Uncertainty hung over Apple's fiscal third quarter coming into today's earnings announcement. Gulfs widened among analysts for overall revenue estimates and about how many iPads or iPhones were sold. No one expected poor performance, there was just more uncertainty about what and where than more recent quarters. Fiscal Q3 will be remembered as sea change coming, as Apple missed Street consensus for the first time in years and iPad sales surged against iPhone.

For fiscal third quarter, Apple reported $35 billion revenue and net profits of $8.8 billion, or $9.32 a share. A year earlier, the company reported revenue of $28.57 billion and $7.31 billion net quarterly profit, or $7.79 per share. Apple announced fiscal Q3 results after the market closed today.

Three months ago, Apple forecasted $34 billion in revenue with earnings per share of $8.68. Analyst average estimates were higher than Apple guidance: $37.18 billion revenue and $10.36 earnings per share. Revenue estimate range: $34.54 billion to $41.73 billion. This breaks an ongoing trend of the Street expecting more than guidance and Apple still beating consensus.

Shareholders responded rapidly to the earnings miss, with shares down more than 5 percent in after-hours trading.

Looking ahead, Apple forecasts $34 billion in revenue for fiscal 2012 fourth quarter, with earnings per share of $7.65.

As expected, Apple will issue a dividend, $2.65 per share, on August 16 to shareholders of record on August 13.

Apple shipped 17 million iPads and 26 million iPhones during fiscal Q3. Analyst consensus was around 15.6 million tablets and 29 million smartphones.

"We’re thrilled with record sales of 17 million iPads in the June quarter", Apple CEO Tim Cook says. "We’ve also just updated the entire MacBook line, will release Mountain Lion tomorrow and will be launching iOS 6 this Fall. We are also really looking forward to the amazing new products we’ve got in the pipeline".

Cumulative iOS device sales reached 410 million at the end of March -- 45 million during fiscal third quarter. Apple has paid $5.5 billion to developers. There are 150 million iCloud subscribers.

Gross margins rose to 42.8 percent from 41.7 percent a year ago. Sales in international markets accounted for 62 percent of revenue.

Q3 2012 Revenue by Product

- Desktops: $1.287 billion, down 19 percent from $1.58 billion a year earlier.

- Portables: $3.646 billion, up 3 percent from $3.525 billion a year earlier.

- iPod: $1.06 billion, down 20 percent from $1.325 billion a year earlier.

- Music: $1.571 billion, up 29 percent from $1.571 billion a year earlier.

- iPhone: $16.425 billion, up 22 percent from $13.31 billion a year earlier.

- iPad: $9.17 billion, up 52 percent from $6.046 billion a year earlier.

- Peripherals: $663 million, up 28 percent from $517 million a year earlier.

- Software & Services: $891 million, up 28 percent from $696 million a year earlier.

Macs. I usually begin my segment breakdown with iPhone and iPad, but Mac shipments cast context onto the other discussions.

During fiscal third quarter, Apple released new Mac Book Pros, which unsurprisingly lifted portable shipments (or what the company calls sales). Apple shipped 4 million Macs during the quarter, up from 3.947 million units a year earlier; growth was 2 percent year over year. Wall Street consensus was about 4.3 million units worldwide -- or 300,000 more than their year-ago estimate, which Apple missed. So Apple missed the Street. Again.

During today's earnings conference call, Apple CFO Peter Oppenheimer says Mac sales to education were record.

Apple ended the quarter with three to five weeks inventory, which is below normal levels.

Mac shipments outpaced the broader market, which performance can only be called disastrous. Gartner and IDC released preliminary calendar second-quarter PC shipment estimates two weeks ago -- flat globally, but down 5.7 percent or 10.6 percent in the United States, depending on whether Gartner or IDC counts the numbers. IDC put Mac shipments down for the first time in years, while Gartner disagreed. Today, Apple answered both.

IDC puts Apple US PC market share at 11.1 percent, down nearly 1 point year over year, while Gartner sees share rising -- from 10.8 percent to 12 percent. US performance foreshadows much, because it is the geography most affected by so-called post-PC devices, particularly smartphones and tablets.

