Recent high profile data breaches involving retailers have led many people to have doubts about the security of transactions.

Chip maker Intel has today announced a new data protection technology that will both address these concerns and help speed up the roll out of internet of things devices in retail environments.

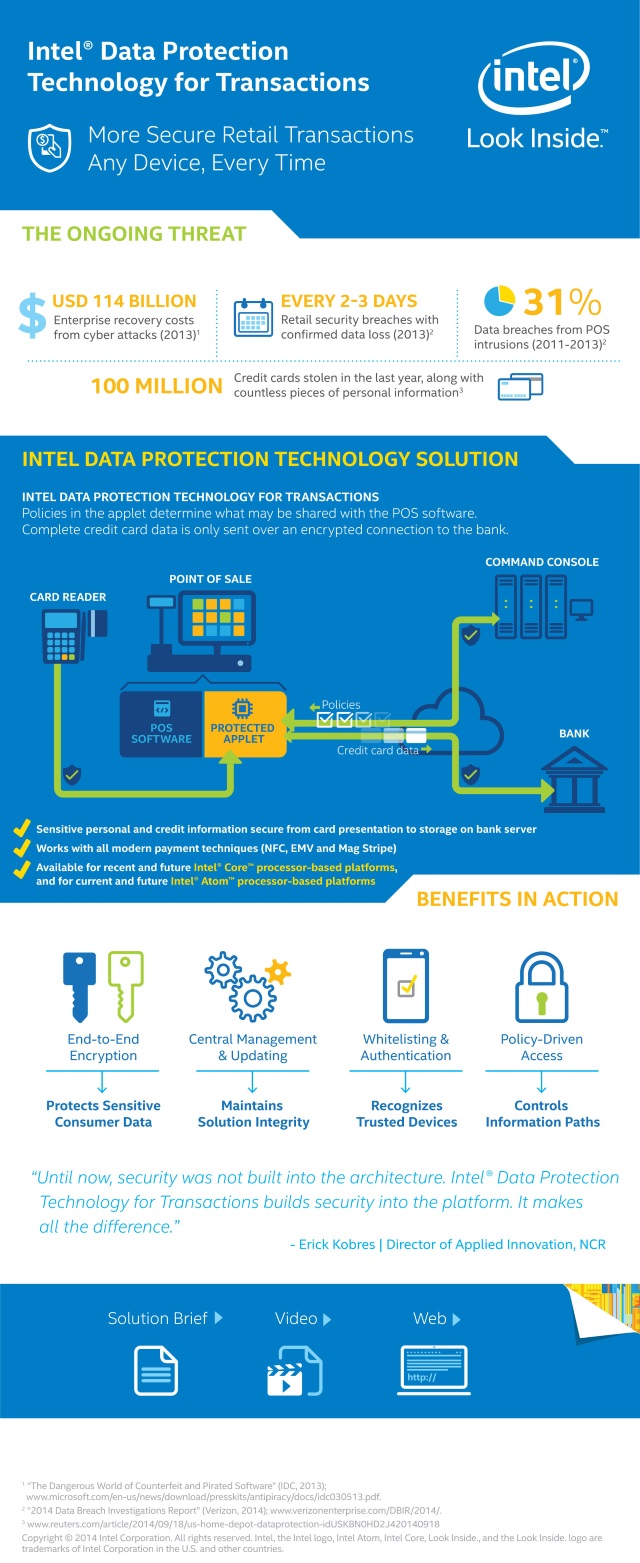

Intel Data Protection Technology for Transactions adds an extra layer of software to protect the payment process. This complements other security and authorization technologies. The software sits on an Intel chipset and creates a secure pathway between the retailer's point of sale system and the servers.

The solution supports all modern forms of credit and debit payment including EMV (Europay, Mastercard and Visa), magnetic stripe and near field communication (NFC) transaction readers, including Google Wallet, Softcard and Apple Pay.

"This solution introduces a significant improvement in today's retail transaction data protection without costly hardware upgrades, and provides retailers a path for adopting new Internet of Things technologies," says Michelle Tinsley, director of Mobility Retail and Payments at Intel. "It also sets the stage to expand to other industries such as financial services, healthcare or even government agencies".

The client software is available now and the full solution is expected to be available to retailers by the end of next year. More information is available on the Intel website and there’s an overview of how it works in infographic form below.

Image Credit: Sergey Nivens / Shutterstock