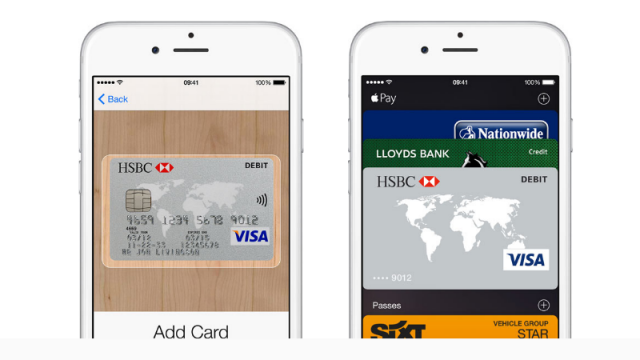

On 14 July 2015, Apple’s mobile payments system Apple Pay was finally launched in the UK after a huge amount of build-up and excitement. At the time of launch, Apple Pay was supported by several of the UK’s biggest financial institutions -- including Royal Bank of Scotland, Santander, Natwest and Nationwide -- along with thousands of supermarkets, restaurants, hotels and retailers.

Initial reviews were largely positive and industry professionals were understandably excited about Apple Pay’s potential as it rode the crest of a growing mobile payments wave. Mix this in with Apple’s loyal fan base and its power in the consumer market and it’s easy to see why its competitors might struggle to keep up.

The system was initially launched in the US the previous October and, although there were some initial concerns around identity theft, it enjoyed a strong start to life in the States as the likes of Disney, McDonald's and Subway jumped on-board early.

Mobile Payments -- The Story So Far

In the months since its launch, Apple Pay has continued to grow. Lloyds Bank, Halifax and HSBC have all signed up for the service -- along with thousands more UK retailers and the limit has risen from £20 to £30.

Its early success has been helped by the growth of the mobile payments industry, both in the UK and abroad. According to a survey published in July by nVest Ventures, millennials are driving the trend, with 26 percent saying paying with cash was inconvenient, 41 percent saying they are interested in using mobile payments and 58 percent expressing a desire for a mobile service that shows their spending habits.

This has led to fierce debate as to whether mobile solutions such as Apple Pay really will trigger the start of a cashless society. Jeremy Nicholds, executive director of mobile at Visa Europe claimed that we are approaching a "seismic shift from plastic to digital" and others have gone so far as to suggest that Apple can rule the sector through in-app payments.

Although it won’t happen overnight, current trends certainly point towards cash being on the way out. Non-cash payments have already overtaken cash payments in the UK and, unless its rivals catch up fast, it’s looking likely that Apple will be at the forefront of the cashless revolution

Benefits For Businesses

Of course, it’s not just consumers that are able to enjoy the benefits of digital payments. There are also some serious advantages for businesses, from small startups all the way up to large enterprises.

US business owners that have embraced mobile payments are growing three times faster than the national average and it’s in the retail sector where going contactless can have a real effect.

For example, the time-consuming transactions of old involving digging through a wallet to find the right card or correct amount of cash will be a thing of the past, so those retailers that experience a regular lunchtime rush will be able to get through significantly more customers in a shorter period of time.

Furthermore, Apple Pay also provides a fresh tool for digital marketers, enabling them to collect customer data to build detailed purchasing habits, engage with customers through personalized promotional content and reach more potential customers through in-app purchases.

Published under license from ITProPortal.com, a Net Communities Ltd Publication. All rights reserved.