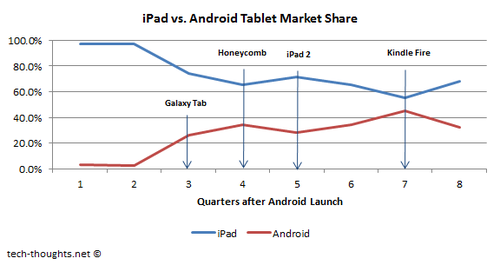

"Consumers are less interested in spending on PCs as [they] are other technology product and services, such as the latest smartphones and media tablets that they are purchasing", Mikako Kitagawa, Gartner principal analyst, says. "This is more of a trend in the mature market as PCs are highly saturated in these markets". Something else the numbers reveal: iPad is cannibalizing Mac sales, even as it dents Windows PCs (see iPad, next, for more on that).

In response to a question about iPad cannibalizing Mac sales, Cook deflected. "It's clear the PC market is weak", but he focused on a slowdown before introduction of the new MacBook Pro as major factor affecting Apple. He says that weekly sales were down before the product announcement and up afterwards.

Cook says that Apple ended the quarter with a backlog of MacBook Pro orders, which he expects to clear out next month.

Q3 2012 Unit Shipments by Product

- Desktops: 1.01 million units, down 13 percent from 1.155million units a year earlier.

- Portables: 3.01 million units, up 8 percent from 2.792 million units a year earlier.

- iPod: 6.751 million units, down 10 percent from 7.535 million units a year earlier.

- iPhone: 26.03 million units, up 28 percent from 20.338 million units a year earlier.

- iPad: 17.04 million units, up 84 percent from 9.246 million units a year earlier.

iPad. The tablet's impact on Apple simply cannot be understated. The company shipped 17 million iPads, generating nearly $9.2 billion in revenue. Analysts estimated about 15.6 million iPads for fiscal Q3, which represents the first full quarter of sales, following release of new iPad with high-resolution Retina Display.

iPad was available in 97 countries and Apple ended the quarter "just within our target range of 4 to 6 weeks channel", Oppenheimer says.

During the quarter, Apple sold 1 million iPads to education. Oppenheimer boasts: "We sold twice as many iPads as Macs to education". Additionally, iPad sales "more than tripled in the enterprise in the past year".

Cumulative iPad shipments: 84 million.

Following Gartner and IDC PC shipment numbers release, Needham & Company analyst Charlie Wolf dramatically revised his iPad shipment forecast -- to 20 million units from 13.5 million, Wolf issued an unusually long report with an unusual admission -- that his iPad sales estimate was "hastily formulated". Coming into the quarter, the analyst predicted iPad shipments would exceed iPhone. Apple answered him today, and I'll continue the discussion in the iPhone breakdown.

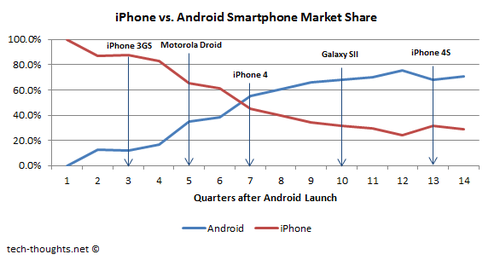

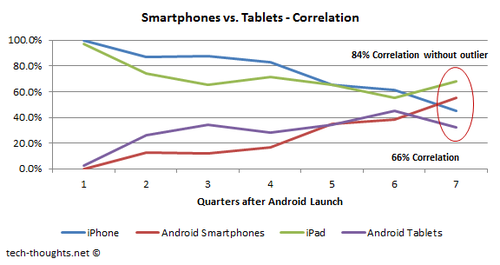

"In the second quarter of 2012, the PC market suffered through its seventh consecutive quarter of flat to single-digit growth", Kitagawa says. Seven straight quarters?Is it any coincidence that Apple started selling the iPad eight quarters ago? Don't answer "no" too quickly. iPad's rapid gains, even its surge against iPhone is another sign that the PC era is over and in transition to the cloud-connected device era.

Q3 2012 Revenue by Geography

- Americas: $12.81 billion, up 26 percent from $10.126 billion a year earlier.

- Europe: $8.24 billion, up 16 percent from $7.098 billion a year earlier.

- Japan: $2.01 billion, up 33 percent from $1.5 billion a year earlier.

- Asia Pacific: $7.89 billion, up 25 percent from $6.332 billion a year earlier.

