- that is imitative innovation. The approach defines many of the most successful companies.

"More than anything, Apple is master of assembly imitation: it follows in the paths of many predecessors, which have existing technologies and materials to generate new technologies by recombining them", Shenkar says.

If you look closely at the history of Apple, there is a consistent pattern: Great innovation in a new product category followed by iteration over a long period of time, but few great new innovations following the first. Apple essentially moves into a nascent or establish category and produces a remarkable product. But eventually development stagnates, with Apple reinventing in a new product category.

The original iPhone changed the way people interact with cellular handsets, by making them more human, more responsive. iPad evoked something more: Intimacy with the device and content. But what followed the original inspiration? Iteration along the same design principles.

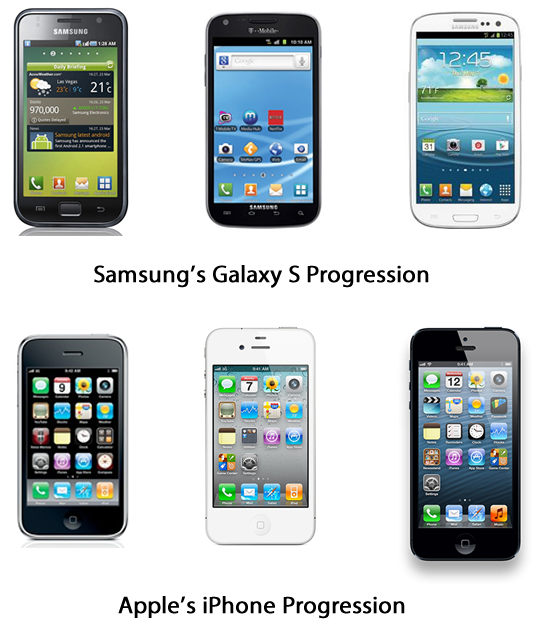

iPod innovation really stopped with the nano in 2005. In 2007, iPhone was truly innovative. Can you say the same about iPhone 5 four-and-a-half years later? True, iPhone 5 is longer but not that different from 4S otherwise. What's so tragic is how little iPhone changed while competing products made leaps and bounds. iPad already peaked. What is there really different now other than a high-resolution display? Meanwhile, Samsung is on its second-generation pen-based tablet, with features ideal for Apple designer customers. How ironic.

Imovator's Dilemma

In many respects, Apple succumbs to the innovator's dilemma. Or perhaps the imovator's dilemma. Apple imitates and reinvents, while its competitors often imitate and extend. Shenkar observes that many pioneers often fall behind those who follow them. "Because imitators often differentiate themselves from the original, they are often more attentive to game-changing technologies".

Take for example convicted copycat Samsung. While iPhone is largely unchanged, Samsung introduced larger displays, better screen technology, software enhancements not available on Apple's handset and opened up the "phablet" category with Galaxy Note. The result: Samsung is the world's leading handset manufacturer based on sales, according to Gartner. It wasn't long ago that the South Korean manufacturer ate Apple's dust.

Samsung is but one of many Android device makers -- hungry companies looking to adapt and gain market share before the feature mobile-to-smartphone conversion is over. They innovate, while Apple iterates. Colleague Wayne Williams rightly asks: "Hey, Apple, where is the innovation?" It's not in iPhone 5, which features catch up to Android smartphones like HTC One X or Samsung Galaxy S III.

Apple needed iPhone 5 to be remarkable. It's not. The Android Army is now unstoppable, short of nuclear obliteration. If Android device markers get tablets right, or even Microsoft and its Windows 8/RT partners, iPad is at risk, too. Amazon's Kindle Fire HD already foreshadows another category where innovation will trump iteration.

From Justin Bieber to Selena Gomez, Rihanna to Barack Obama, just about everyone is using Instagram to share photos these days. And if you’d like to get a closer look at the contents of any particular account then all you need is a copy of the Free Instagram Downloader.

From Justin Bieber to Selena Gomez, Rihanna to Barack Obama, just about everyone is using Instagram to share photos these days. And if you’d like to get a closer look at the contents of any particular account then all you need is a copy of the Free Instagram Downloader.

The golden years of Apple's outright dominance in technical innovation is fading, and quickly at that. The iPhone 5 just launched with a deservedly

The golden years of Apple's outright dominance in technical innovation is fading, and quickly at that. The iPhone 5 just launched with a deservedly

Derrick Wlodarz is an IT professional who owns Park Ridge, IL (USA) based computer repair company FireLogic. He has over 7+ years of experience in the private and public technology sectors, holds numerous credentials from CompTIA and Microsoft, and is one of a handful of Google Apps Certified Trainers & Deployment Specialists in the States. He is an active member of CompTIA's Subject Matter Expert Technical Advisory Council that shapes the future of CompTIA examinations across the globe. You can reach out to him at

Derrick Wlodarz is an IT professional who owns Park Ridge, IL (USA) based computer repair company FireLogic. He has over 7+ years of experience in the private and public technology sectors, holds numerous credentials from CompTIA and Microsoft, and is one of a handful of Google Apps Certified Trainers & Deployment Specialists in the States. He is an active member of CompTIA's Subject Matter Expert Technical Advisory Council that shapes the future of CompTIA examinations across the globe. You can reach out to him at  Talk about your bitter clingers! Here I am, minding my own business, just writing about my

Talk about your bitter clingers! Here I am, minding my own business, just writing about my  F-Secure has announced the availability of its 2013 product family, which includes

F-Secure has announced the availability of its 2013 product family, which includes  Reflecting its recent acquisition by Microsoft, the new

Reflecting its recent acquisition by Microsoft, the new  MAGIX Software has revealed

MAGIX Software has revealed  In October 2009, I explained why "

In October 2009, I explained why "