Apple investors expressed their nervousness this week, following earnings reports from AT&T and Verizon. Carrier iPhones sales sagged from calendar fourth quarter -- and why should they not, considering the holidays and iPhone 4S launch. So the question for Apple today: How many iPhones sold during fiscal second quarter, and iPads, for that matter.

Apple shipped 5.2 million Macs, 11.8 million iPads and 35.1 million iPhones during the quarter. Analyst consensus was around 4 million, 11 million and 33.5 million, respectively. Number of iOS devices sold to date: 365 million.

For fiscal Q2, Apple reported $39.2 billion revenue and net profits of $11.06 billion, or $12.30 a share. A year earlier, the company reported revenue of $24.67 billion and $5.99 billion net quarterly profit, or $6.40 per share. Net profit rose by 94 percent.

Three months ago, Apple forecast $32.5 billion in revenue for fiscal 2012 second quarter, with earnings per share of $8.50. Analyst average estimates were higher than Apple guidance: $36.81 billion revenue and $10.06 earnings per share.

Gross margins rose a stunning 6 points year over year to 47.4 percent. International sales accounted for 64 percent of revenues.

Looking ahead to fiscal third quarter, Apple projects $34 billion revenue and $8.68 earnings per share.

Apple ended the quarter with $110.2 billion in cash, up from 97.6 billion three months earlier.

After closing down 2 percent today, Apple shares jumped more than 7 percent in after-hours trading.

Q2 2012 Revenue by Product

- Desktops: $1.56 billion, up 8 percent from $1.44 billion a year earlier.

- Portables: $3.5 billion, down 7 percent from $3.7 billion a year earlier.

- iPod: $1.2 billion, down 25 percent from $1.6 billion a year earlier.

- Music: $2.51 billion, up 32 percent from $1.6 billion a year earlier.

- iPhone: $22.7 billion, up 85 percent from $12.3 billion a year earlier.

- iPad: $6.6 billion, up 132 percent from $2.84 billion a year earlier.

- Peripherals: $643 million, up 11 percent from $580 million a year earlier.

- Software & Services: $832 million, up 12 percent from $743 million a year earlier.

iPhone. Apple shipped 35.1 million iPhones worldwide during fiscal second quarter, up from 18.65 million iPhones a year earlier. That's an 88 percent increase, year over year. Wall Street analyst average estimate was about 33.5 million units. Apple counts shipments into the channel, typically making them several million units higher than numbers released by Gartner, which measures actual sales.

During the quarter, iPhone 4S was available in 100 countries from 230 carriers. Apple ended the quarter with 8.6 million units in the channel, up 2.4 million sequently for 4 to 6 weeks of inventory.

Recent analyst data bodes well for iPhone. Earlier this month, Nielsen reported a huge surge in the number of new purchasers choosing iPhones compared to Android. For the three months ending in February, 48 percent of Americans who recently bought a smartphone, chose Android -- 43 percent iPhone, according to Nielsen. A year earlier, 27 percent of new acquirers chose Android versus 10 percent for iPhone.

comScore reports share for overall market, not new purchasers. During the three months ending in February, Android share was 50.1 percent among smartphone subscribers 13 and older -- that's up 3.2 points. iOS: 30.2 percent, up 5 points year over year and 1.5 points three months earlier. Those numbers are fairly consistent with Nielsen's: 48 percent for Android and 32 percent for iOS.

But Verizon caused some market panic following news it activated 3.2 million iPhones during first calendar quarter, a 1-millon sequential decrease. I don't see a problem in that but something else: Quarter on quarter, iPhone dropped from 58 percent to about half of Verizon smartphone sales, based on activations. Android is gaining, no doubt propelled by 4G LTE.

Q2 2012 Unit Shipments by Product

- Desktops: 1.2 million units, up 19 percent from 1 million units a year earlier.

- Portables: 2.82 million units, up 2 percent from 2.75 million units a year earlier.

- iPod: 7.7 million units, down 15 percent from 9.02 million units a year earlier.

- iPhone: 35.1 million units, up 88 percent from 18.65 million units a year earlier.

- iPad: 11.8 million units, up 151 percent from 4.7 million units a year earlier.

iPad. Apple shipped 11.8 million iPads globally during the quarter -- that's up from 4.7 million -- a 151 percent -- a year earlier.

Apple ended the quarter with 2 million iPads in the channel, that's down 300,000 units sequentially, for 4 to 6 weeks in inventory. About a month ago, my daughter said that San Diego School District would buy iPads for 2012-13. Today, during Apple's earnings conference call, Apple CFO Peter Oppenheimer says that the school district bought 10,000 iPads during fiscal Q2 and will get another 15,000 this quarter.

"The new iPad is on fire", Oppenheimer says, adding that Apple is selling as fast as it can make them. Supplies are constrained globally. New iPad is available in 40 countries.

Analysts repeatedly asked about the impact of $399 iPad 2 on overall sales. Apple CEO Tim Cook says that lower pricing definitely appeals to educational buyers and in some geographic markets. However, Apple isn't yet certain about the final sales mix between iPad 2 and new iPad.

iPad continues to dominate the tablet market, and it's an increasingly important category. In a report issued yesterday, Forrester Research analyst Frank Gillett proclaims: "Tablets will rule the future personal computing landscape". He predicts the global install base of tablets will be 760 million by 2016, with 375 million sold just in that year -- one third of them to businesses.

He predicts that "tablets will become our primary computing device".

Q2 2012 Revenue by Geography

- Americas: $13.2 billion, up 41 percent from $9.32 billion a year earlier.

- Europe: $8.81 billion, up 46 percent from $6.03 billion a year earlier.