- Retail: $4.08 billion, up 317 percent from $3.505 billion a year earlier.

iPhone. Wolf's sudden turnabout and iPhone sales data from both AT&T and Verizon raised a shadow of fiscal Q3 in the days, even hours, before today's earnings announcement. Analysts expected about 29 million units. Actual: 26 million. So for a second major product category, Apple missed the Street.

AT&T and Verizon foreshadowed mature markets. iPhone dipped for both carriers, down 14 percent and 15.6 percent, respectively. BTIG analyst Walter Piecyk says he expected 3.4 million iPhone activations on Verizon and 3.75 million on AT&T. Analyst consensus was 19 percent decline sequentially.

The fall-off isn't surprising as smartphone growth cools in mature markets and anticipation builds for iPhone 5 -- or whatever Apple calls it. Weekly sales are somewhat rocky because of iPhone 5 rumors, Oppenheimer says.

Apple ended the quarter with iPhone available from 250 carriers in 100 carriers. iPhones in enterprise more than doubled in the last year, Oppenheimer says.

Q3 2012 Unit Shipments by Geography

- Americas: 1.522 million units, up 2 percent from 1.487 million units a year earlier.

- Europe: 941,000 units, up 2 percent from 922,000 units a year earlier.

- Japan: 173,000 units, up 15 percent from 150,000 units a year earlier.

- Asia Pacific: 593,000 units, down 4 percent from 620,000 units a year earlier.

- Retail: 791,000 units, up 3 percent from 768,000 units a year earlier.

iPod. Apple shipped 6.75 million iPods during fiscal third quarter, down from 7.535 million a year earlier. Analyst consensus for fiscal Q3 was about 6.35 million. iTunes generated $1.8 billion in revenue, with education important contributor. There have been 14 million download of the iTunes U app, Oppenheimer says.

Apple ended the quarter with 4 weeks to six weeks iPod inventory, which is normal level.

Retail. Apple Store generated $4.08 billion, selling 791,000 Macs, up from 768,000 a year earlier. Revenue per store was $11.1 million, up from $10.8 million. The stores had 83 million visitors, up 12 percent from 74 million in the same quarter 2011. Apple ended fiscal Q3 with 372 stores, opening 9 during the quarter.

Hanging by itself is Apple TV; the company sold 1.3 million during the quarter and 4 million for the fiscal year so far. "It's still at a level we would call a hobby, but we're still pulling the strings to see where it takes us", Cook says.

I received a sad report on the subject of PC support scams.

I received a sad report on the subject of PC support scams.

Want to get some photos off your Android phone or tablet but don’t have your USB cable with you? Looking for a way to send SMS messages from your computer? Want to copy and paste text between your Android device and computer? These are just some of the things that

Want to get some photos off your Android phone or tablet but don’t have your USB cable with you? Looking for a way to send SMS messages from your computer? Want to copy and paste text between your Android device and computer? These are just some of the things that  VPN clients are a generally a very good way to maintain your anonymity online, and

VPN clients are a generally a very good way to maintain your anonymity online, and

The theory of outsourcing and offshoring IT as it is practiced in the second decade of the 21st century comes down to combining two fundamental ideas: 1) that specialist firms, whether here or overseas, can provide quality IT services at lower cost by leveraging economies of scale, and; 2) that offshore labor markets can multiply that price advantage through labor arbitrage using cheaper yet just as talented foreign labor to supplant more expensive domestic workers who are in extremely short supply. While this may be true in the odd case, for the most part I believe it is a lie.

The theory of outsourcing and offshoring IT as it is practiced in the second decade of the 21st century comes down to combining two fundamental ideas: 1) that specialist firms, whether here or overseas, can provide quality IT services at lower cost by leveraging economies of scale, and; 2) that offshore labor markets can multiply that price advantage through labor arbitrage using cheaper yet just as talented foreign labor to supplant more expensive domestic workers who are in extremely short supply. While this may be true in the odd case, for the most part I believe it is a lie.

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of  Nir Sofer has released his latest creation,

Nir Sofer has released his latest creation,  Whenever I think about tablets v. PCs, I remember a bold prediction of old: “Son, 10 years from now everyone will drive an electric car!” When was that, 20 years ago? We’ve all read something like that from someone believing to be clairvoyant.

Whenever I think about tablets v. PCs, I remember a bold prediction of old: “Son, 10 years from now everyone will drive an electric car!” When was that, 20 years ago? We’ve all read something like that from someone believing to be clairvoyant.