Paper money sucks. When you spend it, you cannot easily track it by category, and unlike credit cards, you do not get protection, points, or cash-back. Unless you are doing illegal activity, you are better served to use plastic -- as long as you pay your balance in full each month, that is. Paying interest is for suckers.

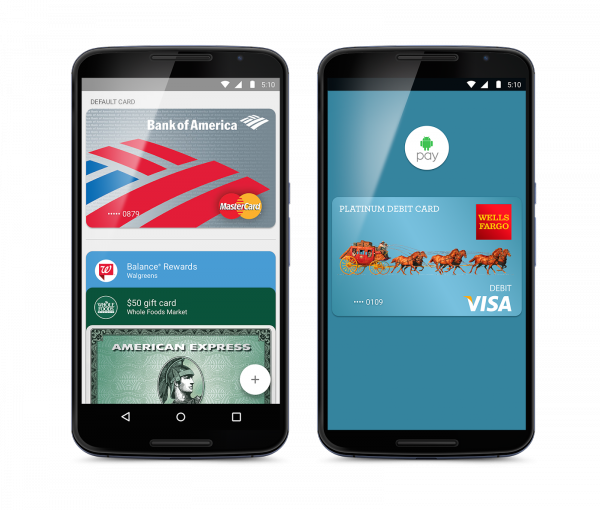

With all of that said, carrying slabs of plastic feels rather archaic in 2015, so I gladly welcome the transition to smartphones for making payments. Apple Pay is cool, but it is not available on Android, and it would stink to have one company dominate this method of payment. Today, Google announces the official launch of its smartphone payment service, the unimaginatively named, Android Pay. Will you use it?

If you don't have a cutting-edge phone, don't panic. Google's service works with all NFC-equipped Android smartphones that have at least version 4.4 of the operating system. This should be a healthy amount of handsets.

The four major USA card networks have all pledged support -- Visa, MasterCard, American Express, and Discover. With that said, not all banks will have compatible credit and debit cards. Major institutions like Bank of America and USAA are early adopters, but if you bank with something smaller, you may have to wait. Some gift cards are supported too, by the way.

If you are hesitant to give your credit card details to Google, you aren't crazy -- it is smart to be vigilant with your card details. However, Android Pay looks rather secure, as it does not pass your card details to the merchant. Instead, it utilizes virtual numbers and tokens to limit fraud and abuse. Quite frankly, it should be safer than even EMV chip and pin offerings.

Supported merchants are respectable, and include Panera Bread, Subway, Walgreens and more. Sadly, Starbucks is not listed, and that is huge deal-breaker for me. Keep in mind, the coffee chain offers its own refillable payment system, which is essentially interest-free loans. It gets your money in advance and doesn't pay for it. Android Pay threatens this money-maker. Hopefully it and other merchants are added in the future.

Besides payment cards, loyalty cards are supported too. This means you can stop carrying hundreds of cards in your wallet or purse for every store you visit -- hallelujah!

So, how do you get Android Pay on your handset? It will be offered through the Wallet app in the Play Store. The updated app is not yet available to everyone, however, as it is slowly being rolled out. You can install the older version in the interim, so you are alerted to the update when it comes.

Are you excited for Android Pay? Am I wrong that paper money sucks? Sound off in the comments.