- Japan: $2.65 billion, up 91 percent from $1.38 billion a year earlier.

- Asia Pacific: $10.15 billion, up 114 percent from $4.74 billion a year earlier.

- Retail: $4.4 billion, up 38 percent from $3.2 billion a year earlier.

Computers. Mac shipments rose significantly during fiscal second quarter. Apple sold -- what company executives really mean by shipped -- 4 million Macs during the quarter, up from 3.54 million units during fiscal Q2 2011; growth was 7 percent year over year. Wall Street consensus was about 4.5 million units worldwide.

Apple PC growth easily beats the market at large. Two weeks ago, Gartner and IDC reported dismal global shipments. IDC put year-over-year growth at 2.3 percent, but only 1.9 percent by Gartner's estimates. The hard drive shortage had nominal impact compared to fourth calendar quarter.

The Mac is big windfall benefactor of the PC shipment/sales crisis, because:

- Apple's brand is sizzling hot right now.

- Most people use Windows, which is old to them if upgrading, while the Mac is fresh.

- iPad cannibalizes Windows PC sales, as businesses and consumers buy the tablet as upgrade companion or even replacement.

- Apple is more insulated from the hard drive shortage, in part because of how it sources components compared to most other computer makers.

"The consumer segment continued to be a drag on market growth, as PC demand was low", Mikako Kitagawa, Gartner principal analyst, says. "Questions remain on whether low-end systems can attract consumers, as their attention has moved to other devices". Reiterating previous observations, Gartner again highlighted smartphones and tablets as leaders among those "other devices".

But those consumer sales problems are specific to the larger industry, and not Apple. In the United States, Apple ranks third. IDC puts market share at 10 percent and Gartner at 10.6 percent.

Q2 2012 Unit Shipments by Geography

- Americas: 1.21 million units, flat from 1.21 million units a year earlier.

- Europe: 1.05 million units, up 5 percent from 995,000 units a year earlier.

- Japan: 158,000 units, up 2 percent from 155,000 units a year earlier.

- Asia Pacific: 771,000 units, up 29 percent from 596,000 units a year earlier.

- Retail: 826,000 units, up 4 percent from 797,000 units a year earlier.

iPod. Apple shipped 7.7 million iPods during fiscal first quarter, down from 9.02 million a year earlier -- a 15 percent decline. iPod touch accounted for more than half of units sold. Apple ended the quarter with 4 to 6 weeks of inventory.

iTunes revenue: $1.9 billion, up 35 percent year over year.

Retail. Revenue was $4.4 billion up 38 percent year over year. Apple retail stores sold 826,000 Macs during the quarter. Apple opened two new stores for 363 worldwide. With average 361 stores open for the quarter, they generated $12.2 million each.

Photo Credit: Francesco Dazzi/Shutterstock

One of the most eagerly anticipated online storage services -- and one of the worst kept secrets in computing -- has finally seen the light of day.

One of the most eagerly anticipated online storage services -- and one of the worst kept secrets in computing -- has finally seen the light of day.

Web album creator

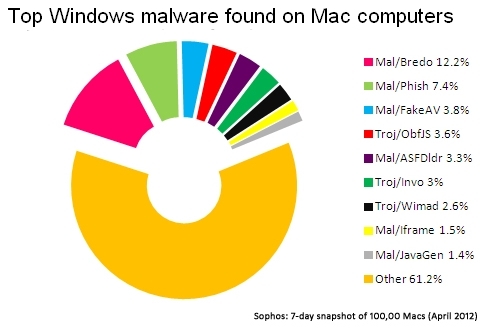

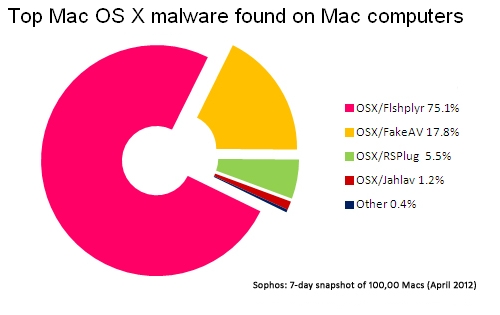

Web album creator  What do sexually transmitted diseases and Mac viruses share in common? Surprisingly lots,

What do sexually transmitted diseases and Mac viruses share in common? Surprisingly lots,

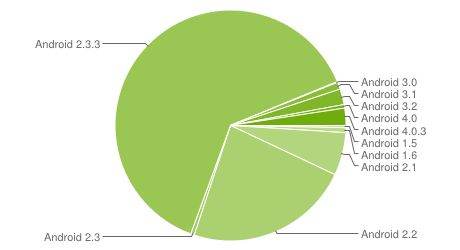

It is only a week since

It is only a week since  Microsoft on Monday launched a new version of SkyDrive, bringing the cloud-file sharing service to the desktop. This move did not come without a cost -- new users will have far less space, and current users only have a "limited time" to keep the generous storage the Redmond, Wash. company provides. But more on that a bit later.

Microsoft on Monday launched a new version of SkyDrive, bringing the cloud-file sharing service to the desktop. This move did not come without a cost -- new users will have far less space, and current users only have a "limited time" to keep the generous storage the Redmond, Wash. company provides. But more on that a bit later.

Indeed, these are the kinds of problems we would love to have, but when they actually occur we need solutions nonetheless. So, how do you handle the issues that occur when audience demand overwhelms the infrastructure you have provisioned to serve your content?

Indeed, these are the kinds of problems we would love to have, but when they actually occur we need solutions nonetheless. So, how do you handle the issues that occur when audience demand overwhelms the infrastructure you have provisioned to serve your content? Robert Levitan is CEO

Robert Levitan is CEO