Developers must make hard choices when choosing what platforms to support. In mobile, popular convention is iPhone first. But does that approach, in the real world of smartphone ownership, really make sense in 2013? Let us take a look at the hard numbers that were recently published by comScore and see what they can tell us.

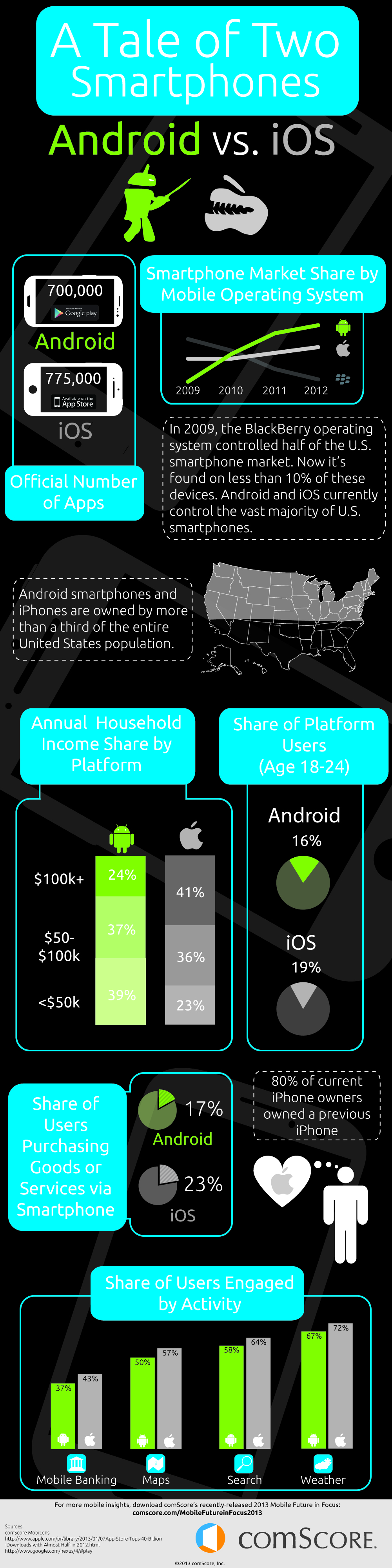

This may be a self-perpetuating problem for Apple; according to ComScore, the Google platform simply offers more opportunity because of its larger user base, though that is far from the only consideration for developers. Granted, both mobile operating systems are wildly popular, despite the best efforts of Microsoft to get Windows Phone OS into contention (OK, maybe "best efforts" is going a bit far) -- Android and Apple combine for nearly 90 percent of the smartphone market -- 53 and 36 percent respectively.

But that is only half of the puzzle -- While Android holds a commanding lead in share, it retains only 48 percent of those users, while Apple holds onto 62 percent. That means that just over 25 out of 100 users stick with Google, while a bit more than 22 look at the world through Apple goggles. Sounds good, but if the trend were to continue then the sides would eventually change. Except that is not the case. You see, while 8 out of 10 current iPhone customers are returning buyers, that current 62 percent number means shrinking to only 6 of 10.

Benjamin Travis says that "iOS is popular among a slightly younger demographic than Android users, with 18-24 year olds representing 19 percent of all iPhone owners compared to 16 percent of Android owners". While that may initially sound promising, the news for Apple is not all good here, plus the gap just is not that big and likely could be shrinking.

The two smartphone bases engage differently with mobile content as well. First of all, comScore finds that the Android platform has a greater number of media users in each category. While iPhone users tend to be generally more engaged with their devices and apps, market share becomes important -- shear audience size is hard to beat.

Travis goes on to point out that "iPhone users show a greater propensity to engage in [M-Commerce] behavior with 23 percent having done so versus 17 percent of Android owners. iPhone owners are also more likely to make purchases on their phones on a regular basis". This is also an important consideration for those looking to monetize by means other than in-app ads, but that is less than half of the apps on the market.

comScore also points out that iPhone owners tend to think very highly of their devices and, as a result, they are likely to remain loyal users over time. This is perhaps the red herring. Sixty-two percent of iPhone users would stick with the device versus forty-eight percent for Android.

There are other considerations not mentioned. The biggest one is a users' library of purchased apps -- once you are invested in a platform it becomes increasingly harder to move on. Regardless of income level nobody wants to purchase the same apps twice. Again, the larger share is likely more important to Android now.

In the end, while comScore tries to play fair with both sides and avoid controversy, when you read between the lines, the direction is clear. Android's ever-increasing market share means more potential downloads and, with M-Commerce numbers that are not that far apart, more potential revenue. Google also runs a more open platform, making it easier to gets apps into the market -- something Apple developers have sometimes struggled with.